When I first heard “Fogo is a high performance L1 that uses the Solana Virtual Machine,” my brain did that thing it always does: it filed it under fast chain, SVM, probably another ‘we’re scalable’ story. But the more I dug through what they’re actually shipping and the little breadcrumbs in the ecosystem, the more it stopped feeling like “a new city for builders” and started feeling like something else entirely.

It feels like a pop-up exchange.

Not in the token-listing sense. In the infrastructure sense. Like the team is trying to compress the time between “a user does something” and “the network settles it” until it’s basically limited by physics and good engineering. And that’s a different personality than most L1s. Most chains try to be a general purpose universe. Fogo reads like it’s trying to be a venue: a place where real-time apps especially markets don’t feel like they’re operating through molasses.

That’s why the SVM piece, while important, doesn’t feel like the main story to me. SVM compatibility answers the question “what can run here?” The more interesting question is “what kind of environment is this chain trying to create?” And Fogo keeps answering that with very practical signals: the kind you see in release notes, in SDK repos, in the weird little “workaround” tools that appear when developers run into reality.

One of the clearest signals is how “unromantic” their upgrades look. Take their v19.0.0 release notes. They aren’t trying to wow you with a cinematic announcement; they’re changing knobs that matter when you’re chasing real performance. They mention setting inflation to a fixed 2%, adding priority repair support, updating block limits, and improving RPC CPU usage. That’s not the language of “please like our narrative.” That’s the language of “we’re tightening the machine.” And honestly, that’s the kind of thing I trust more than glossy performance claims, because the bottlenecks in high-performance networks are almost always boring and mechanical.

Another place where Fogo starts to feel unusually grounded is the UX direction. Crypto UX is mostly a tragedy of interruptions: connect wallet, sign, sign again, approve, sign again, error, try again, sign again. If you’ve ever watched a normal human use DeFi, you can practically see their patience leaking out of their ears. That’s why I keep coming back to Fogo Sessions.

The Sessions idea is simple in a way that’s almost suspicious: reduce the number of times you have to pull a user out of what they’re doing to ask for a signature, and make it possible for apps to sponsor the “gas” experience without becoming custodians. The repo describes it in very practical terms usable with any Solana wallet, gasless transactions, and the “sign once to log in” style flow. And it’s not just a concept doc; it’s a living codebase with releases and obvious ongoing work.

The best analogy I’ve found is that Sessions is trying to give self-custody the thing the web got from cookies and sessions: continuity. The web became usable at scale when logging in didn’t feel like a ritual. But the web also paid for that convenience with a whole new category of security problems. So the real question for Fogo isn’t “does this improve UX?” It almost certainly does. The question is whether they can thread the needle: make interactions feel smooth while keeping session scoped permissions tight enough that it doesn’t become the next big foot gun. If they get that right, it’s not just a nicer experience. It changes how apps can operate: apps can sponsor friction away as a growth lever, rather than forcing every user to become a token handling expert on day one.

Then there’s a detail I actually love because it’s so honest: the existence of a shim for transaction history.

There’s a third-party repo called fogo-scan-shim that basically exists because, at the time it was created, Fogo didn’t have an archival node and RPC nodes pruned historical transaction data after a few days. So the shim routes historical calls like getTransaction and getBlock to an indexed service and proxies everything else to public RPC. This is the kind of thing you never see in marketing. You only see it when real developers hit real limitations and someone decides to fix it in the least glamorous way possible.

I don’t read this as a “gotcha.” I read it as a realistic early-network signal. Archival infrastructure is expensive, and early chains often optimize for current performance and uptime before they invest deeply in historical access. But it matters if Fogo wants to be taken seriously as a venue for financial activity, because speed alone doesn’t create trust. Auditability creates trust. If traders, protocols, or institutions can’t reconstruct what happened without relying on a handful of indexers, you end up with a weird gap between “the chain is fast” and “the chain is dependable.”

On token utility, I’m going to avoid the usual “fees, staking, governance” boilerplate not because those aren’t true, but because they’re not what makes a token economically interesting. Tokens become interesting when they shape behavior.

Two things stood out to me.

First, inflation appears to be treated like an operational knob. The v19.0.0 release notes explicitly say inflation was set to a fixed 2%. That tells me they’re still tuning the economic environment in a very hands-on way. And in early networks, that usually isn’t ideological it’s pragmatic. You’re trying to balance security incentives and network sustainability while usage is still forming.

Second, “gasless” UX doesn’t remove token value. It can actually concentrate it. If apps sponsor user interactions, the token still matters because someone is paying the base fee asset. It shifts the question from “does every user hold tokens immediately?” to “which actors end up being the consistent buyers of blockspace?” That’s a very different dynamic. You get something closer to web economics: platforms subsidize onboarding because the lifetime value is worth it. If Sessions becomes widely adopted, that could make Fogo’s token less visible to end users but more structurally important to the ecosystem.

Zooming out, my honest read is that Fogo is building for a world where milliseconds are money, and that’s both exciting and dangerous.

It’s exciting because crypto has mostly failed at building on chain systems that feel “real-time” without turning into centralized black boxes. A chain that can make markets feel responsive while keeping settlement open and verifiable is genuinely valuable.

It’s dangerous because ultra low latency systems tend to create invisible forms of centralization even when the code is open. Shared infrastructure becomes a chokepoint. Co-location becomes a privilege. Priority fees become a subtle fairness problem if they turn into an insider fast lane. The chain can still be “decentralized on paper” while the experience increasingly favors the people closest to the metal.

So if I were tracking whether Fogo is becoming something real, I wouldn’t obsess over TPS claims. I’d watch a few very boring, very falsifiable indicators.

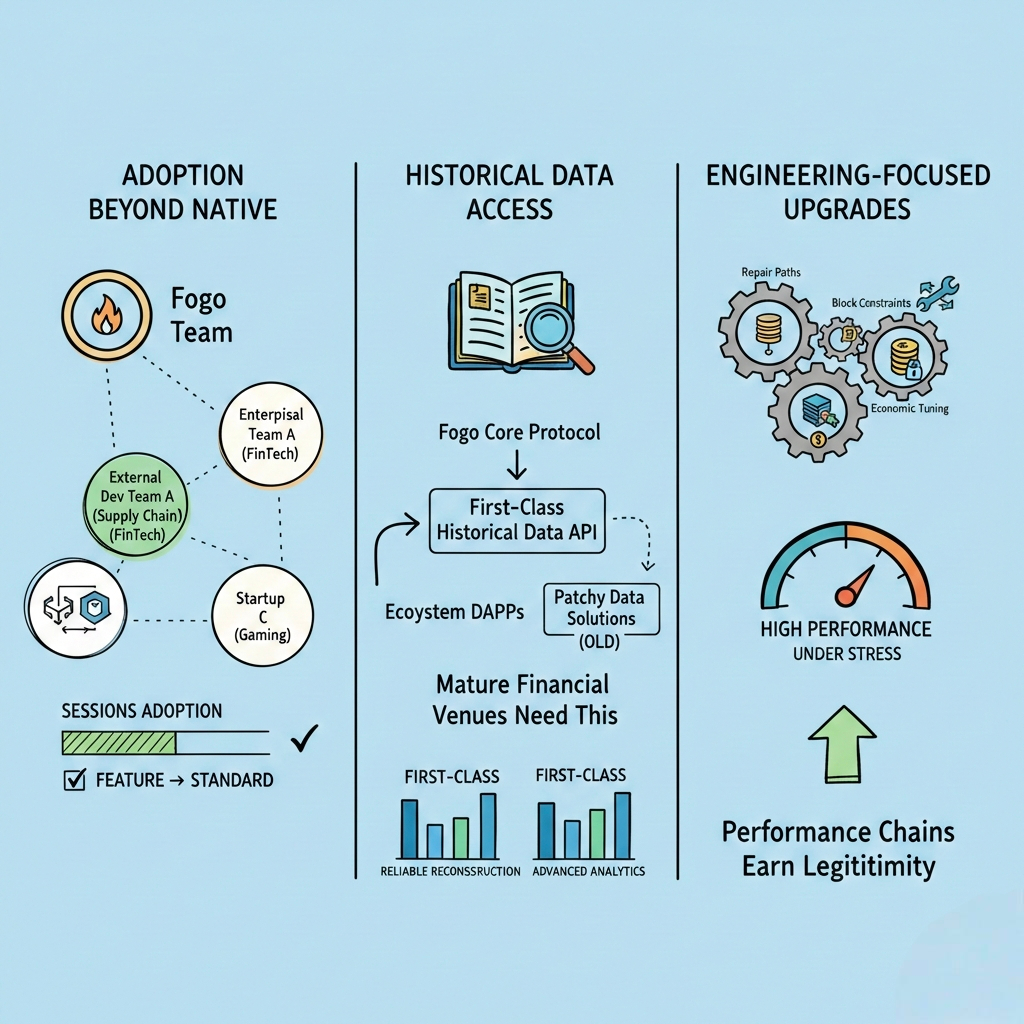

I’d watch whether Sessions gets adopted beyond “native” Fogo teams, because that’s what separates a feature from a standard.

I’d watch whether historical data access becomes first-class rather than something the ecosystem has to patch around, because mature financial venues need reliable reconstruction and analytics.

And I’d watch whether the protocol upgrades keep looking like engineering fixing repair paths, RPC load, block constraints, economic tuning especially under stress, because that’s where performance chains either earn legitimacy or fall apart.

If Fogo wins, I don’t think it wins by being “another SVM L1.” It wins by proving something tougher: that you can push performance toward exchange grade responsiveness without losing the things that make blockchains worth using in the first place open participation, verifiable history, and a fee market that doesn’t quietly evolve into rent-seeking.

That’s the thesis I’d bet on or bet against based on what happens next.