It is one of the silent rules in crypto that transparency is synonymous with fairness.

When all people are able to see everything, it is said, there would be better market behavior. This notion does make sense until one examines it in relation to the way real financial markets do run. Professional markets are actually constructed with the idea of controlled exposure rather than complete visibility. Information is disclosed strategically, at the appropriate time, to the appropriate parties. Any other establishes distortions.

This is when Dusk can be interesting not as a type of a privacy chain, but as infrastructure built with the mechanisms of exposure in regulated finance.

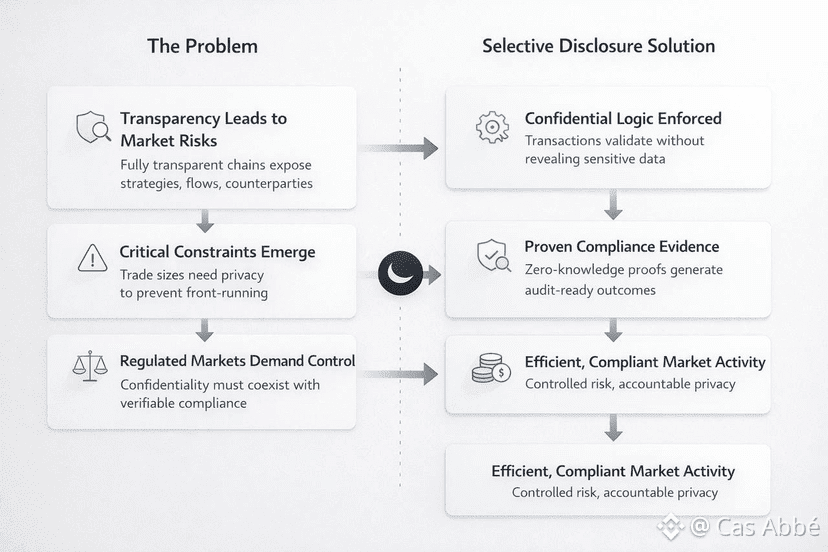

In conventional markets exposure is controlled. A fund does not show its position sizes on a real-time basis. A treasury desk does not make announcements over rebalancing plans in advance. The issuer does not release any sensitive investor information to the world to demonstrate compliance. However, audits, reports, and enforcement remain with regulators. The system is effective since disclosure is not absolute.

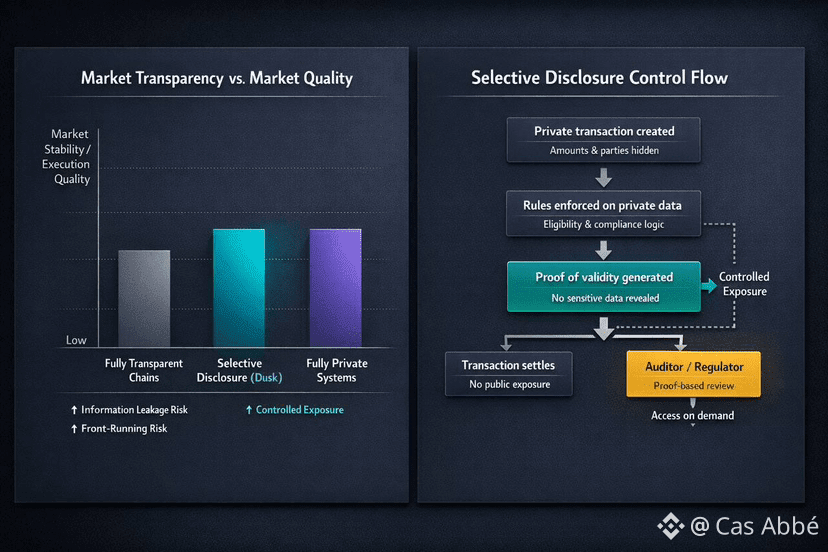

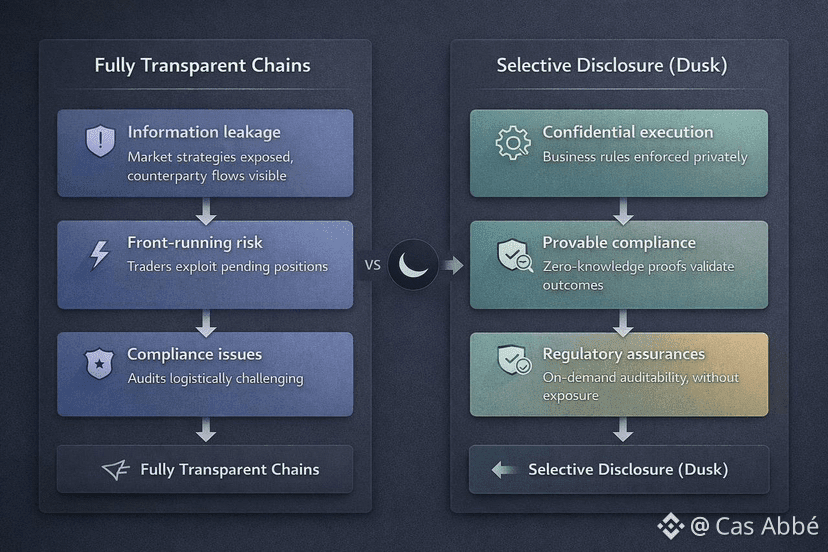

The majority of blockchains disequilibrium this balance. Flow, strategy, and counterparty are by default revealed through fully transparent ledgers. At the other end, systems completely privatized conceal too much to place it in the hands of regulators and institutions. What you end up with is the fake option: transparency on the surveillance level or non-regulated capital.

The design of Dusk tries to be in between that issue. Its design is designed in such a way that it can ensure confidentiality to the market activity and maintain verifiability to the overseers. That is not a philosophical position--it is a reaction to a structural imperative. Markets do not fail because the market participants are concealing too much. They are not successful because information leaks at an inappropriate moment.

Dusk is in many ways best thought of as an exposure management layer. The protocol does not make the assumption that all data must be visible but instead leaves the decision on what data must be visible and what data must be confidential to the application. Confirmations of transactions, regulations and finality can be reached without making each of our actions a public announcement. This is far more consistent with the operation of regulated markets which are already operating off-chain.

So what is the significance of this to adoption? The exposure has direct influence on behavior. Players understand that their trading activities will be aired live and this makes them alter their trading behaviors. Orders are split, rerouted inefficiently or bypassed. Fragmentation of liquidity is not due to lack of demand but rather due to high cost of being observed. Capital (serious capital) seeks over time places (and attempts to place) its money in venues to which transparency does not reduce the quality of execution.

The coming of dusk is an indication of something different. The network can also minimize the signaling risk without eliminating accountability by permitting confidentiality when it is operationally required. Auditors and regulators do not require a live feed of all strategies but only the possibility to check that the rules were adhered to and the investigation of the cases when something goes wrong. That is a fine difference, yet very important.

And this is particularly so in case you consider tokenized real-world assets. Each of the issuance, settlement, and secondary trading demand various exposure requirements. A issuer might require the demonstration of a public existence of an asset. Investors are possibly required to have privacy on holdings. Under certain conditions, regulators may be required to access audit trails. The system which causes one mode of visibility to be practicable throughout all these steps brings friction somewhere along the pipeline.

The architecture of Dusk is shaped such that it minimizes that friction by making exposure configurable instead of binary. This does not ensure success, but it eliminates one of the biggest structural disjunctions between the blockchain dynamics and financial reality.

There exist tradeoffs, and they are best made out. Systems that facilitate selective disclosure are more difficult to implement, audit and design. Not everything being public by default makes developer tooling, wallet UX, and liquidity routing more difficult. Complexity makes it slow to adopt when the benefits are not evident. That is the risk aspect of the strategy of Dusk.

However, the positive also manifests itself. In case the markets would tend to shift toward tokenized instruments as regulated, the ones that thrive will not be the loudest or the fastest. They are the ones that will seem to issuers, be compliant to the regulators, and safe to those participants who are not interested in trading in a glass box.

The actual issue is not whether privacy is good or bad. Whether a blockchain can handle exposure in such a manner that it does not fall under regulation is the question. Dusk believes that the missing component is controlled disclosure, rather than radical transparency. And should that be the case, the infrastructural component that will be of the greatest value is probably the one that is least goal-oriented at the time when all is going well.