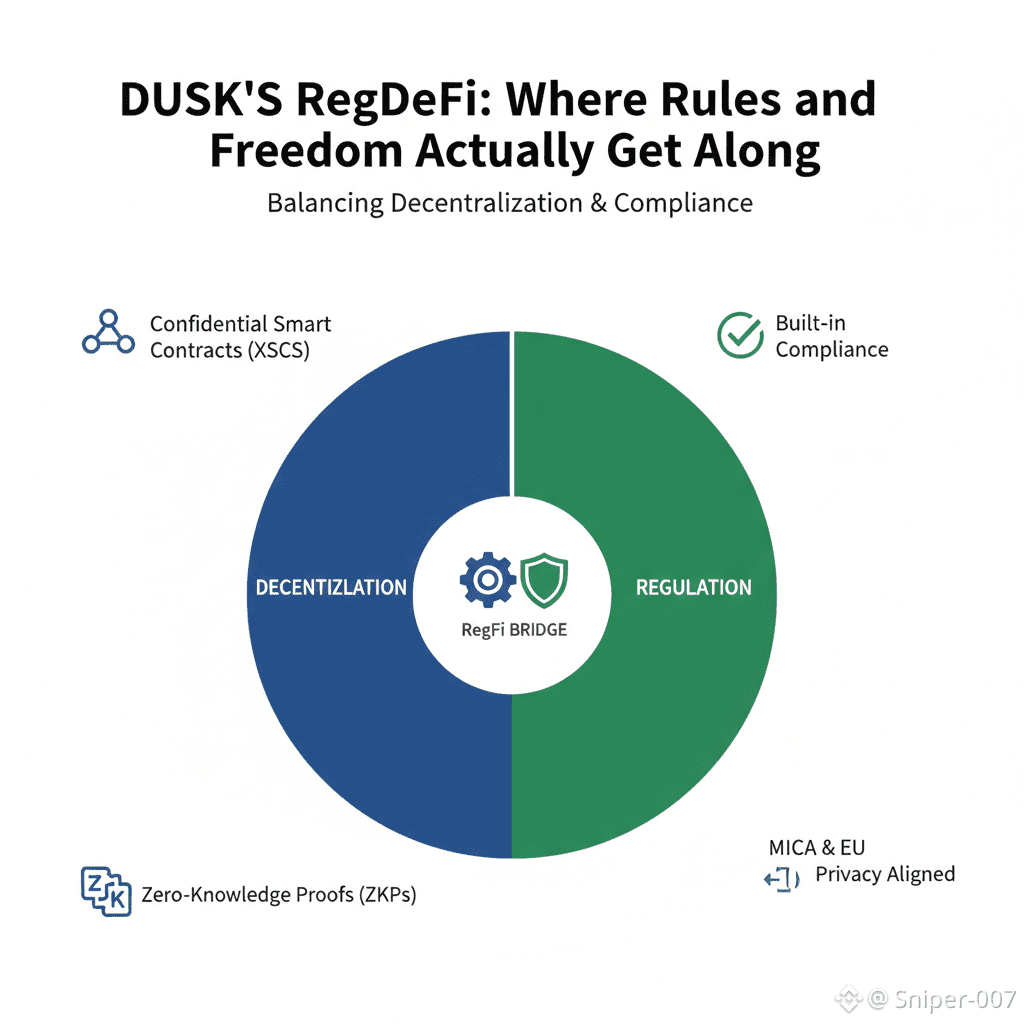

Man, figuring out how to mix real regulation with proper decentralization is tough. Most projects either go full wild west or lock everything down so much it feels like TradFi 2.0. But Dusk Network's RegDeFi thing? It actually feels like they're nailing it. They don't slap compliance on top like some band-aid – they build it straight into the core protocol. That way big institutions can get in without needing a million middlemen, and it lines up with EU stuff like MiCA and those privacy rules.

The secret sauce is their Confidential Smart Contracts, or XSCs. These let you set rules right on the chain using zero-knowledge proofs. So someone can prove they're legit – like an accredited investor or whatever – without spilling their whole life story. For tokenized bonds or securities, the contract just handles payouts automatically, checks eligibility, keeps identities hidden, and still follows laws like MiFID II. Public side does the visible settlements, private side hides the sensitive bits, and Merkle proofs let auditors check without peeking everywhere.

It's like RegDeFi is this bridge, you know? Decentralization is the wide open part, regulation the solid foundation holding it up. Dusk makes tokenizing real stuff easy – real estate, invoices, whatever – then split it up fractional and trade it. Oracles pull in off-chain info privately (credit checks, etc.), so no need for custodians eating fees. Some pilots showed costs dropping like 80-90%, which is huge.

They tackle KYC/AML smart too with reusable identities. You make a soulbound token once proving your stuff, then use it everywhere without redoing KYC over and over. Fits with DIDs and standards, cuts the data mess. Rules change by country, but their modules let you swap in what you need – FATF travel rules for transfers across borders, things like that.

Tokenized securities is where it gets exciting. Issuers launch XSCs enforcing lock-ups, transfer limits, all verifiable on-chain. Not like those permissioned chains that ditch decentralization; Dusk keeps it public enough to verify, private enough to protect. And $DUSK ties it together – fees fund bounties so auditors hunt violations and get paid, keeps everyone sharp.

Sure, oracles can be a weak spot if they go bad. Dusk spreads it out with multiples and ZK wraps to protect. Cross-chain to Polygon or Solana? They're building bridges that don't break compliance, using their Piecrust VM for that.

Real-world use? Imagine private equity funds on-chain. Investors prove net worth privately, payouts auto-trigger. Opens up markets that used to shut out regular people. Even governance checks proposals against regs in sims before votes.

With mainnet live now and big partnerships like NPEX tokenizing hundreds of millions in securities, RegDeFi could set the standard for hybrid finance – TradFi and DeFi actually playing nice. Regs keep shifting, but Dusk's upgradable setup lets them adapt fast without chaos.

At the end of the day, Dusk turns compliance from a headache into a legit advantage. Building a space where decentralization and oversight actually work together for the long haul.

Thoughts? Anyone else watching this space?