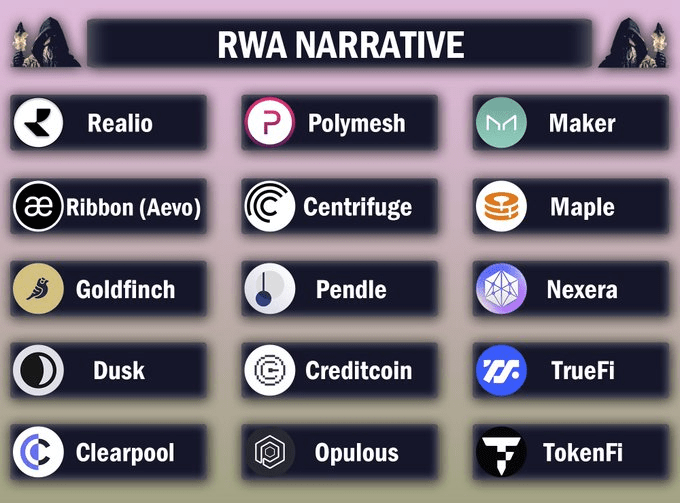

Get ready for the most promising narrative of 2024: RWA

If you don't know about these projects, you're missing out on 10-100x gains. Don't say I didn't warn you!

Bridging the gap between TradFi and DeFi is essential for unlocking real-world value. The rapid growth of RWA has captured the attention of esteemed financial institutions like J.P. Morgan, BlackRock, Swift, and others.

There is no doubt that the sector holds impressive potential that could be fully unlocked in 2024-2025. In my list below, I will discuss projects that, in my opinion, hold the potential for substantial long-term profitability and massive returns.

Always DYOR before investing.

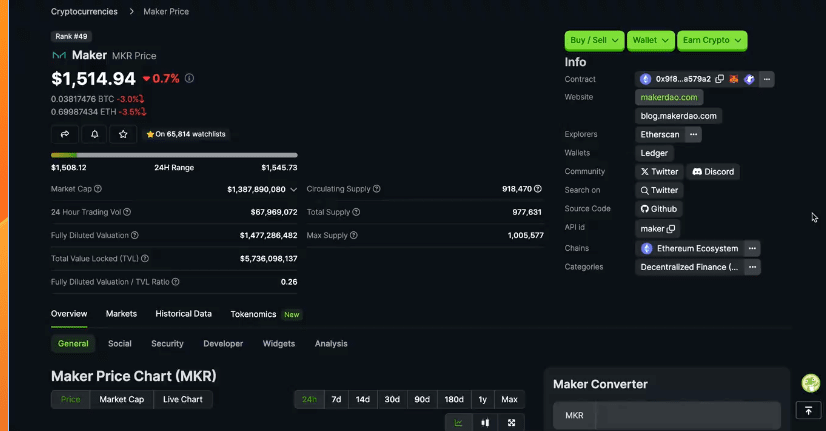

① $MKR: MakerDAO

Market Cap: $1.35B MakerDAO, the protocol behind the stablecoin $DAI, has been using RWAs to generate a substantial portion of its revenue. $DAI is backed by digital assets from borrowers and, increasingly, by various RWAs.

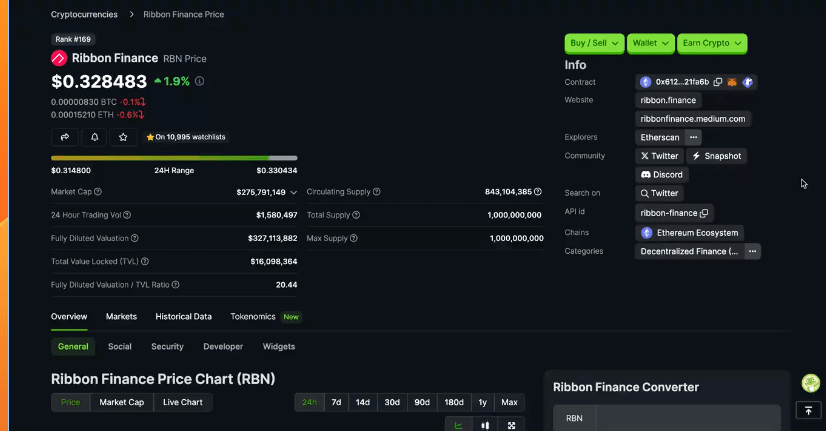

② $RBN: ribbonfinance

Market Cap: $275M Ribbon leverages financial engineering to create structured products that generate a sustainable yield. The protocol also empowers developers to create custom structured products by combining different DeFi derivatives.

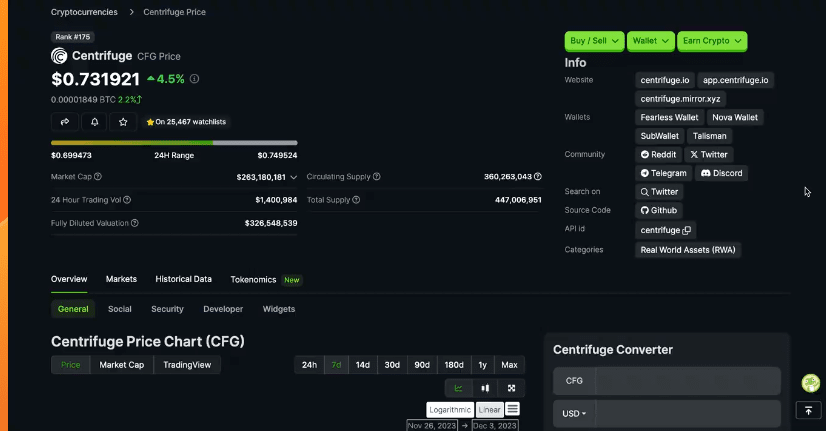

③ $CFG: centrifuge

Market Cap: $263M Centrifuge connects DeFi with RWA, aiming to reduce the cost of capital for SMEs and offer investors a stable source of income. The project's primary objective is to generate profits that are independent of volatile crypto assets.

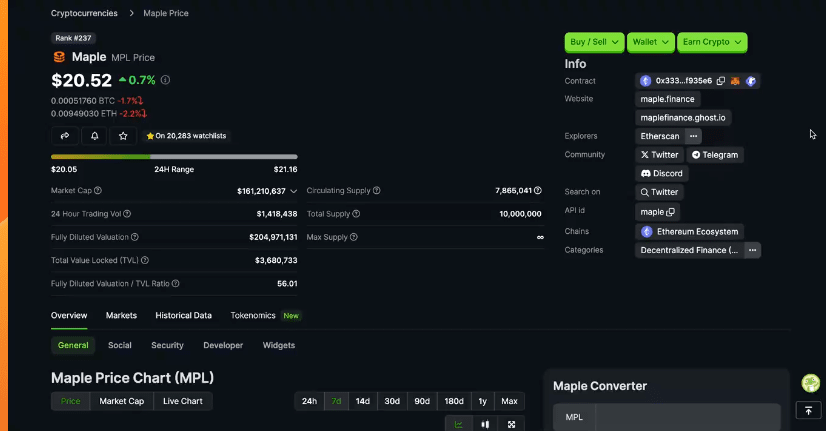

④ $MPL: @maplefinance

Market Cap: $161M Maple is a decentralized corporate credit market. They provide borrowers with transparent and efficient financing, all completed on-chain. For liquidity providers, Maple offers a sustainable yield source by lending to pools.

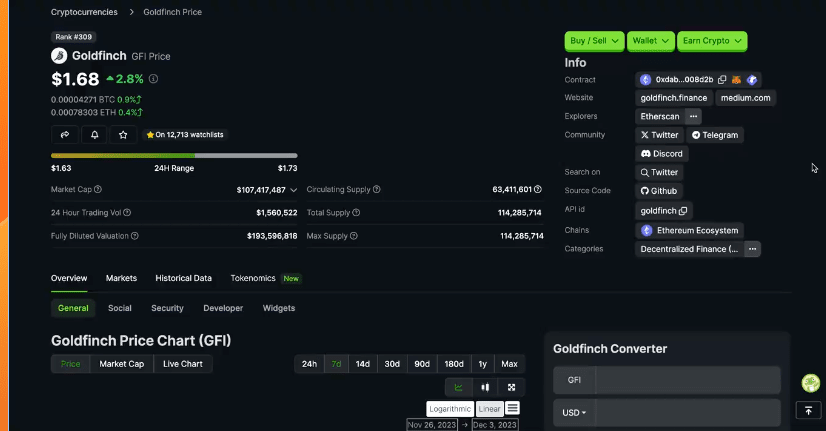

⑤ $GFI: goldfinch_fi

Market Cap: $107M Goldfinch: the global credit protocol offering stablecoin yields fueled by real-world economic activity. Say goodbye to DeFi's volatility and hello to sustainable, high-quality returns.

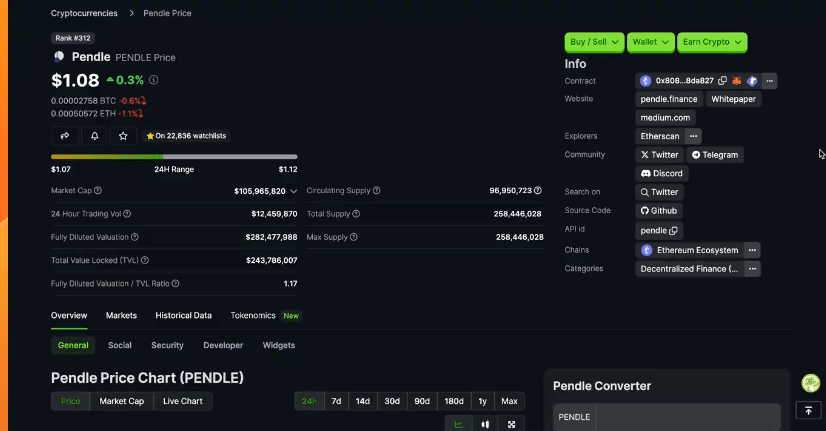

⑥ $PENDLE: pendle_fi

Market Cap: $105M Pendle is a protocol that enables the tokenization and trading of future yield. By introducing a unique AMM that supports assets with time decay, Pendle empowers users to have greater control over future yield through optionality.

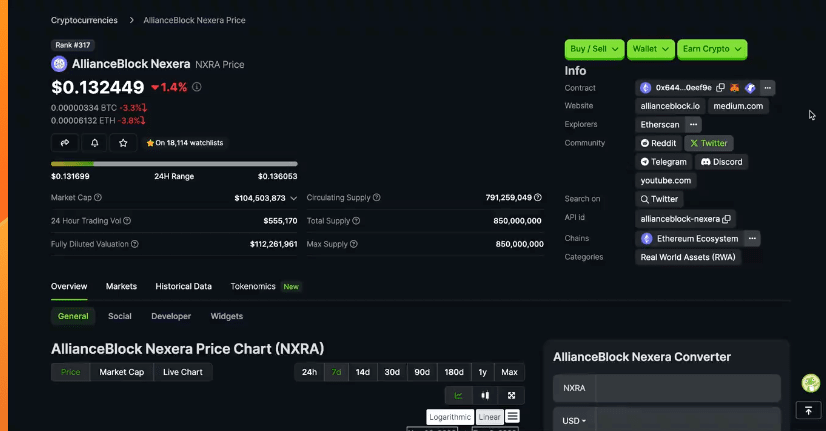

⑦ $NXRA: allianceblock

Market Cap: $104M AllianceBlock is a platform that enables businesses to tokenize assets and securely issue, manage, and trade within an inclusive financial ecosystem. The platform's goal is to connect traditional finance with DeFi ecosystems.

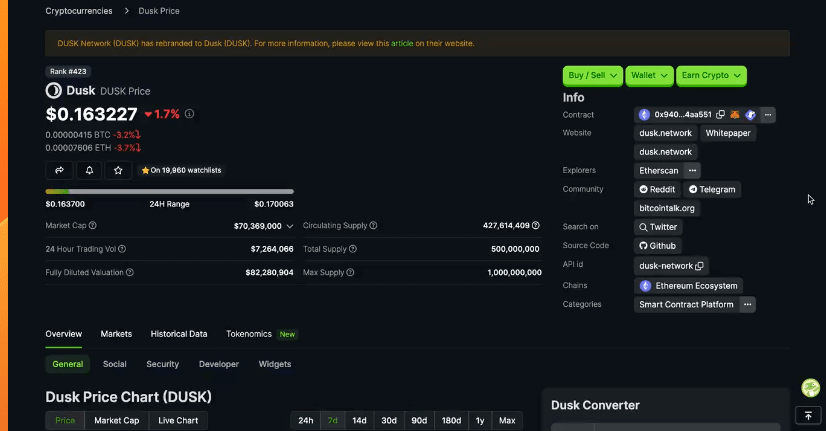

⑧ $DUSK: DuskFoundation

Market Cap: $70M Dusk is an L1 platform designed to offer privacy and compliance, enabling anyone to trade RWAs from their wallet. Its goal is to evolve the financial landscape by facilitating the on-chain integration of regulated assets.

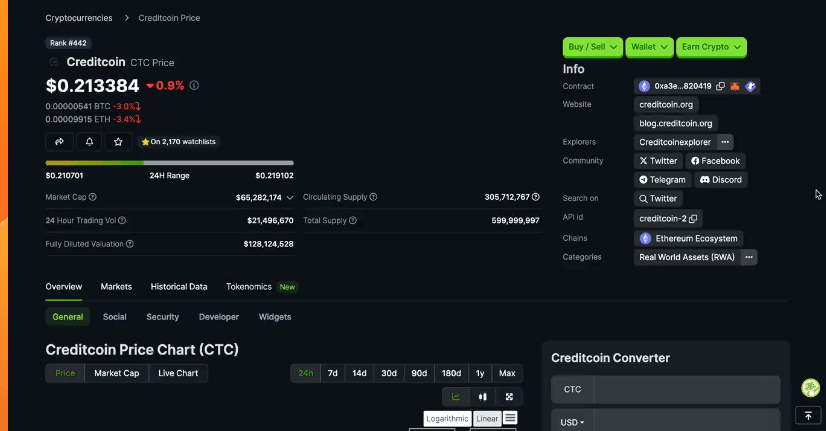

⑨ $CTC: Creditcoin

Market Cap: $65M Creditcoin aims to address the lack of a credit system among the unbanked in emerging markets. The project aims to solve this problem by recording credit transaction history objectively on a public blockchain.

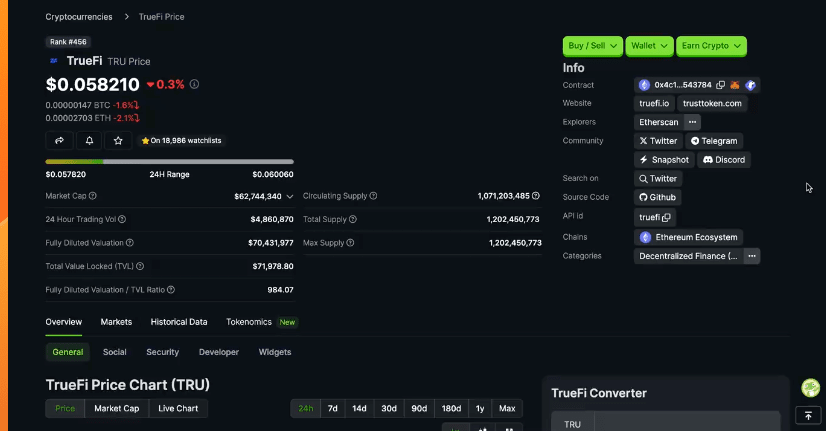

⑩ $TRU: TrueFiDAO

Market Cap: $63M TrueFi is DeFi's credit protocol, offering lenders predictable and transparent yields on both real-world and crypto-native lending. It allows the creation of interest-bearing pools with high APRs, benefiting liquidity providers.

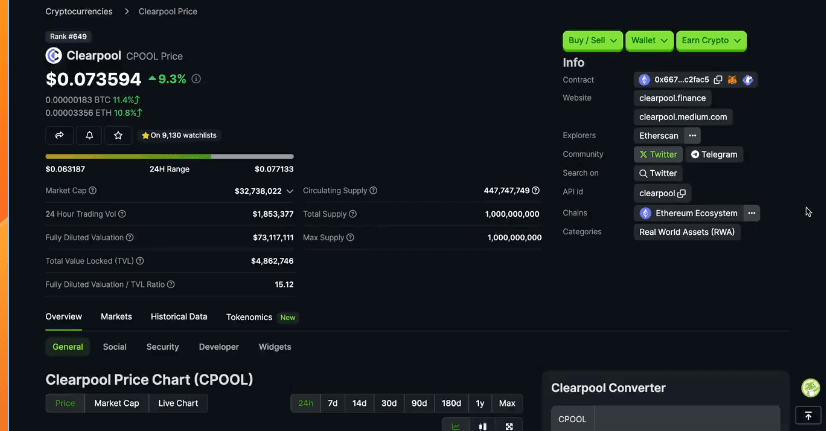

⑪ $CPOOL: ClearpoolFin

Market Cap: $32M Clearpool is a platform that enables institutional borrowers to access unsecured loans directly from the DeFi ecosystem. They have introduced a dynamic interest model that is influenced by market supply and demand forces.

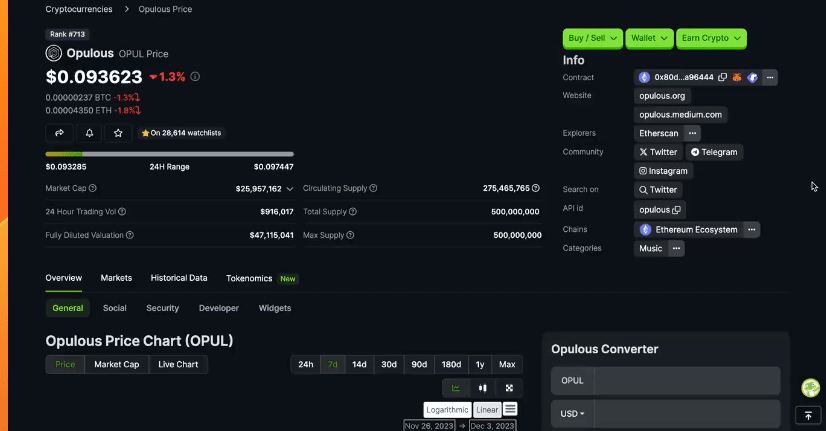

⑫ $OPUL: opulousapp

Market Cap: $26M Opulous is the leading platform for RWA in the music industry, powered by blockchain technology. Their mission is to offer the community the finest products and opportunities to participate in one of the most reliable RWAs: music.