Decentralized data markets have been discussed for years, yet real adoption has been slow. The technology exists, liquidity exists, and demand exists — but something fundamental has been missing. From an investor and trader perspective, the issue is not infrastructure speed or decentralization itself. It is the absence of confidentiality.

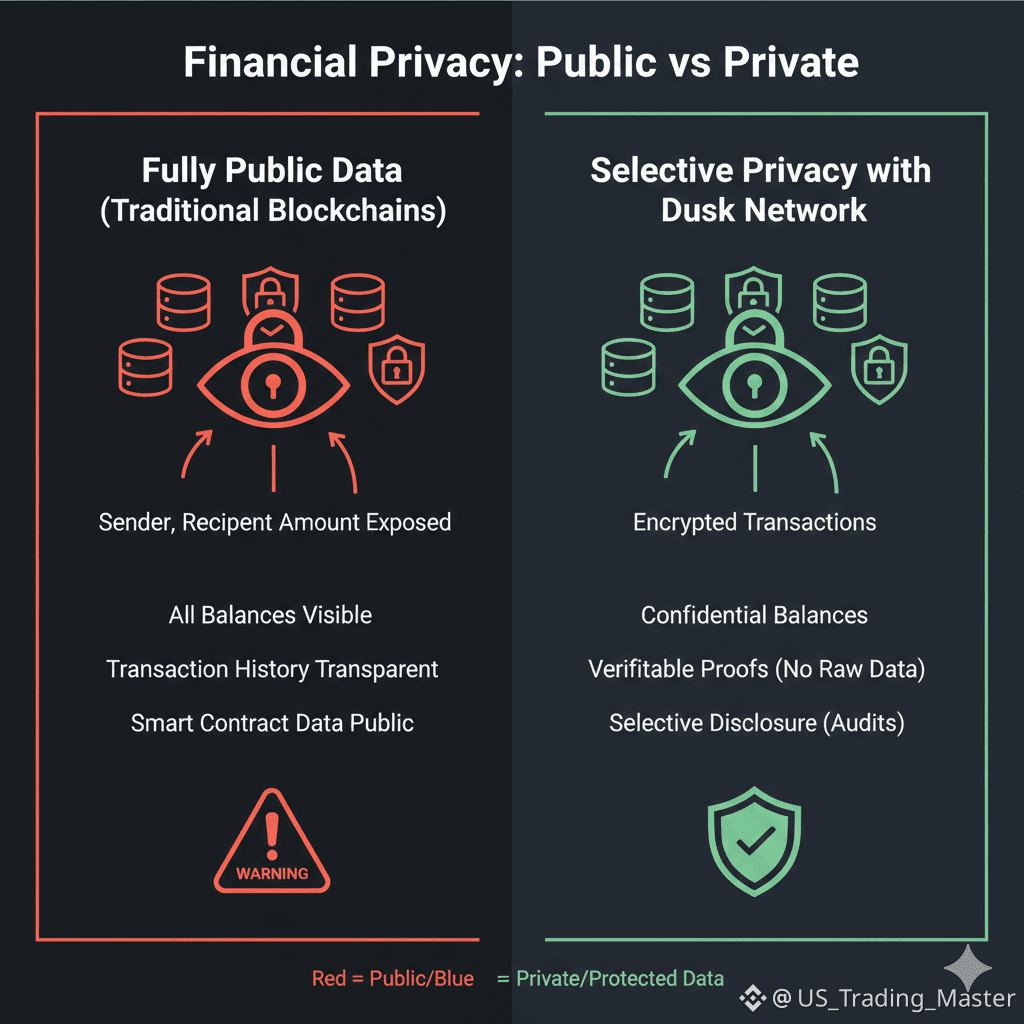

Data is valuable precisely because it is not public. Trading strategies, private agreements, institutional positions, proprietary models, and financial contracts lose their edge when exposed. Traditional blockchains, by default, treat all data as public. That design choice, while powerful early on, creates a ceiling for adoption in serious financial environments.

This is the gap Dusk Network is designed to fill.

Dusk is best understood not as a general-purpose blockchain, but as a decentralized confidential data network — one that enables data to be used, verified, and settled without being fully revealed. That distinction is subtle, but it changes everything about how decentralized data markets can function.

Why Decentralized Data Markets Have Stalled

From a market perspective, most decentralized data systems struggle with a trade-off:

Full transparency → usability issues for finance

Full privacy off-chain → loss of trust and composability

As a result, sensitive data often ends up centralized again, defeating the purpose of decentralization.

This limitation affects:

Institutional DeFi

Tokenized real-world assets

Private market instruments

AI datasets

Enterprise blockchain adoption

The truth is simple: data markets cannot scale if participants are forced to expose valuable information.

Dusk Network reframes the problem. Instead of asking how to store or publish data, it asks a more practical question:

How can data be executed and verified without being revealed?

Dusk Network’s Core Design Philosophy

Dusk Network is a Layer-1 blockchain engineered specifically for financial-grade confidentiality. Every major design choice reflects one principle: privacy must be verifiable, not blind.

This is critical for decentralized data markets, because trust cannot rely on secrecy alone. Systems must prove correctness without disclosing sensitive details.

Phoenix Transaction Model

The Phoenix transaction model enables transactions where balances, inputs, and outputs can remain private while still being validated by the network.

For traders and institutions, this means:

Positions are not publicly traceable

Strategies are protected

Settlement remains verifiable

Phoenix shifts blockchain validation from “show everything” to “prove correctness”. This is essential for data markets where exposure equals risk.

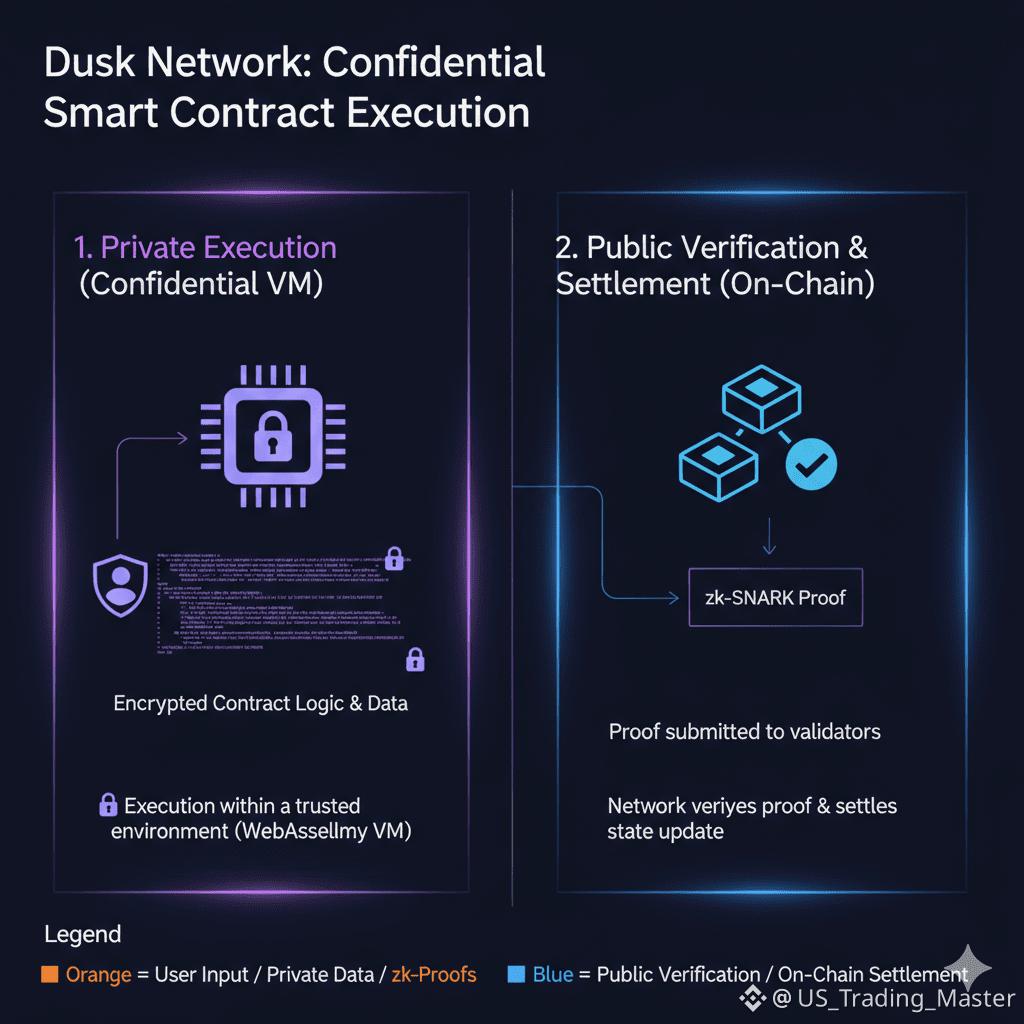

Confidential Smart Contracts (XSC): Private Logic on Public Infrastructure

Traditional smart contracts expose both logic and data. This transparency works for simple applications but breaks down in finance.

Dusk’s Confidential Security Contracts (XSCs) allow:

Contract logic to execute privately

Sensitive data to remain confidential

Outcomes to be settled publicly

This is a key enabler for decentralized data markets. Contracts can process private datasets, private bids, or private financial terms while still providing cryptographic guarantees.

From an investor’s perspective, XSCs unlock:

Private auctions

Confidential asset issuance

Secure financial workflows

This moves blockchain closer to real financial infrastructure rather than experimental tooling.

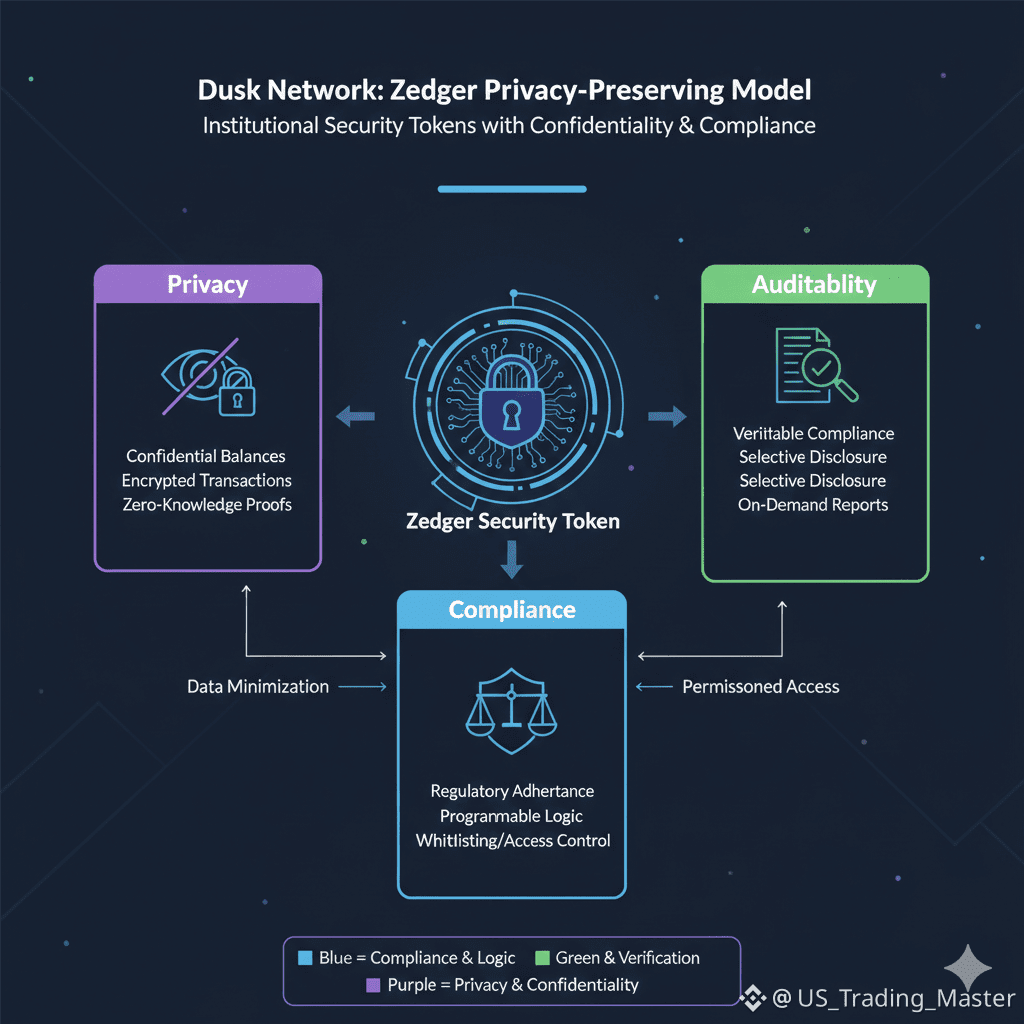

Zedger: Privacy That Still Works With Regulation

One of the most overlooked challenges in decentralized data markets is regulation. Total anonymity is incompatible with regulated finance, yet full transparency is unacceptable.

Zedger is Dusk’s hybrid privacy model designed specifically to address this tension.

It enables:

Selective disclosure when required

Auditability without constant exposure

Compliance without sacrificing privacy

For tokenized securities and RWAs, this is non-negotiable. Markets cannot function if every participant must choose between privacy and legality.

Zedger allows data to remain private by default, while still enabling verification when necessary — a foundational requirement for institutional participation.

Selective Disclosure and Verifiable Privacy

The core innovation behind Dusk Network is not secrecy, but control.

Selective disclosure means:

Only necessary data is revealed

Proofs replace raw information

Verification replaces trust

This allows decentralized data markets to function without leaking competitive information. Traders can execute strategies, institutions can settle agreements, and applications can process sensitive inputs — all without exposing the underlying data.

This model aligns far more closely with how traditional finance operates, which is why it matters from a market adoption standpoint.

Connecting Dusk to Real Data Market Use Cases

AI

AI systems depend on high-quality data, but the most valuable datasets are private. Dusk enables AI workflows where:

Data remains confidential

Outputs are verifiable

Models can operate without data leakage

This opens the door to decentralized AI markets that respect data ownership.

DeFi

Public DeFi suffers from front-running and strategy exposure. With Dusk:

Positions can remain private

Execution logic can be hidden

Settlement is still trustless

This reduces exploitation and creates space for more sophisticated financial strategies.

NFTs

Beyond art, NFTs represent licenses, credentials, and ownership rights. Dusk allows metadata and contractual logic to remain private while preserving authenticity and settlement.

RWAs

Real-world assets require confidentiality. Pricing, counterparties, and legal terms cannot be public. Dusk’s architecture supports on-chain RWA markets without violating these constraints.

Economic Implications for Investors

From an investor’s perspective, Dusk Network targets a structural weakness in blockchain design rather than a trend. Privacy is not a niche feature — it is a prerequisite for scale.

Economically, this enables:

Lower operational risk

Reduced data leakage

Higher institutional participation

As decentralized data markets mature, networks that support confidential execution will become more valuable than those optimized solely for visibility.

$DUSK represents exposure to this thesis.

Why Dusk Is Infrastructure, Not a Narrative

Many crypto projects compete for attention. Dusk Network competes for relevance.

Its value does not depend on consumer hype, but on whether decentralized systems can realistically serve financial markets. As regulation increases and professional capital enters the space, privacy-preserving infrastructure becomes more important — not less.

Dusk is building for that environment.

Looking Ahead: From Transparent Ledgers to Confidential Markets

The first phase of blockchain proved that data can exist without centralized control. The next phase must prove that data can be used without being exposed.

Decentralized data markets will not succeed on transparency alone. They require confidentiality, verification, and control. Dusk Network provides the tools to make that transition possible.

For developers, it offers a framework to build applications that were previously impossible on public chains.

For investors, it represents a bet on the maturation of decentralized finance itself.

In my view, privacy is not an optional upgrade — it is the missing layer. And Dusk Network is one of the few projects designed to deliver it correctly.