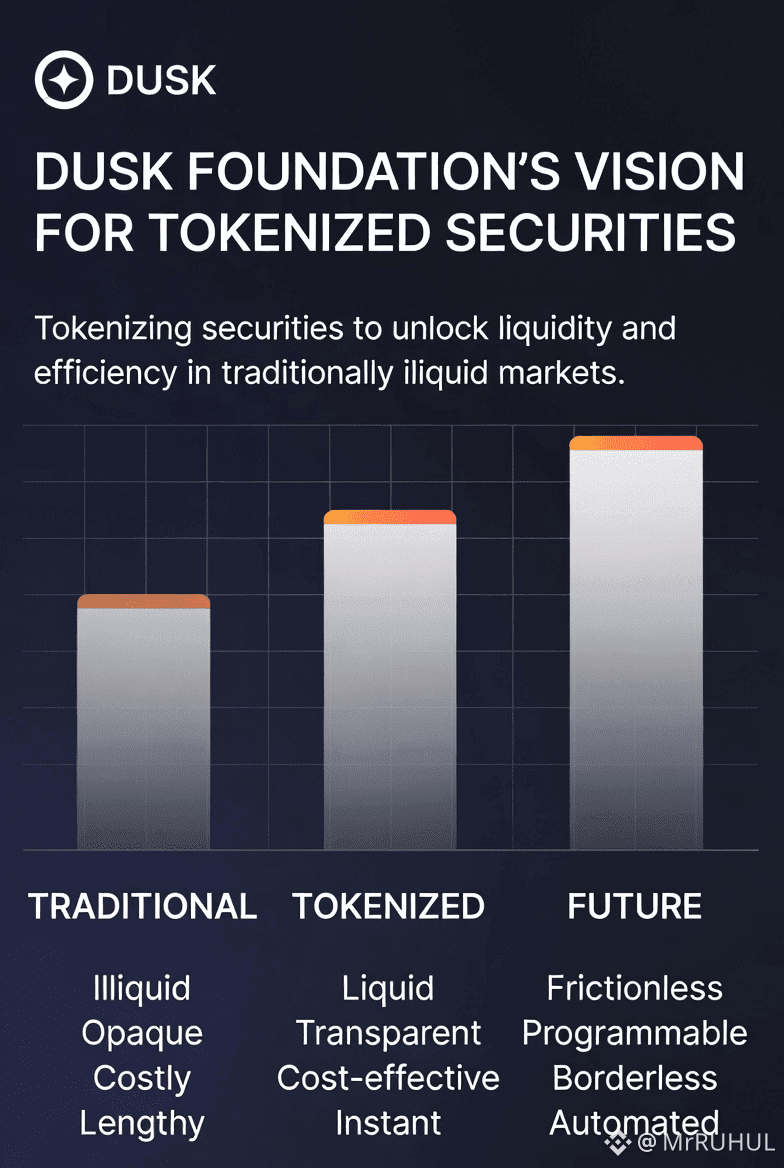

Dusk Foundation wants to change how financial markets work, plain and simple. Their main goal? Build a new backbone for trading—one where stocks, bonds, and funds actually exist, move, and settle right on the blockchain. They’re not chasing the latest crypto fad. Dusk is serious about pulling regulated finance into the world of decentralized tech. For them, tokenized securities—digital versions of real assets—are the missing link tying traditional finance to this new landscape.

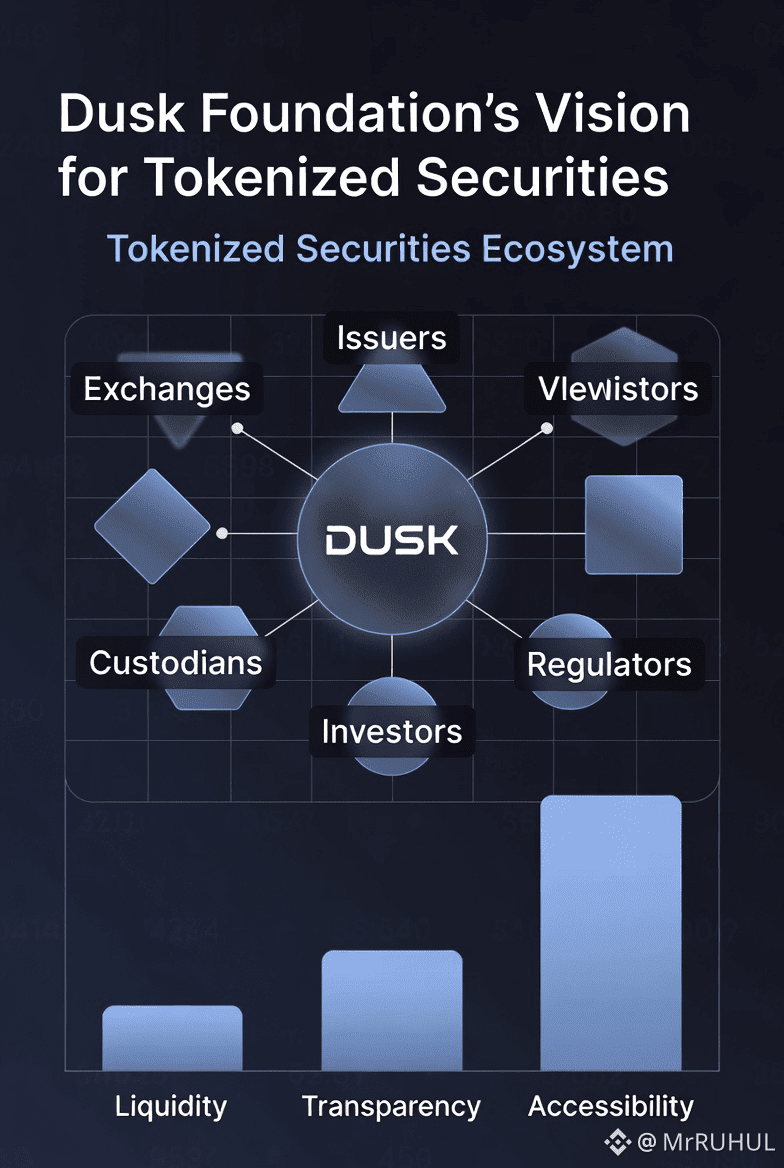

What really drives them is the belief that blockchain can shake up capital markets. It speeds things up, cuts out a bunch of costs, and invites more people in, all while sticking to the rules. The old system is packed with middlemen: custodians, clearinghouses, depositories. Every new party adds time, money, and headaches. Dusk’s answer is a decentralized market infrastructure (DeMI) where compliance and all those legal rules aren’t bolted on later—they’re right there, baked into the blockchain.

So, why care about tokenized securities? Because these tokens aren’t just “crypto.” They represent actual ownership—stocks, bonds, whatever you want. They have real value and have to follow strict legal rules: who can own them, how they move around, paying out dividends, voting, reporting—the works. Dusk’s plan is to code all that legal stuff into the blockchain itself, so everything from issuing to transferring to settling just runs on autopilot, clear and transparent.

This setup wipes out a lot of old problems. Settlements that used to drag on for days? Now they’re almost instant. Paperwork and expensive middlemen start to disappear. Ownership records are locked down and easy to check. Since compliance is built into the system, only verified people can trade, so the whole thing stays above board with KYC and AML laws.

Of course, there’s a tricky part: privacy versus compliance. Blockchains are open by nature, but too much openness risks exposing details that banks and institutions want to keep private. Dusk handles this with zero-knowledge proofs and privacy-focused transactions. So, transaction details stay hidden from the public, but regulators can still check things when they need to.

For fund managers and issuers, this is a real shift. They can move assets or manage portfolios on-chain without showing their cards to the competition, while regulators don’t lose their grip.

A lot of platforms just “wrap” old assets as tokens. Dusk doesn’t settle for that. They want native issuance—financial instruments created on the blockchain from the ground up, with compliance and lifecycle rules built in from the start. No more just putting a digital sticker on old processes—they’re rebuilding the whole system. In Dusk’s model, compliance, trading, settlement, dividend payouts—it all runs automatically through smart contracts.

They use token standards like XSC (Confidential Security Contract) to plug in all the legal logic—transfer rules, automated audits, the stuff regular tokens like ERC-20 can’t handle. That’s what turns security tokens into real securities, just in a decentralized world.

And this isn’t just theory. Dusk is teaming up with real partners, like the Dutch exchange NPEX, which operates under strict European financial rules. Together, they’re letting people issue and trade regulated securities straight on the blockchain, mixing decentralized finance with real-world compliance.@Dusk #Dusk $DUSK