Chapter 1.1: Evolution of Money – Barter to Digital Assets

1.1.1 Introduction:

With human civilization, money has also evolved.

Money is not just a physical object — it is a Value Transfer System based on trust. As society became more complex and trade expanded, the structure of money also changed.

In this section, we will systematically understand how money has traveled from Barter to Digital Assets.

1.1.2 Barter System – Initial Exchange Model

The very first exchange system was the Barter System, where goods and services were exchanged directly.

Example: If someone has wheat and needs clothes, they will have to find a person who needs wheat and has clothes.

❌ Major Problem: Double Coincidence of Wants

Transaction was only possible when both parties wanted each other's items. This limitation made large-scale trade almost impossible. Barter worked at a local level but was not suitable for the global economy.

1.1.3 Commodity Money – Intrinsic Value Based System

To solve the inefficiency of barter, people chose items that had intrinsic value — such as:

Gold 🥇

Silver 🥈

Salt 🧂

Livestock 🐄

Why did Gold and Silver become dominant?

Scarcity: Limited supply.

Durability: They do not become worthless.

Divisibility: Can be divided into smaller parts.

Portability: Easy to carry.

❌ Limitation:

Transporting large quantities was risky and difficult. It was inconvenient for international trade.

Here trust has shifted from physical scarcity.

1.1.4 Representative and Fiat Money – Centralized Control

As trade and economy grew, governments and banks introduced:

Representative Money: Paper notes that were backed by gold reserves.

Fiat Money: Later, the gold backing was removed. The value of fiat money comes not from any physical commodity, but from Government Authority.

Key Features:

Central Bank controls supply.

Legal Tender status.

Policy-driven monetary system.

❌ Risks:

Inflation: Excessive money printing.

Centralization: Decision making in the hands of a few.

Here trust shifted from physical assets to Government Authority.

1.1.5 Digital Payments – But Still Centralized

After the Internet, money converted into digital form (Bank transfers, UPI, Cards).

But the important thing:

The system was still Centralized. Banks and payment processors maintained the ledger.

❓ Fundamental Question:

Can digital value exist without any central authority?

1.1.6 Digital Assets – Blockchain Era 🔗

Blockchain introduced a completely new concept: Money that operates on Code, secured by Cryptography, and validated by Decentralized Network.

Digital Assets Defined:

Digital assets are value units that are recorded on the blockchain and protected by cryptographic security.

Core Innovations:

✅ Decentralized Validation: No single bank controls it.

✅ Immutable Ledger: Data cannot be altered.

✅ Algorithmic Scarcity: Supply is fixed by code.

Here trust has shifted: from Institution to Mathematics and Network Consensus.

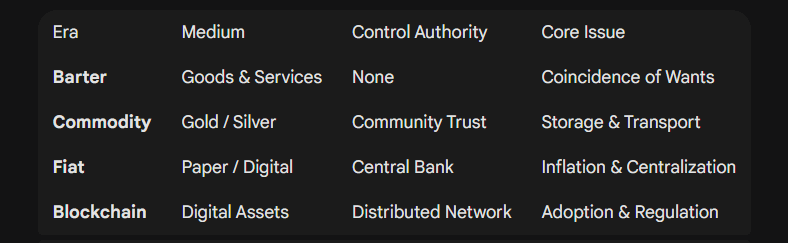

1.1.7 Comparative Overview 📊

1.1.8 Trust Architecture Evolution

The history of money is essentially the history of trust:

Barter → Trust in Individuals.

Commodity → Trust in Scarcity.

Fiat → Trust in Government.

Blockchain → Trust in Code & Consensus.

Blockchain shifts trust from institutional structure to Algorithmic Framework.

1.1.9 Conclusion & Class Discussion 💬

The journey from Barter to Digital Assets was not random. Each stage aimed to solve the limitations of the previous system.

Blockchain is the natural next step in evolution — a system that:

It is decentralized.

It is transparent.

It is secure.

❓ Today's Question (Comment Below) 👇

We saw how trust shifted: Community → Gold → Government → Code.

Who do you trust more and why?

Fiat Money: Which the Government controls (Unlimited printing risk).

Digital Assets: Controlled by Math and Code (Fixed Supply).

Write your answer in the comments: "Team Fiat" or "Team Crypto"?

The comment from the student providing the best logic will be featured in our next video!

👉 Next Chapter: What was the biggest challenge for digital systems — The Double-Spending Problem, and how Blockchain solved it.

#BinanceAcademy #EvolutionOfMoney #CryptoEducation #BlockchainHistory #DementedCapital