I used to dismiss “privacy for regulated finance” as a nice-to-have, until I tried to picture the unglamorous day-two work: issuance, transfers, corporate actions, and an auditor asking for answers without turning every holder into a public datapoint.

The problem is simple. Public ledgers make it easy to verify history, but regulated markets are built on selective disclosure. Issuers need to enforce eligibility and limits, investors don’t want strategies broadcast, and supervisors still need a clean way to validate what matters.

Most projects in this lane hit the same wall: maximum privacy breaks oversight, maximum transparency breaks participation. The real engineering problem is incentives and workflow how to make confidentiality compatible with rules, reporting, and dispute resolution instead of treating “compliance” as an off-chain spreadsheet.Dusk is positioned as a privacy-enabled, regulation-aware chain where confidentiality is the default but transparency can be revealed to authorized parties when required.It’s like a vault with viewing windows that only open for the right keys.

One mechanism-level detail I actually care about is how consensus avoids turning stake into a public social graph. In the SBA design, block generators submit “Blind Bids” that hide identity and stake amount, include a secret value, and later prove (with a zero-knowledge proof) that their lottery score was computed correctly; valid bids are kept in a Merkle tree, and a provisioner committee ratifies a block once it gathers a supermajority threshold (described as 75% signatures).

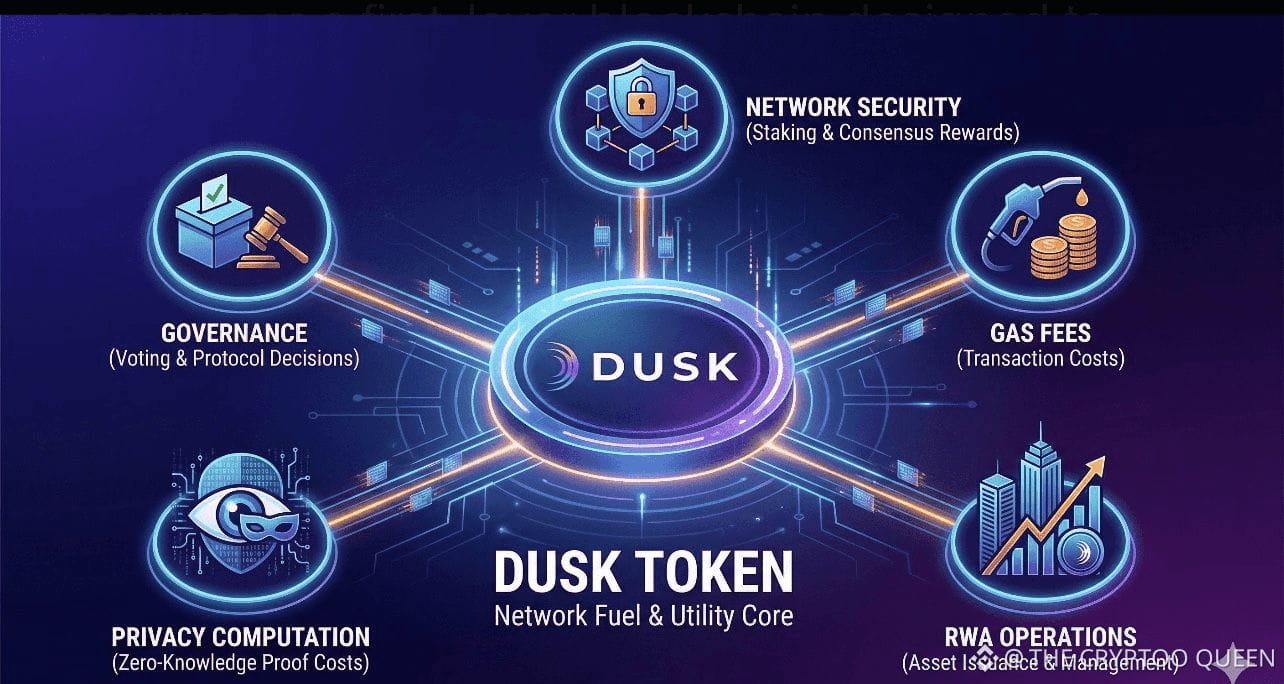

A second implementation detail sits higher up the stack: the securities flow is packaged into a Confidential Security Contract (XSC) model via Zedger, described as a hybrid transaction approach (UTXO + account-style) with built-in lifecycle functions that map to real cap-table maintenance compliant settlement and redemption, capped transfers, plus corporate actions like dividends and voting while keeping balances private.The token’s role is neutral plumbing: it pays fees/gas, it’s staked for consensus participation and rewards, and it can anchor governance around protocol and asset-standard rules.

From a trader-investor lens, the short-term market tends to price the headline (“privacy + RWAs”) and ignore the boring constraints: integration time, legal review cycles, and the operational cost of running compliant venues. Long-term value, if it shows up, is whether issuers can run issuance-to-settlement-to-corporate-actions with predictable behavior, and whether supervisors can audit without forcing the whole market to go fully public.

Failure mode: if an issuer updates eligibility or transfer-cap parameters after a regulatory change and that update is delayed or misconfigured, matched trades can start failing mid-settlement and force off-chain reconciliation that undermines the whole “single source of truth” promise.Uncertainty: I still don’t have a crisp picture of how liveness holds up under validator concentration during low-activity periods.

Quietly, I like the ambition here because it treats compliance as a first-class system requirement, not a marketing appendix, but it will live or die on whether the “right people can see the right slice of truth” works in production without adding fragility.