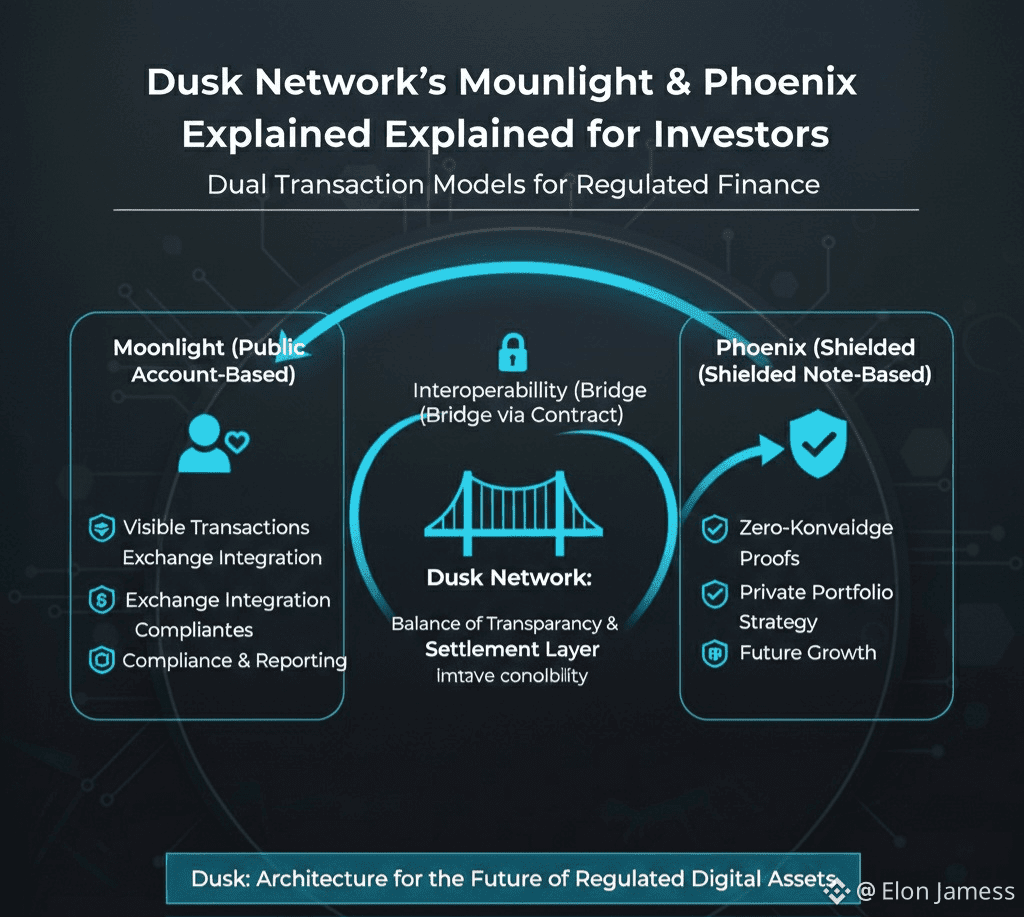

When people first hear “privacy blockchain” they often think it is only for hiding things but in reality privacy is the default in institutional finance Funds don’t show their positions Market makers hide their inventory and treasury desks avoid showing their moves at every moment At the same time regulators still require audit trails reporting and the ability to prove everything is legitimate This is where Dusk Network’s design becomes interesting Instead of choosing one extreme fully public or fully private Dusk built two transaction models that can exist together on the same settlement layer Moonlight and Phoenix Understanding this dual model is more important for investors than memorizing buzzwords because it directly affects liquidity how exchanges support the network compliance and long term use cases

On DuskDS value can move in two native ways Moonlight is the public account based model Phoenix is the shielded note based model powered by zero knowledge proofs Both exist on the same chain but with different privacy exposure This is not marketing hype it is exactly how the protocol explains its transaction system

Think of Moonlight as the part of the chain the wider crypto market already knows It works like regular account balances You send from address A to address B and observers can see the flow This matters because exchanges market makers compliance teams and even portfolio trackers rely on normal transactional visibility Dusk engineers describe Moonlight as a tool to improve speed and enable protocol level compliance

Phoenix is the other side It is shielded and designed around confidential transfers where balances and flows are hidden using cryptography rather than being public The system uses zero knowledge proofs to guarantee correctness In Dusk’s documentation Phoenix is described as note based and shielded while Moonlight is account based The Phoenix repository on Github also shows it is built to allow confidential transfers using a UTXO like structure

The idea of a two transaction model comes from how value moves between these two systems Moving funds from Moonlight to Phoenix or the other way is not the same as sending within the same system Right now doing this requires two steps developers have explained on Github that converting from Moonlight to Phoenix involves a contract deposit and then a withdrawal so it is not a single transaction

This matters for investors because it affects friction for users switching privacy modes how liquidity pools form between public and shielded transactions and how exchanges and institutions integrate with the chain Capital usually follows the easiest path If switching from public to private is harder many users simply won’t do it unless there is a strong reason This shapes where fees volume and activity actually happen

To understand it in a real scenario imagine a tokenized bond issuance platform on Dusk The issuer might want public transparency for the issuance total supply timestamp and proof the bond exists This fits Moonlight But for secondary trading among institutions a fund buying fifty million dollars worth of bonds does not want the world front running the flow or tracking portfolio strategies This is where Phoenix comes in It allows confidential ownership transfers while still allowing selective information sharing if needed Dusk calls it privacy by design and transparency when required

Moonlight helps Dusk work with visible trackable habits of crypto infrastructure Phoenix targets confidentiality norms in real finance Many privacy chains failed because they forced users into one mode Everything transparent which is awkward for institutions or everything shielded which is hard for compliance Dusk solves this by letting applications decide transaction by transaction what should be public and what should be private

Regulated markets are built slowly through integrations not hype If Dusk’s dual transaction model works technically and operationally it does not need viral attention it needs serious use cases that demand both confidentiality and auditability

There is a caution though Dual systems add complexity Two models mean more moving parts Wallet UX developer tools liquidity segmentation and friction in switching modes Complexity slows adoption unless value is clear And value is obvious only in certain areas tokenized real world assets compliant DeFi institutional settlement or any application where front running and portfolio leakage are real business risks

The right question for investors is not whether Phoenix is better than Moonlight It is whether Dusk has a credible path to be the chain where real financial assets want to live If tokenized markets grow confidentiality and compliance will not be optional They will be required And Dusk is trying to make that part of the infrastructure not an afterthought

Moonlight and Phoenix are not just technical details They are the architecture behind Dusk’s institutional strategy Moonlight allows visibility and compliance Phoenix allows confidential transfers Both work together to let the network support both public and private needs This positions Dusk to handle tokenized bonds securities institutional trading and other regulated financial assets Moonlight enables exchanges and compliance reporting while Phoenix protects confidential portfolio strategies

From an adoption perspective Moonlight makes the chain familiar and accessible to existing infrastructure Phoenix makes it attractive to institutions that require privacy Combined they allow Dusk to target both retail and professional use cases without forcing a compromise

Investors need to consider technical execution real market support and whether users and integrators can adopt both models naturally Dual systems only succeed if they solve real problems for real users Moonlight and Phoenix do that by balancing transparency speed compliance and confidentiality in one platform

Dusk Network is betting that this dual model approach will create a foundation for regulated on chain finance Privacy is not hiding it is part of market structure Transparency is not a weakness it is a requirement The chain that can combine both may become the default infrastructure for tokenized markets Moonlight and Phoenix are the building blocks of that vision and understanding them is key for anyone considering Dusk as an investment