For years, crypto markets have obsessed over transparency. Public ledgers, open transactions, and fully visible smart contracts were treated as the ultimate breakthrough. But as the market matures, traders, investors, and builders are starting to ask a harder question: is full transparency actually compatible with real financial activity?

Decentralized systems don’t fail because they lack openness — they fail because they lack practical data control. Institutions, funds, enterprises, and even advanced DeFi protocols operate on sensitive information. Strategies, balances, identities, and contractual terms cannot always be public. This is where the next evolution of decentralized data markets begins — not with more visibility, but with verifiable privacy.

This is the problem space Dusk Network operates in, and it’s why $DUSK deserves attention beyond short-term price action. @dusk_foundation is not trying to build another general-purpose blockchain. It is building infrastructure designed specifically for confidential data execution in financial environments — an area crypto has historically struggled to serve.

Why Decentralized Data Markets Need Privacy to Scale

From a trader or investor perspective, data is not just information — it’s competitive advantage. Whether it’s trading strategies, portfolio composition, private deals, or institutional workflows, most valuable data loses its value the moment it becomes public.

Public blockchains exposed a structural contradiction:

Decentralization encourages openness

Finance requires discretion

This contradiction has limited blockchain adoption in regulated and professional markets. Decentralized data markets cannot mature if all data is either fully public or entirely off-chain.

Dusk Network addresses this gap by enabling selective disclosure — a system where data can remain private while still being verifiable on-chain. This is not secrecy for secrecy’s sake; it is privacy with accountability, a requirement for serious financial use cases.

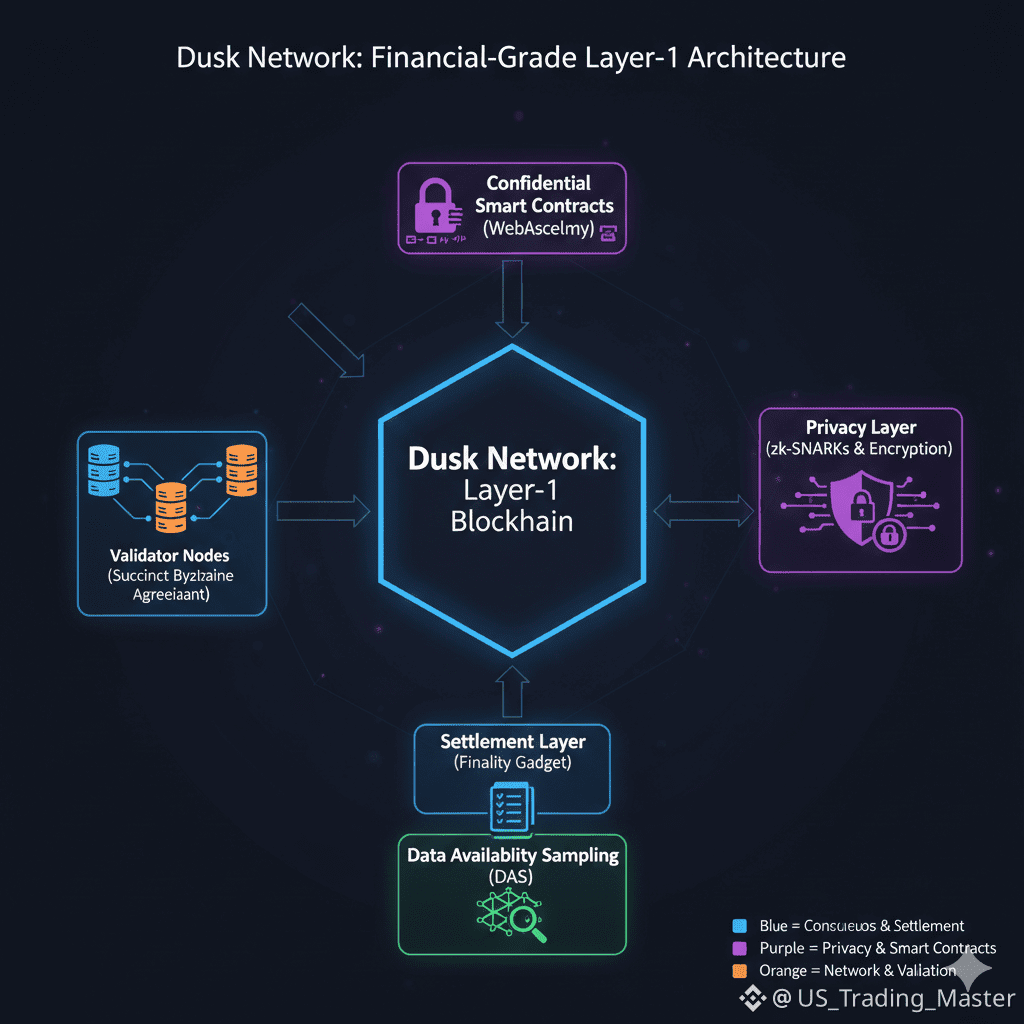

The Core Technology Behind Dusk Network

Dusk Network is a Layer-1 blockchain purpose-built for confidential financial applications. Its design choices reflect one central idea: data should be usable without being exposed.

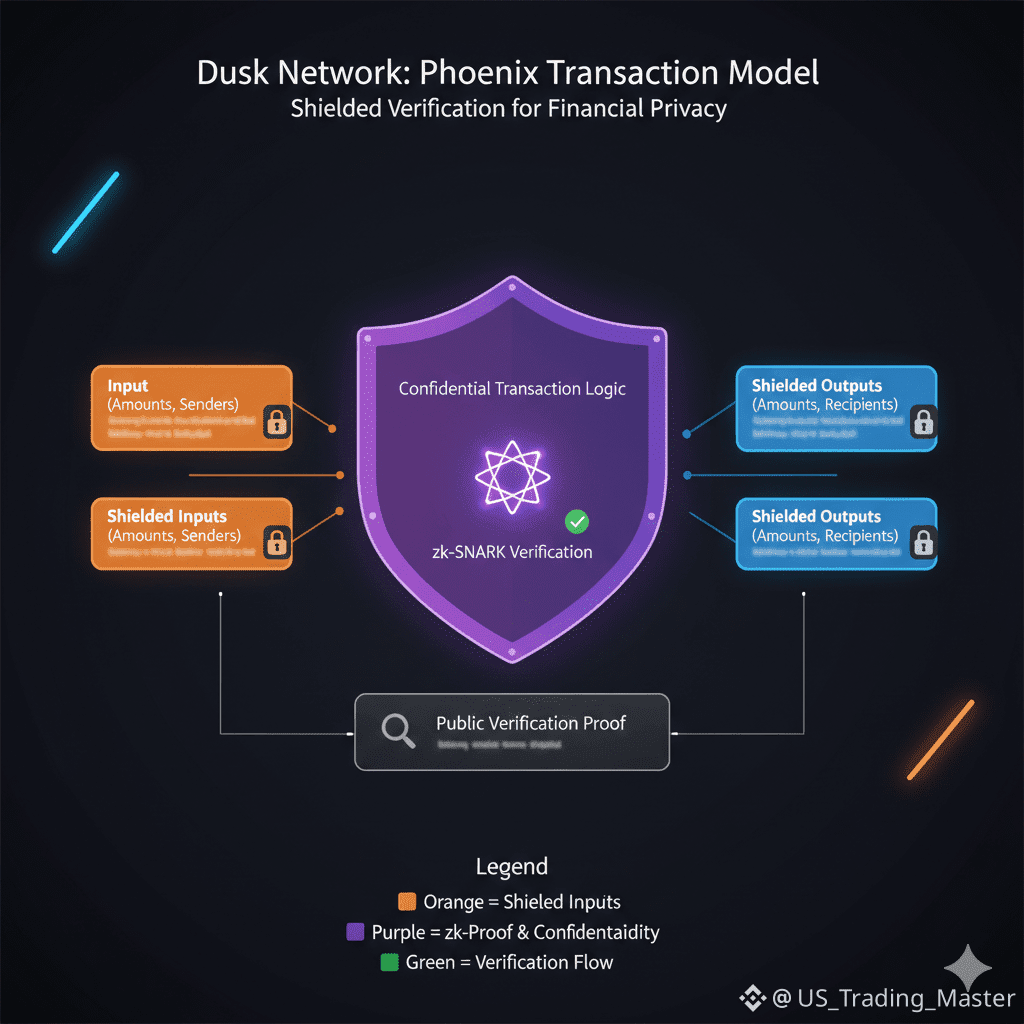

Phoenix Transaction Model

At the heart of Dusk’s architecture is the Phoenix transaction model. Phoenix allows transactions to be validated without revealing sensitive details publicly. Instead of broadcasting full transaction data, the network verifies correctness while keeping private information shielded.

This matters because it allows:

Private balances

Confidential transfers

Regulated data handling

without sacrificing the integrity of the blockchain.

Confidential Smart Contracts (XSC Standard)

Dusk introduces Confidential Security Contracts (XSCs), which allow smart contracts to execute logic privately. Traditional smart contracts expose both logic and data. XSCs change this by separating execution from disclosure.

From a market perspective, this unlocks:

Private financial agreements

Confidential asset issuance

Institutional-grade workflows

Smart contracts no longer need to be transparent to be trustworthy — they need to be provably correct.

Zedger: Privacy with Compliance

Zedger is Dusk’s hybrid privacy-preserving model designed specifically for security tokens and regulated assets. It enables privacy while maintaining auditability and compliance — a balance regulators and institutions require.

This is critical for real-world assets (RWAs), private equity, bonds, and tokenized securities. Without this layer, decentralized data markets remain retail-only.

How Dusk Transforms Decentralized Data Markets

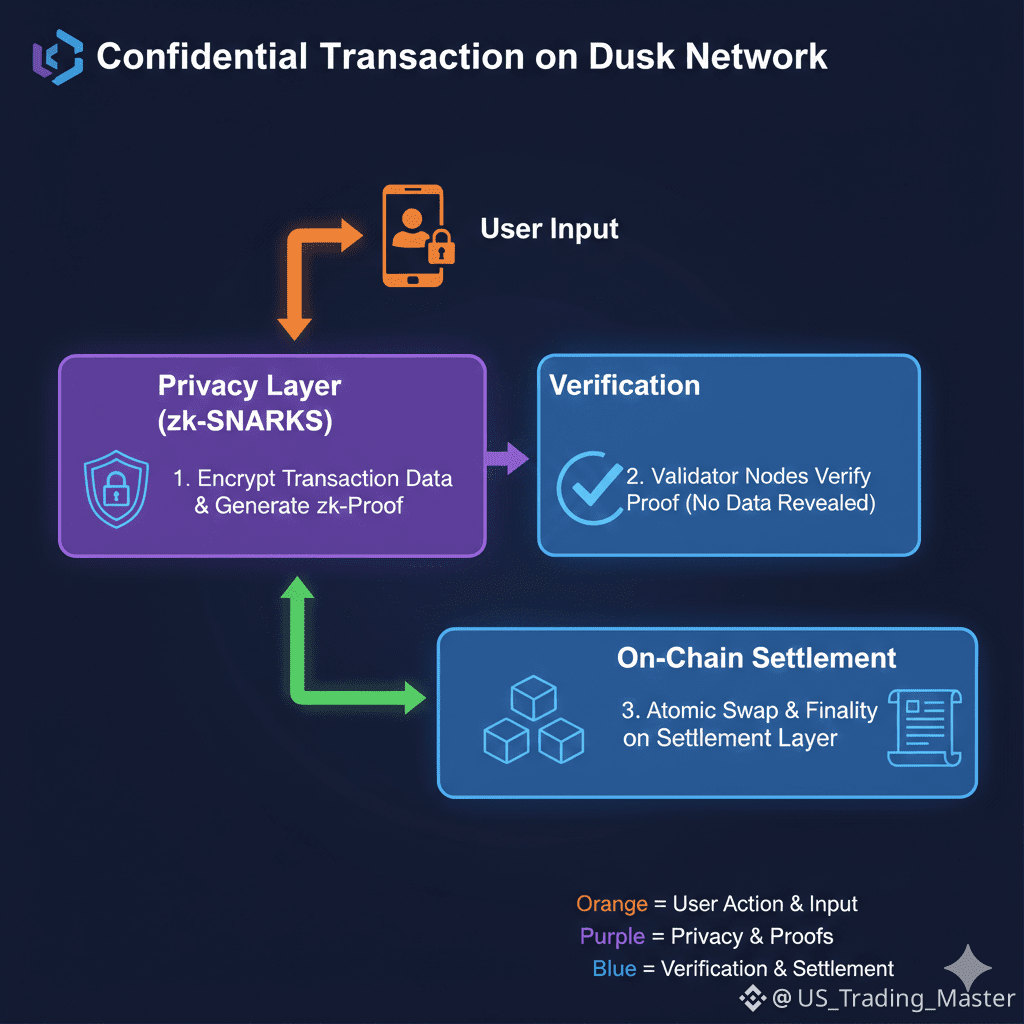

Most discussions around decentralized data markets focus on storage or access. Dusk approaches the problem differently: execution and validation of sensitive data.

In practical terms, Dusk enables:

Data to be used without being revealed

Contracts to execute without exposing inputs

Markets to verify outcomes without seeing strategies

This transforms data from something that must be hidden off-chain into something that can exist securely on-chain.

That shift is fundamental.

Economic and Market Implications

Cost Efficiency

Public blockchains force users to pay for unnecessary data exposure. Dusk reduces this inefficiency by minimizing what must be published on-chain. Less exposed data means:

Lower operational risk

More predictable costs

Better scalability for financial applications

Verifiability Without Exposure

For investors, trust matters — but blind trust doesn’t scale. Dusk’s approach allows systems to prove correctness cryptographically without revealing proprietary information. This is a powerful economic primitive.

Markets can function when participants:

Don’t trust each other

Don’t want to expose data

Still need settlement guarantees

Enabling New Data Markets

Because data can remain private yet usable, Dusk enables markets that were previously impossible:

AI models trained on sensitive financial data

DeFi strategies executed without front-running

NFT ownership with private metadata

RWAs with confidential terms

In each case, data becomes a tradable, composable asset rather than a liability.

Use Cases Across Emerging Sectors

AI

AI systems thrive on data, but most valuable datasets cannot be public. Dusk allows AI workflows to verify data usage and outcomes without exposing raw data, opening doors for decentralized AI markets built on trustless verification.

DeFi

Private strategies, hidden liquidity positions, and confidential liquidation logic reduce exploitation and manipulation. Dusk provides the privacy layer DeFi has been missing.

NFTs

Not all NFTs are art. Some represent licenses, credentials, or ownership rights. Dusk allows metadata and ownership logic to remain private while preserving authenticity.

RWAs

Tokenized assets demand confidentiality. Pricing, legal terms, and counterparties cannot be public. Dusk’s architecture makes on-chain RWA markets feasible.

Why This Matters for Investors

From an investor’s perspective, infrastructure that solves structural problems tends to outlast narratives. Dusk Network is not betting on hype cycles — it is addressing the mismatch between blockchain design and financial reality.

Privacy is not anti-transparency. In mature markets, it is a prerequisite.

As regulation tightens and institutional participation increases, networks that support confidentiality, compliance, and verifiability will become more relevant — not less.

$DUSK sits at this intersection.

Looking Forward: Storage Was Step One, Execution Is Step Two

Decentralized storage proved that data can exist without central custodians. Dusk pushes the evolution further by proving that data can be used, traded, and verified without being exposed.

This is how decentralized data markets mature:

From visibility → to usability

From openness → to controlled access

From experimentation → to infrastructure

Dusk Network is positioning itself as a foundational layer in this transition.

For developers, it offers tools to build applications that were previously impossible.

For investors, it represents exposure to a narrative that aligns with how real markets operate.

In my view, the question is no longer whether privacy matters, but which networks understand how to implement it correctly. @Dusk has taken a clear stance — and $DUSK reflects that long-term vision.