I’m looking at Dusk Network as a project that decided not to take shortcuts. They’re building for finance that actually exists in the real world, not just inside speculation. If money is going to move on chain in a serious way, privacy cannot be optional and rules cannot be ignored. Dusk Network is shaped around that belief, and everything else grows out of it.

Most blockchains treat transparency as the default truth. Everything is visible, forever. That sounds clean, but it breaks down fast once real people and real businesses step in. Who wants competitors watching treasury movements. Who wants trading strategies exposed in real time. Who wants personal spending history permanently tied to an address. Dusk Network asks a simple question, should using a blockchain mean giving up basic financial privacy. Their answer is no, and that answer defines the entire system.

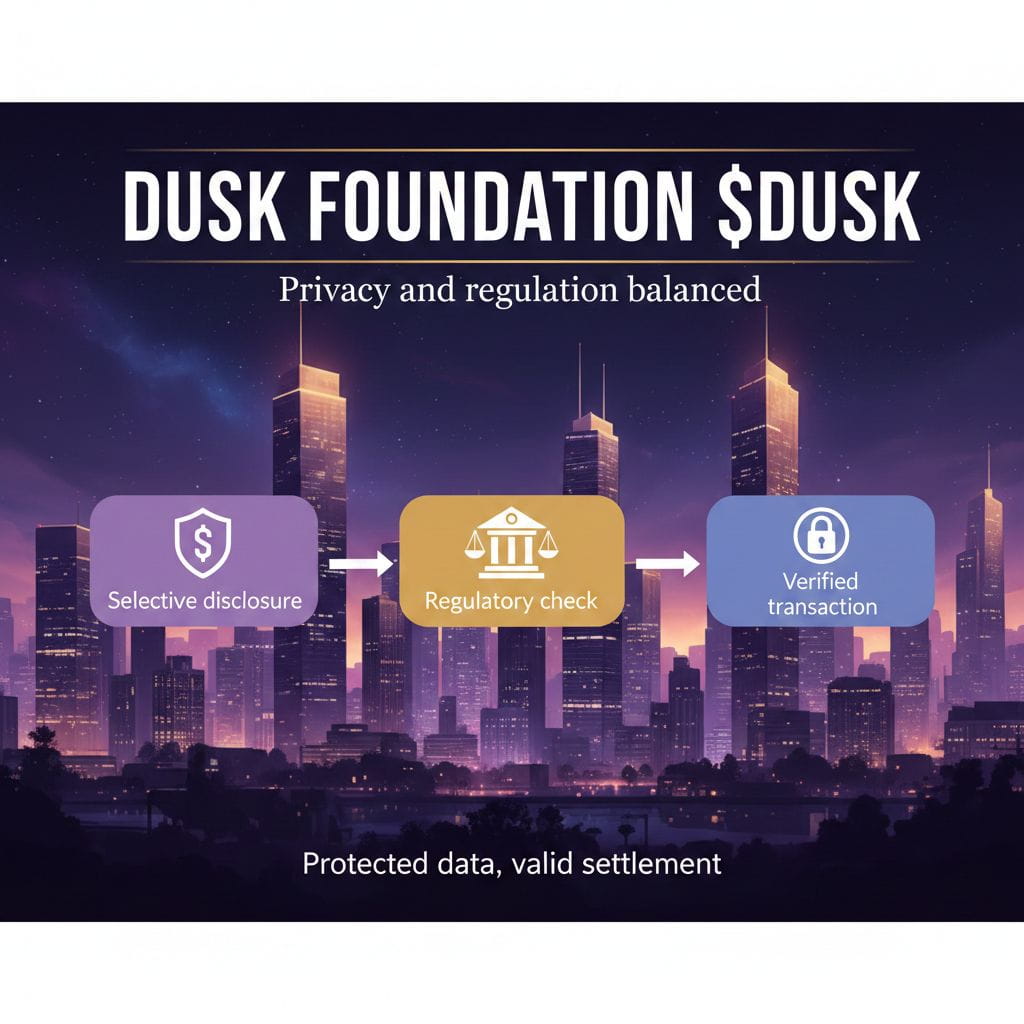

At the core, Dusk Network is trying to make “privacy” and “compliance” live together instead of fighting each other. They’re not promoting darkness or secrecy for its own sake. They’re aiming for “selective disclosure” — a setup where sensitive details stay hidden from the public, but proof can still be shown when rules demand it. If a regulator needs confirmation, the system should allow it. If an audit is required, the data can be revealed in a controlled way. The important shift is this, privacy is the default, not the exception.

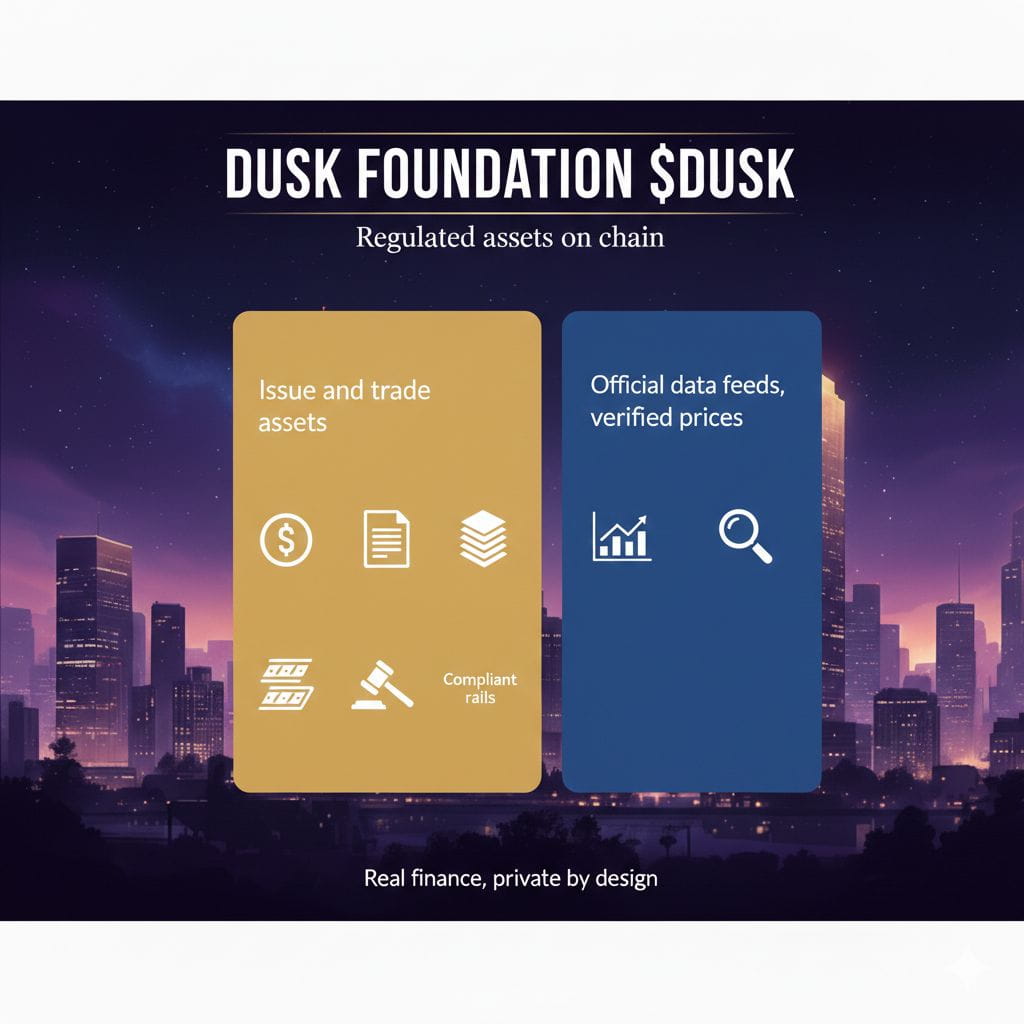

The way value moves on Dusk Network reflects that philosophy. They don’t force every transaction into one shape. There is a public path and a shielded path, both built into the base design. The public path works like most people expect. Balances can be visible, transfers can be traced, and everything is open. This fits situations where transparency is required or preferred.

The shielded path is where Dusk Network feels different. Value is not displayed as open balances. Instead, transactions are validated using “zero knowledge proofs”, which let the network confirm that a transfer is valid without revealing the full details. The system checks correctness without exposing amounts, history, or intent to the entire world. If you’ve ever wondered why using crypto feels like standing under a spotlight, this approach feels like a relief.

This design choice matters because exposure changes behavior. Markets behave differently when every move is watched. Traders hesitate. Institutions stay away. Users feel unsafe. Dusk Network is trying to build an environment where confidentiality protects participants instead of raising suspicion. That’s why they keep pushing the idea that privacy is not about hiding wrongdoing — it’s about allowing normal financial behavior to exist without constant risk.

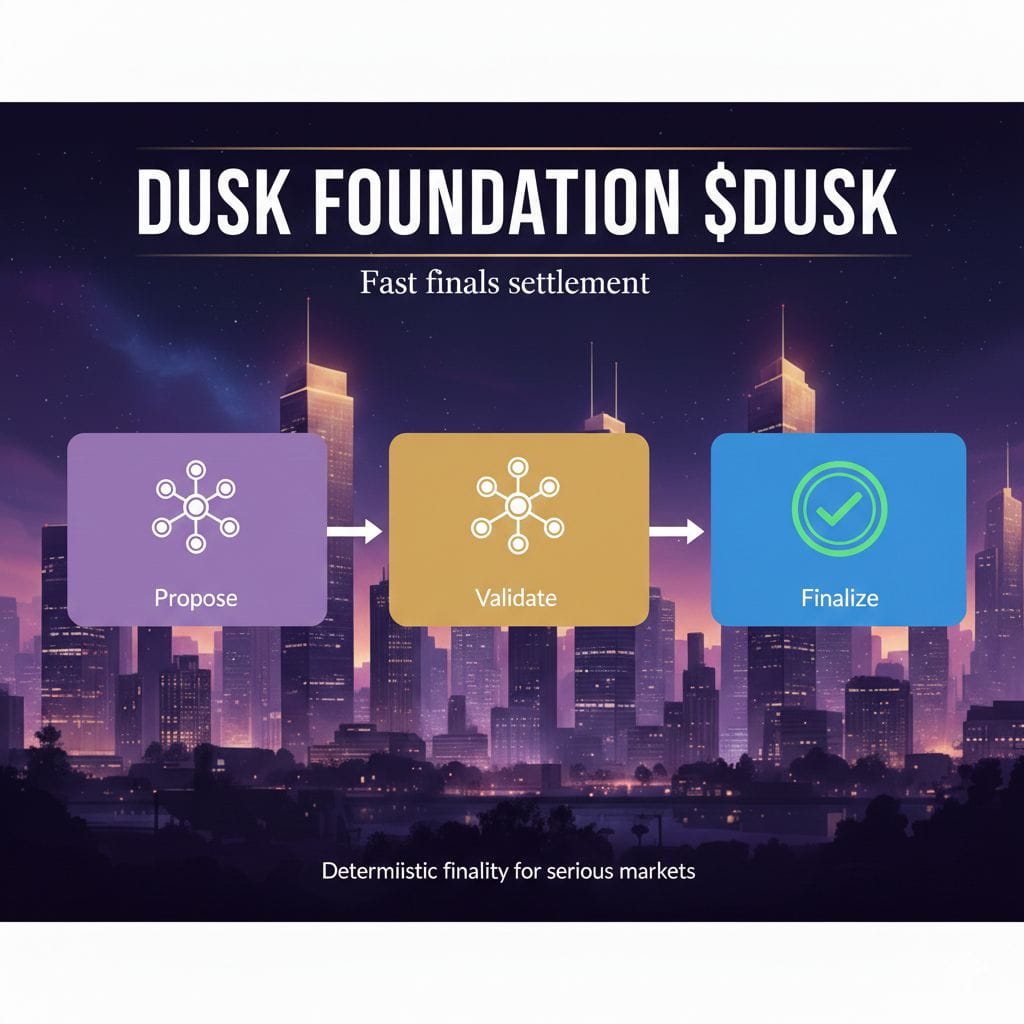

Security and settlement are treated just as seriously. Dusk Network runs on proof of stake, where validators, often called “provisioners”, help secure the network and finalize blocks. This is not just a technical detail. Regulated assets need certainty. A transaction must reach a point where it is done, not maybe done. That’s why Dusk Network focuses on “deterministic finality”, meaning once the system confirms something, it stays confirmed.

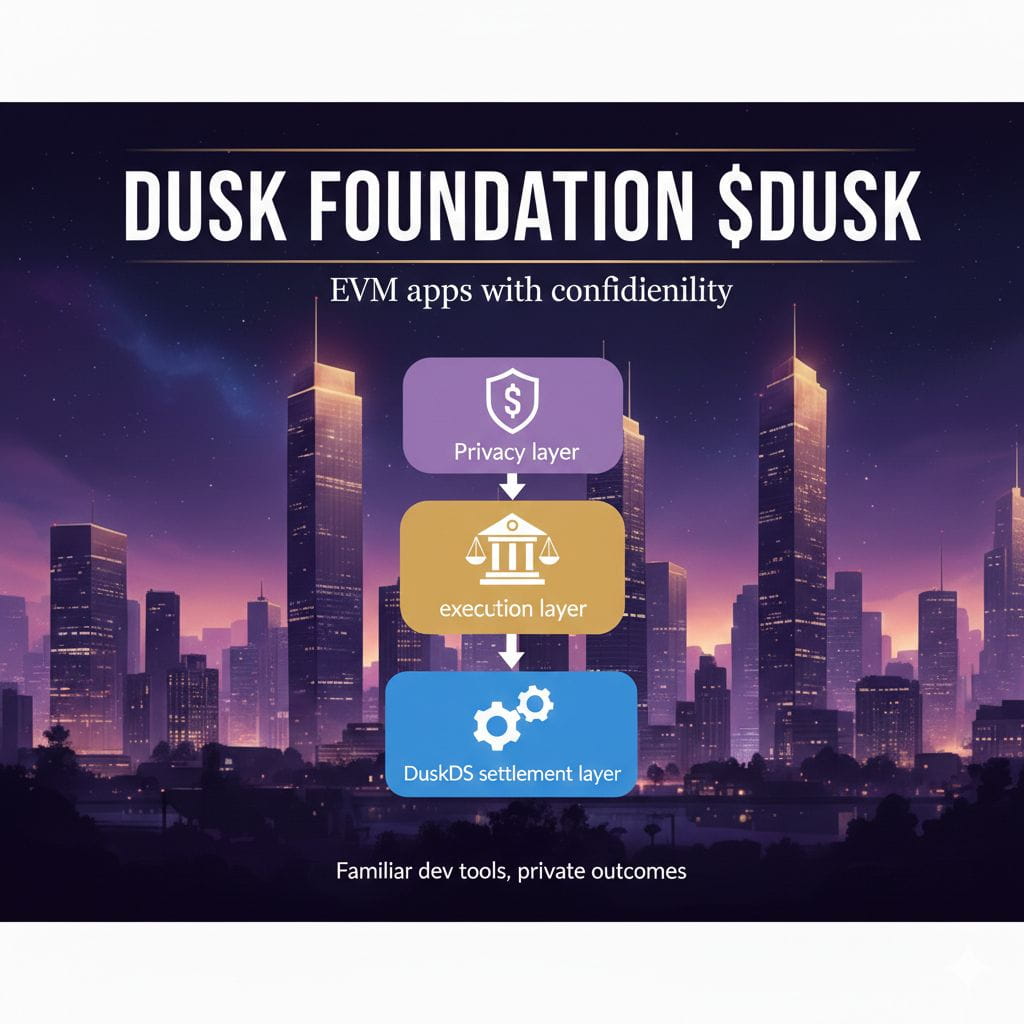

I’m also paying attention to how Dusk Network thinks about builders. Most developers already work with EVM tools. Fighting that reality slows adoption. Dusk Network is moving toward an EVM compatible execution environment while keeping its base layer focused on settlement and security. This is where “DuskEVM” comes into play. The goal is not to copy other chains, but to let builders use familiar tools while gaining access to a privacy focused, regulation aware foundation.

But running smart contracts is not the hard part. The hard part is confidentiality inside normal application flows. That’s where “Hedger” enters the picture — Dusk Network’s direction for enabling private actions within EVM style applications. The aim is to let apps handle sensitive logic without leaking everything publicly, while still allowing verification when needed. If this works the way it’s intended, it unlocks use cases that transparent chains struggle with.

Think about trading for a moment. Should everyone see your intent before you act. Should positions be visible while they’re still being built. Should strategies be readable in real time. Dusk Network is asking these uncomfortable questions because real markets already answered them long ago. Privacy supports fairness. Exposure creates imbalance. That’s why confidential order flow and protected positions are not luxuries in serious environments, they’re requirements.

The bigger direction of Dusk Network points toward “real world assets”. Securities, funds, and other regulated instruments cannot live on chains that ignore rules. They need structure, permissioning, and clear accountability. Dusk Network is positioning itself as infrastructure where these assets can exist without turning every participant into a public record. This is what people mean when they talk about “compliant DeFi” — not marketing words, but systems that actually respect how finance works.

Interoperability also matters. A chain that cannot connect to the wider ecosystem becomes isolated. Dusk Network has been building ways for value to move in and out, because access is part of usefulness. A strong system that no one can reach does not grow. A system that connects carefully can.

Token design and staking incentives support this long view. Dusk Network uses a capped supply model and long term emissions to reward participation and secure the network over time. This is not about fast hype. It’s about stability. If the goal is to support finance that lasts, the incentives must last too.

I’m watching Dusk Network because they’re building in a direction many projects avoid. They’re choosing discipline over noise. They’re choosing structure over shortcuts. If they continue executing with this mindset, the value won’t come from loud promises. It will come from being one of the few networks designed to let privacy, rules, and real finance coexist without forcing users to give up their safety just to participate.