Most conversations around stablecoins always circle back to the same obsession. How fast is the transfer and how cheap is it. I get it. Fees and speed are easy to measure and easy to tweet about. Plasma is already strong there with zero fee transfers and a stablecoin first design. But the longer I look at real adoption, the more convinced I am that speed is not the real bottleneck.

The real issue is that payments are not just money moving. Payments are information moving with money.

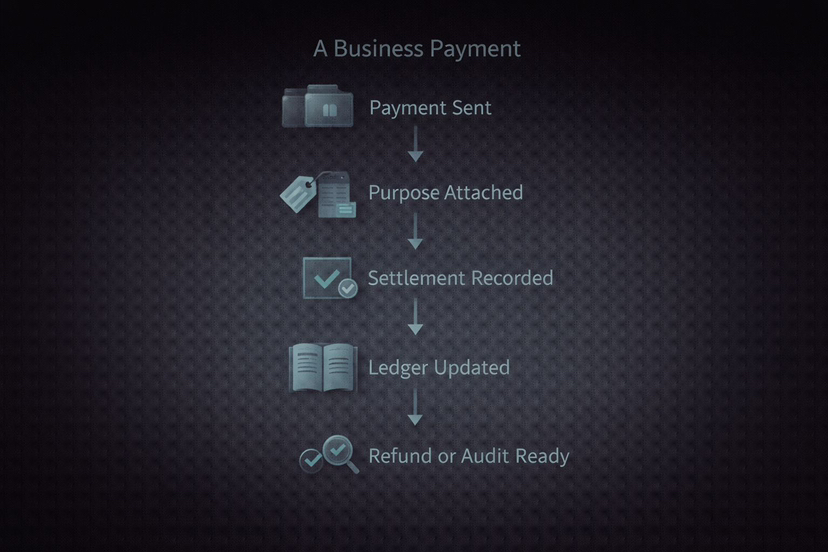

In real businesses, nobody sends funds just for the joy of it. Every payment is tied to something concrete. An invoice. A salary. A supplier settlement. A subscription renewal. A refund. A dispute. A reconciliation entry. Banks and payment processors dominate business finance not because they are fast, but because they carry structured data that accountants and finance teams can actually work with.

This is where I think Plasma has a much bigger opportunity than most people realize. If stablecoin transfers evolve into data rich payments, businesses can actually run operations on them instead of treating crypto like a side experiment.

When payments stop being blind, stablecoins start to scale.

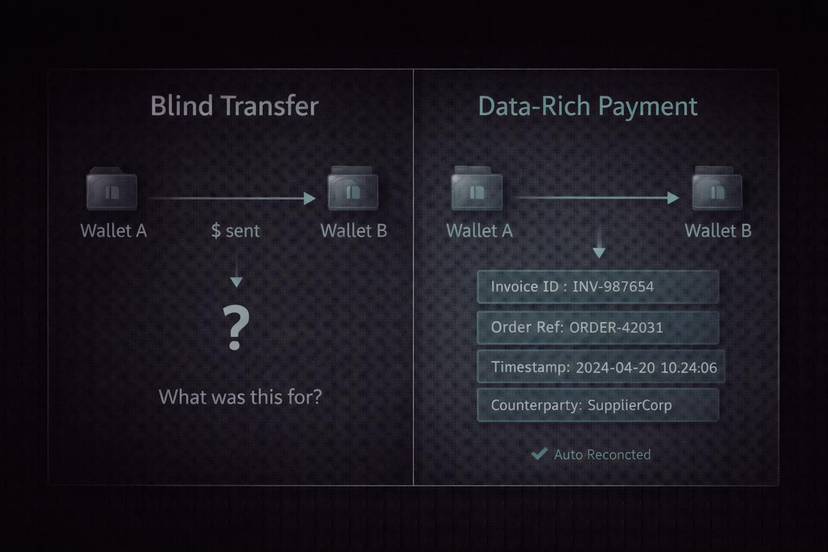

In crypto, most transfers are blind by design. Wallet A sends funds to wallet B and the chain records that it happened. From a protocol perspective that is enough. From a business perspective it is not.

If I run a marketplace with ten thousand sellers, I do not need ten thousand transfers. I need ten thousand transfers that are clearly linked to orders, fees, refunds, and adjustments. If I pay contractors globally, each payment must be tied to a job, a contract, and a tax record. If I run ecommerce, every refund must reference the original purchase cleanly.

Without this information, stablecoin payments stay stuck in a crypto native workflow where humans manually piece things together. Humans do not scale. Businesses cannot scale like that either.

So the future is not just stablecoins everywhere. The future is stablecoins that carry the same quality of payment information that businesses already expect.

Why traditional payment systems care so much about data.

There is a reason legacy payment rails look boring. That boredom is the feature.

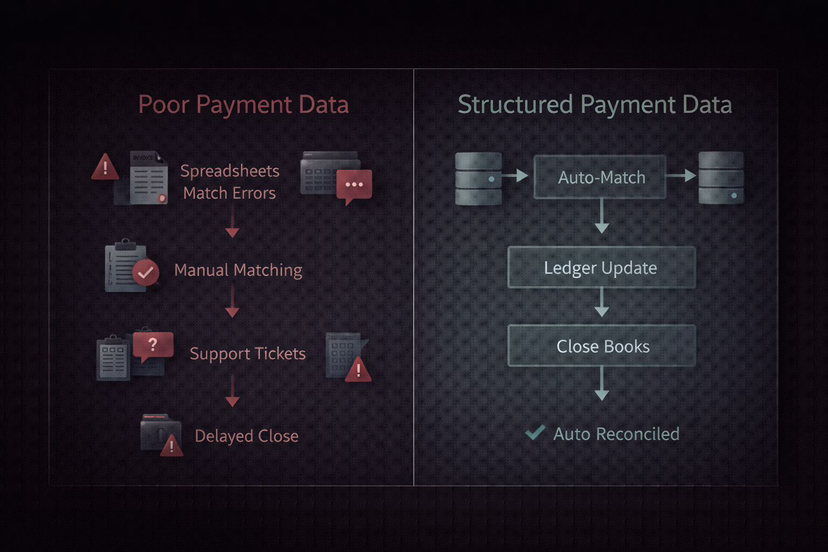

Banks spent decades building messaging standards so payments could carry structured information end to end. That structure is what allows systems to auto match payments to invoices, lets support teams trace failures, and keeps accounting sane.

When payment data is weak, exceptions explode. Exceptions turn into spreadsheets, tickets, delays, and manual work. Finance teams fear exceptions more than fees. Fees are predictable. Exceptions are not.

This is why I keep coming back to a simple belief. The moment stablecoin rails reduce exceptions, they become mainstream.

Plasma already positions itself around institutions and payment companies. That comes with a higher bar. Institutions do not just ask if it works. They ask if it can be reconciled, audited, traced, explained to compliance, and operated at scale without drowning in edge cases.

That is exactly where payment data becomes a differentiator.

Stablecoins that a CFO can sign off on.

If Plasma treats payment data as first class, it can turn stablecoin transfers into something finance teams are comfortable approving. Reference fields, structured metadata, traceable links between payments, refunds, and adjustments. These are not flashy features, but they are the difference between experimentation and production.

The result is simple. Stablecoin payments start to feel like something a CFO can approve, not just something crypto users enjoy.

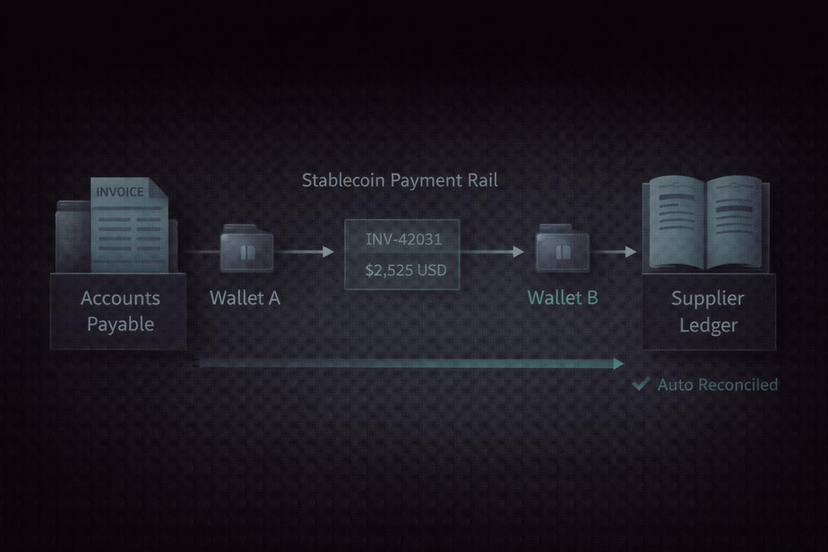

The real killer use case is invoice level settlement.

Most global trade runs on invoices. Companies pay because an invoice exists and needs to be cleared. Invoices have identifiers, dates, line items, partial payments, and adjustments.

Now imagine stablecoin payments that are always invoice clean by default. Not a sloppy memo field meant for humans, but structured data meant for systems.

That changes everything.

A business can auto match incoming stablecoin payments to invoices.

Suppliers immediately know which order was paid.

Support teams can trace payments back to checkouts.

Auditors can verify flows against obligations without guesswork.

This is not hype. This is maturity. It is stablecoins crossing from transfers into real payment infrastructure.

Money always carries meaning.

A quiet truth in finance is that people do not transfer money. They transfer intent.

Customers pay for something specific. Companies pay suppliers for specific obligations. Platforms pay users for specific actions. Meaning matters.

Most stablecoin systems today leave meaning fragmented or off chain. The chain records value, while businesses rebuild context elsewhere. That duplication is fragile and expensive.

If Plasma can embed meaning directly into stablecoin payments in a consistent way, it stops being just a settlement chain. It becomes a bridge between crypto settlement and real business operations.

Better data makes refunds and disputes sane.

Refunds are not just sending money back. They are about linking a new transaction to an old one in a way that systems can understand. Purchases, items, dates, and policies all matter.

When refunds are treated as normal, data linked operations instead of edge cases, stablecoin commerce becomes safer without recreating chargeback chaos. Systems can automatically relate refunds to original payments, and everyone can see what happened.

This is how consumer protection and merchant safety can coexist.

Operable payments are the next battlefield.

Any payment rail that cannot be observed will scare serious operators away. Real payment infrastructure is operable. Teams can monitor flows, detect anomalies, debug failures, and explain incidents.

If Plasma combines rich payment data with observability, it can become a system that settlement teams can actually run, not just trust blindly.

Why this matters to normal users too.

This is not only a business story. Better payment data improves everyday user experience.

Clear receipts.

Clear refund status.

Payments linked to purchases.

Fewer where is my money moments.

Fewer support tickets.

Less anxiety.

Good reconciliation is invisible to users, but they feel the smoothness it creates. That is how fintech wins quietly.

What success would look like for Plasma.

If Plasma wins on payment data, it will not look like a viral chart. It will look like quiet adoption.

Businesses accept stablecoins because reconciliation is easy.

Marketplaces run payouts because everything is traceable.

Refunds feel normal and safe.

Finance teams stop resisting.

Support tickets drop.

That kind of success sticks.

The big takeaway.

Stablecoins become real money only when they carry real payment data.

Value is only half the story. Meaning is the other half.

If Plasma makes payment data a first class citizen, transfers turn into payments and payments turn into infrastructure. You do not just move money faster. You move money that businesses can actually operate on.

That is how stablecoins graduate from crypto rails to real financial rails.