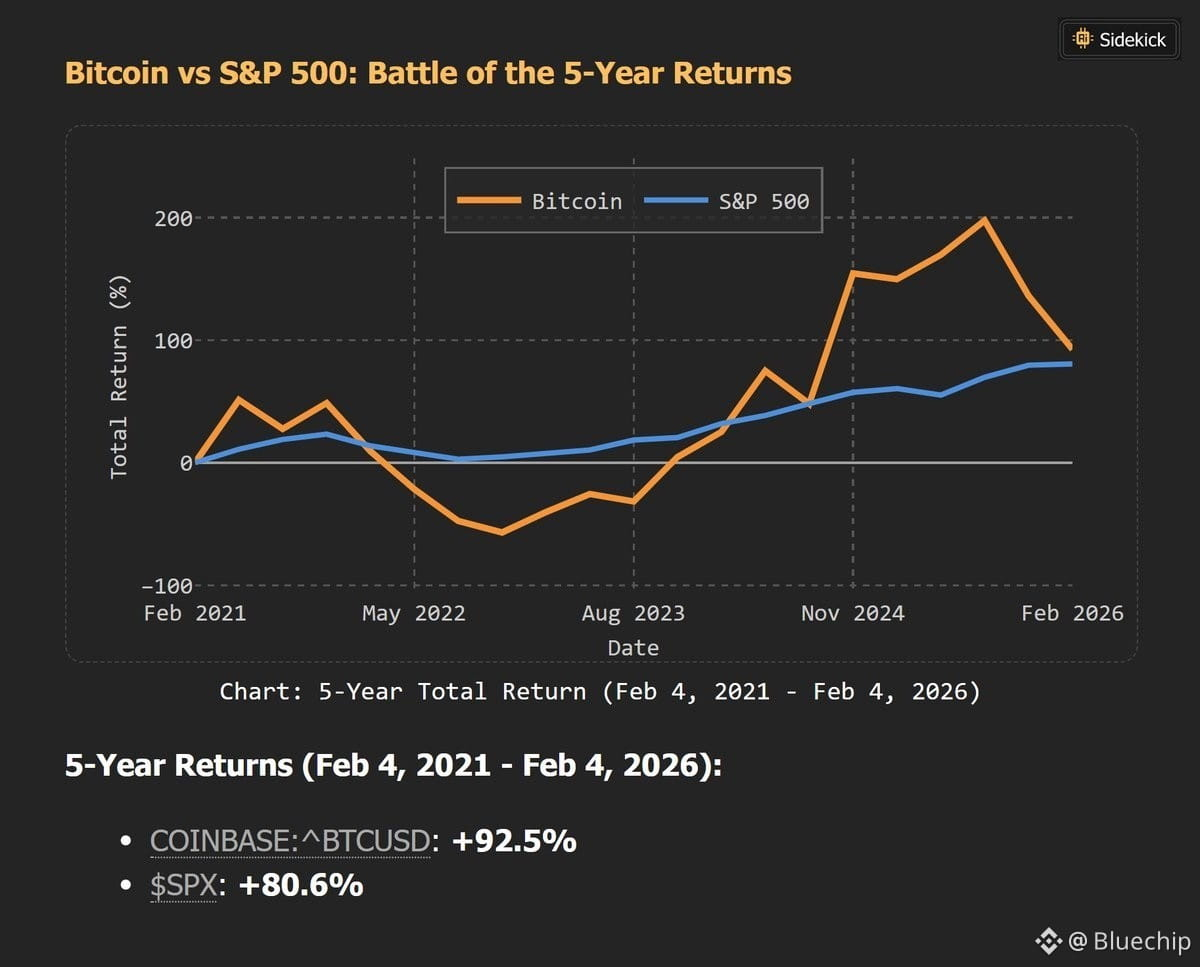

📈 1. BITCOIN VS S&P 500: 5-Year Returns Battle (Feb 2021 - Feb 2026)

The Revealing Chart:

· Period: February 4, 2021 → February 4, 2026 (exactly 5 years)

· Bitcoin (BTC): +92.5% total return

· S&P 500 (SPX): +80.6% total return

Performance Analysis:

Bitcoin Wins, But Just:

· Bitcoin Advantage: +11.9% over 5 years

· Volatility: Bitcoin extremely more volatile

· Risk/Reward: Less favorable for Bitcoin

Important Temporal Context:

· Start: February 2021 (Bitcoin ~$45K, S&P ~3,800)

· End: February 2026 (Bitcoin ~$71K, S&P ~6,850)

· Bitcoin has survived: Bear market 2022 + correction 2025-2026

Lessons:

1. Bitcoin outperforms the S&P 500 long term

2. But volatility is huge

3. Critical entry timing

---

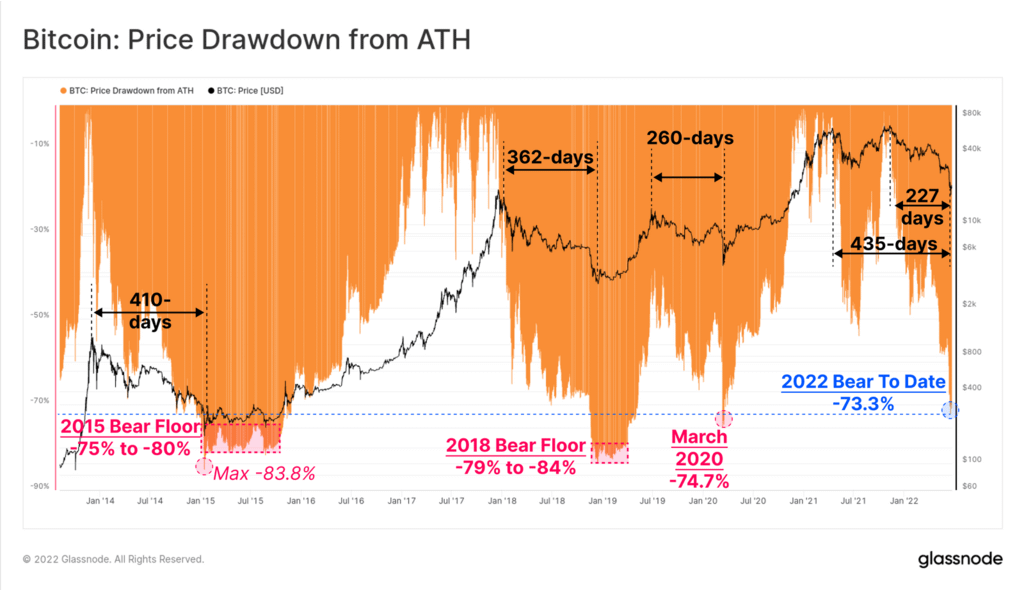

📉 2. HISTORICAL DRAWDOWNS: How Much Lower Can Bitcoin Go?

Worst Drawdowns Table:

Drawdown Event since ATH BTC Price Corresponding Level (ATH $126K)

2018 Bear Floor -79% to -84% $26K-$21K $26K-$20K

2022 Bear -73.3% $34K $34K

March 2020 -74.7% $32K $32K

Historical Max -83.8% $20K $20K

Current Position (February 2026):

· ATH: $126,198 (October 2025)

· Current price: ~$71,000

· Current drawdown: -43.7%

Possible Scenarios:

Optimistic Scenario (40%):

· Drawdown similar to 2022 (-73.3%)

· Bottom: $34K

· Still -52% from current level

Medium Scenario (35%):

· Drawdown similar to 2020 (-74.7%)

· Bottom: $32K

· Still -55% from current level

Pessimistic Scenario (25%):

· Maximum drawdown (-83.8%)

· Bottom: $20K

· Still -72% from current level

Conclusion: Historically, Bitcoin can still drop 50-70% from current levels.

---

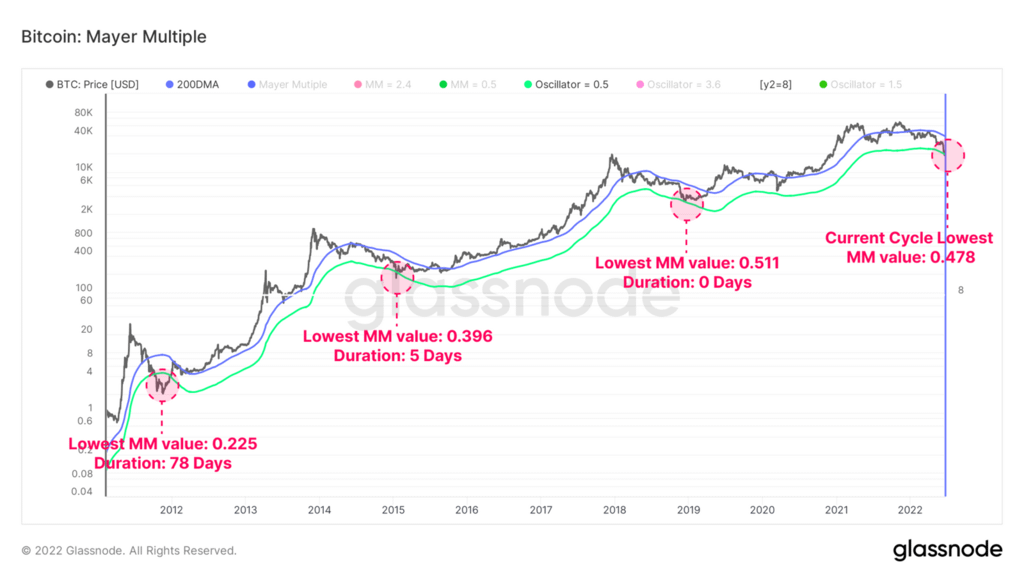

🔄 3. CYCLE METRICS: Mayer Multiple and Oscillators

Mayer Multiple (MM):

· Formula: Price / 200-day Moving Average

· Signals:

· MM > 2.4: Overbought (sell)

· MM < 0.5: Undervalued (buy)

· Current (est.): ~1.1 (neutral)

Oscillator:

· Critical levels:

· 0.5: Accumulation zone

· 1.5: Neutral

· 3.6: Distribution zone

· Current: ~1.0 (slightly below neutral)

Data Analysis of the Chart:

Clear Cyclical Pattern:

1. 2012-2016: Accumulation (low oscillator)

2. 2017-2021: Expansion (ascending oscillator)

3. 2022-2026: Correction (descending oscillator)

Current Position in the Cycle:

· End of corrective phase

· Oscillator approaching accumulation zone (0.5)

· But not yet in "buy" zone

--- $BTC

$BTC

🎯 SYNTHESIS OF 3 DATASETS:

The Big Picture:

1. Relative Performance:

· Bitcoin beats the S&P long term (+92.5% vs +80.6%)

· But volatility makes timing crucial

2. Drawdown Risk:

· Current drawdown: -43.7% (historically moderate)

· Potential bottom: $20K-$34K (still -52% to -72%)

· Psychological support: $30K (2021 level)

3. Position in the Cycle:

· Phase: Advanced correction

· Metrics: Approaching accumulation zone

· Not yet at "maximum fear"

---

💡 DATA-BASED INVESTMENT STRATEGY:

Strategic Accumulation Levels:

Level 1: $45,000 (MM ~0.8)

· Conservative entry

· -37% from current

· Corresponds to drawdown -64%

Level 2: $35,000 (MM ~0.65)

· Aggressive entry

· -51% from current

· Drawdown -72% (near 2022)

Level 3: $25,000 (MM ~0.5)

· Maximum accumulation

· -65% from current

· Drawdown -80% (near 2018)

Action Plan:

For Investors:

· Now: Wait (MM 1.1 too high)

· At $45K: DCA 25% of capital

· At $35K: DCA 50% more

· At $25K: Remaining all-in

For Traders:

· Short: Up to $45K support

· Long: Wait for rebound from $45K

· Range trade: $45K-$65K next phase

---

⚠️ IDENTIFIED RISKS:

Historical Risk:

1. Drawdown not finished (history suggests -70% minimum)

2. Recovery time: 2-3 years after bottom

3. Permanent loss possible if panic selling

Cycle Risk:

1. MM not yet in buy zone (0.5)

2. Oscillator not at the bottom

3. Sentiment not at "capitulation"

---

📊 PROJECTION 2026-2027:

Probable Scenario:

· Q2-Q3 2026: Test $45K-$35K

· Q4 2026: Bottom formation $30K-$35K

· 2027: Start of institutional accumulation

· 2028-2029: New bull market

Long Term Goals:

· 2030: Retest ATH $126K

· 2032: New ATH $200K+

· Condition: Survive current drawdowns

---

💎 FINAL CONCLUSION:

Historical data is clear:

1. Bitcoin outperforms long term (+92.5% vs S&P 500)

2. But drawdowns are brutal (-80% possible)

3. We are not at the bottom (MM 1.1 vs 0.5 target)

4. Patience will be rewarded

Your best strategy:

· Wait for accumulation levels ($45K, $35K, $25K)

· Gradual DCA

· Ignore media noise

· Focus on metrics, not emotions

Reminder: Bitcoin has survived worse. This is not the end, it’s a cycle.

---

Data: Coinbase, Bitcoin history, cycle metrics. Analysis based on historical patterns. DYOR. No financial advice.

#bitcoin #HistoricalData #MarketCycles #InvestmentStrategies y #DrawdownAnalysis #BitcoinVsSP500 #trading #CryptoResearch $ETH $BNB