Stablecoins have become one of the most widely used tools in crypto, but most blockchains still treat them like just another token. They move fast, but their behavior is inherited from systems designed for general-purpose computation rather than financial settlement.

Plasma approaches this problem differently. It is a Layer 1 blockchain designed specifically for stablecoin settlement, where the primary goal is not peak throughput or flexibility, but deterministic outcomes. In financial workflows, knowing exactly when a transfer becomes final matters more than shaving milliseconds off confirmation times.

Settlement Is a State, Not a Feeling

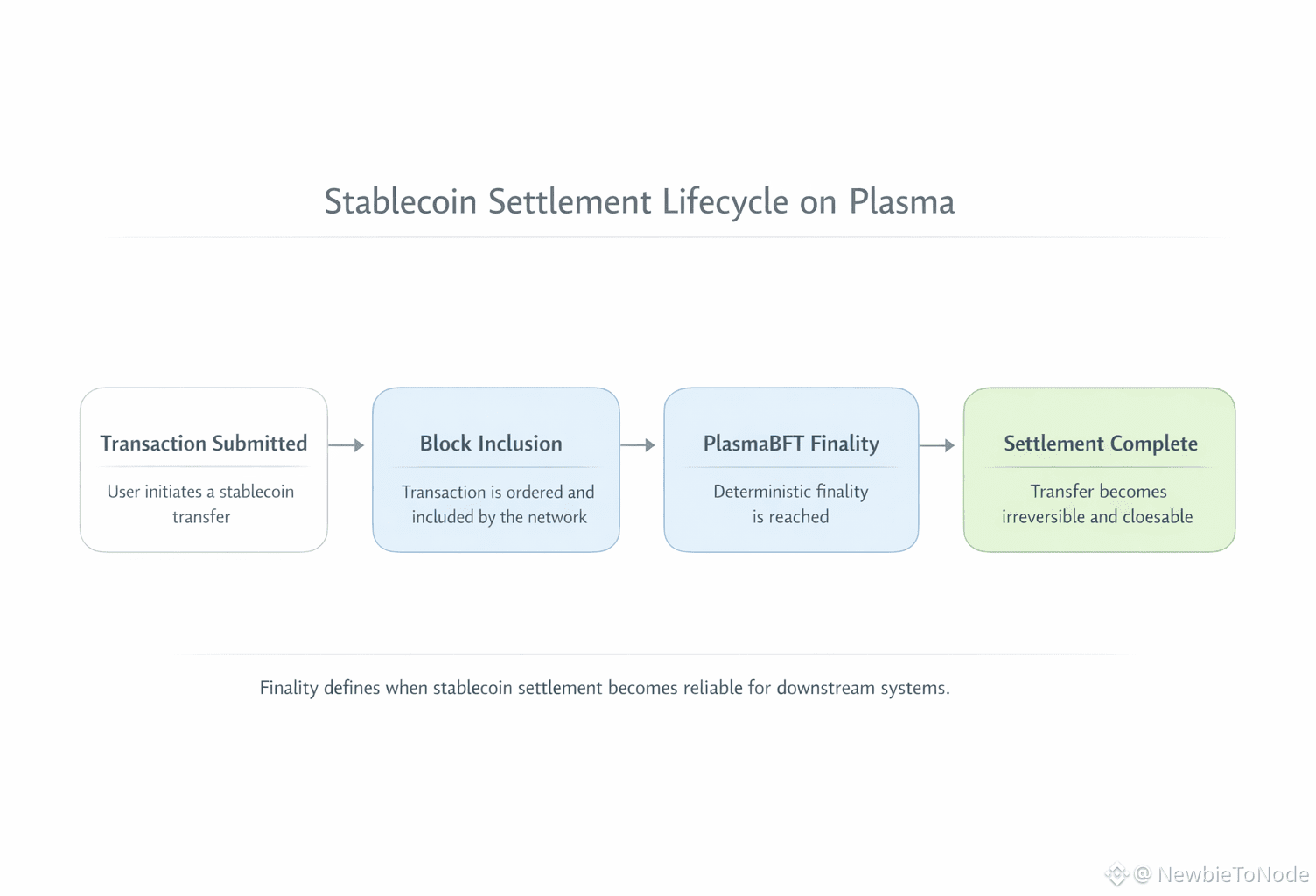

Many users experience stablecoin transfers through wallet interfaces that emphasize immediacy. A button is clicked, a status changes, and the transaction appears complete. But behind that interface is a deeper question: when does the system itself recognize the transfer as irrevocable?

Plasma’s use of PlasmaBFT focuses on delivering deterministic finality. This means that once finality is reached, the transaction is not just likely to succeed—it is settled in a way that downstream systems can rely on. For payments, accounting, and treasury operations, that distinction is critical.

Stablecoin-First Design Changes Priorities

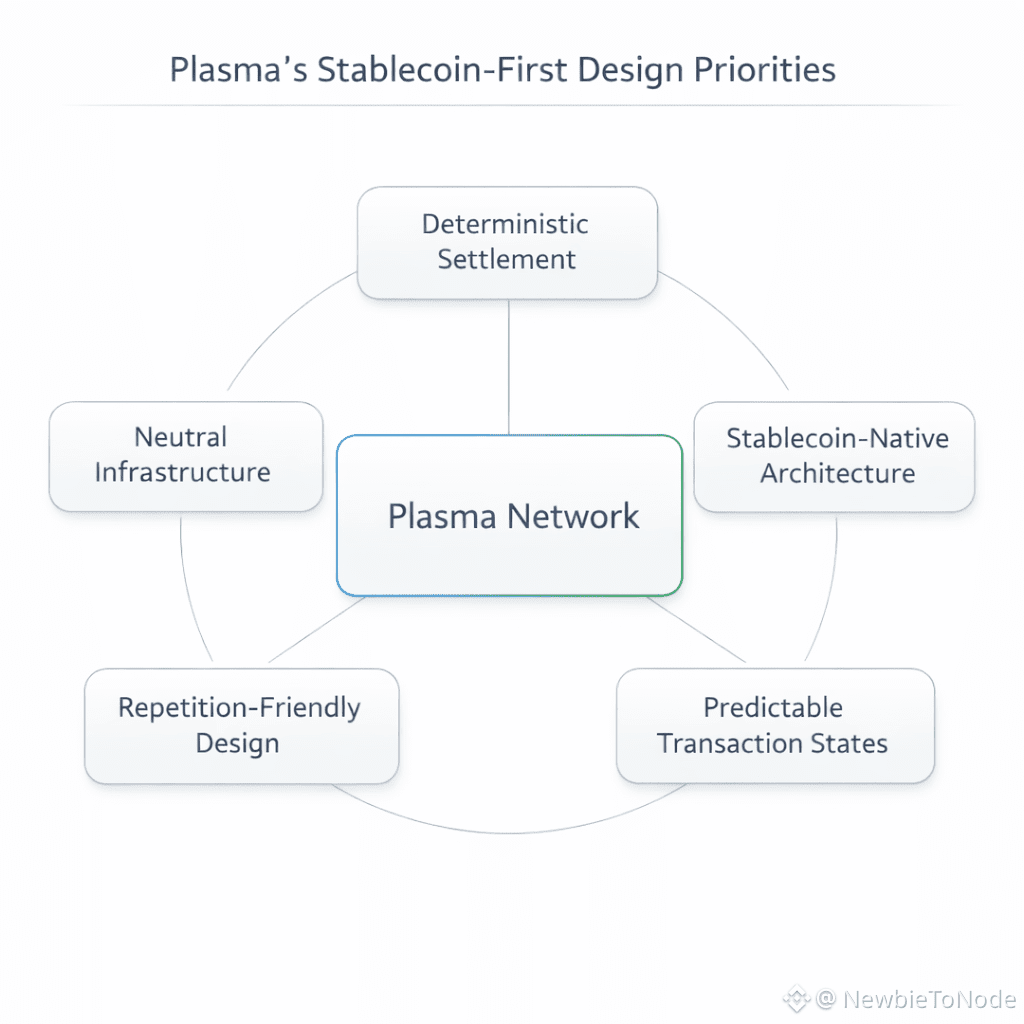

By designing the network around stablecoins rather than adapting stablecoins to a general-purpose chain, Plasma shifts the order of priorities. Instead of optimizing for arbitrary application logic first, it optimizes for predictable settlement behavior.

This matters because stablecoins are increasingly used as operational money. They support payroll, cross-border payments, merchant settlements, and internal treasury movements. These use cases value consistency, clarity, and neutrality over experimentation.

Infrastructure for Repetition, Not Surprise

Financial infrastructure succeeds when it behaves the same way under the same conditions. Plasma’s architecture emphasizes repeatability. Transactions follow a clear lifecycle, finality is deterministic, and the network’s role is to provide a neutral settlement layer rather than interpret intent.

This predictability allows teams to build processes that assume fewer exceptions. Instead of designing around uncertainty, they can design around known states. Over time, this reduces operational overhead and simplifies integration.

Neutrality as a Feature

Plasma’s Bitcoin-anchored security model reinforces its focus on neutrality and censorship resistance. For stablecoin settlement, neutrality is not ideological—it is practical. Participants need confidence that transactions are processed based on protocol rules rather than discretionary decisions.

This is especially important as stablecoins move beyond crypto-native use and into broader financial systems. Infrastructure that behaves consistently and transparently is easier to trust, audit, and integrate.

A Different Definition of Performance

Performance in settlement systems is often reduced to speed. Plasma reframes performance as the ability to deliver clear, deterministic outcomes repeatedly. Fast execution matters, but only when paired with certainty.

As stablecoins continue to evolve into everyday financial instruments, blockchains designed around their actual behavior—not retrofitted later—may become the foundation others build on. Plasma represents that design choice: settlement treated as infrastructure first, and everything else built around it.