Some tokens rise 100X more than others during bull market. Wanna predict them? Tier 1 VCs set narratives - follow them. I've analyzed a16z article, and here're their bets for 2024!

To find the next big gainers, you must first identify promising narratives. Therefore, I analyzed a recent article from a16z about their expectations for 2024 and extracted 8 narratives they believe in.

I will also give you 3 tokens for each predicted narrative; as well as a list of token-less projects they have invested in. Let's start:

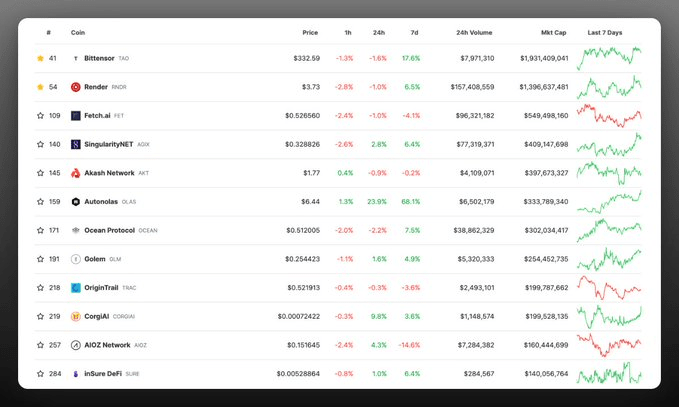

1/➮ AI Narrative:

✰ Projects focused on integration of AI in blockchain, creating new possibilities in AI markets and addressing challenges such as AI-generated content verification & fake management.

✧ rendernetwork | $RNDR

✧ The_Delysium | $AGI

✧ opentensor | $TAO

2/➮ Decentralized Governance & DAO Narrative:

✰ Focus on creating more effective DAO structures and governance mechanisms that address complexities of decentralized decision-making and accountability

✧ ribbonfinance | $RBN

✧ fraxfinance | $FXS

✧ redactedcartel | $BTRFLY

3/➮ Modular Blockchains: Focusing on developing modular, open-source technology stacks in the blockchain space. They aim to enhance network effects, encourage permissionless innovation, and improve overall system performance.

✧ CelestiaOrg | $TIA - first modular blockchain

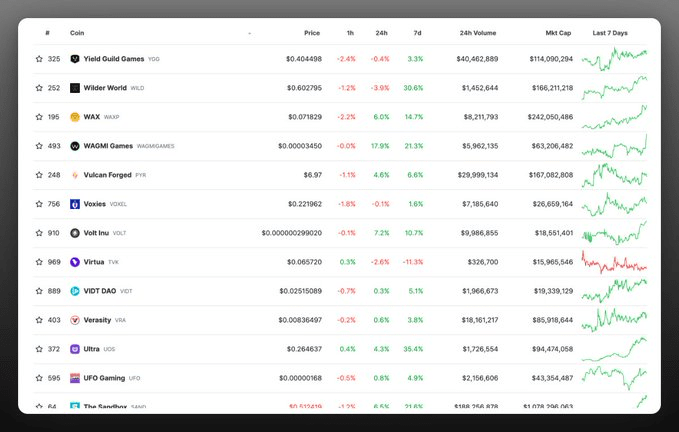

4/➮ GameFi: GameFi, metaverses, and P2E games were popular in late '21. These trends can resurface. Not only a16z, but many prominent VCs have invested in GameFi this year and will pump their bags.

✧ aminorewards | $AMO

✧ aavegotchi | $GHST

✧ Treasure_DAO | $MAGIC

5/➮ NFTs in Branding & Marketing Narrative:

This narrative includes projects that leverage NFTs as mainstream brand assets for customer engagement, digital representation of physical goods, and co-creation of experiences with users.

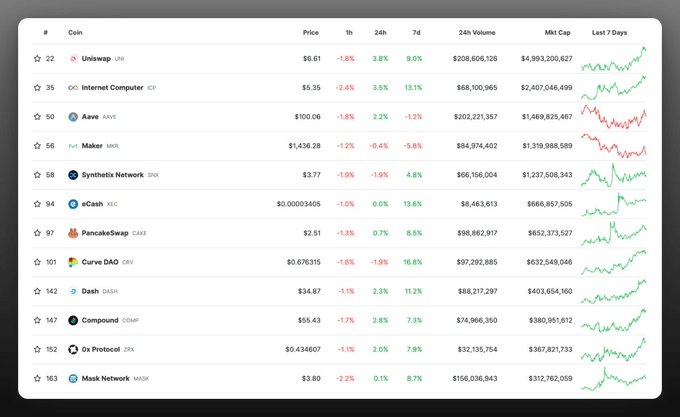

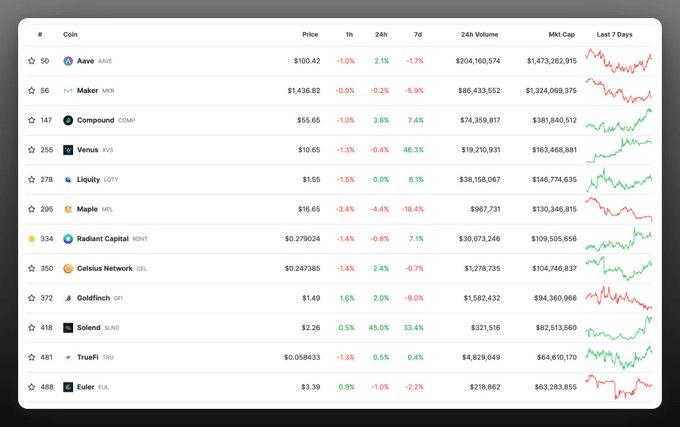

6/➮ Lending/Borrowing Narrative:

They believe in projects that can be used for risk diversification. I'm also bullish on this sector, as I constantly borrow stables on lendings and hedge everything I can.

✧ RDNTCapital | $RDNT

✧ eulerfinance | $EUL

✧ MakerDAO | $MKR

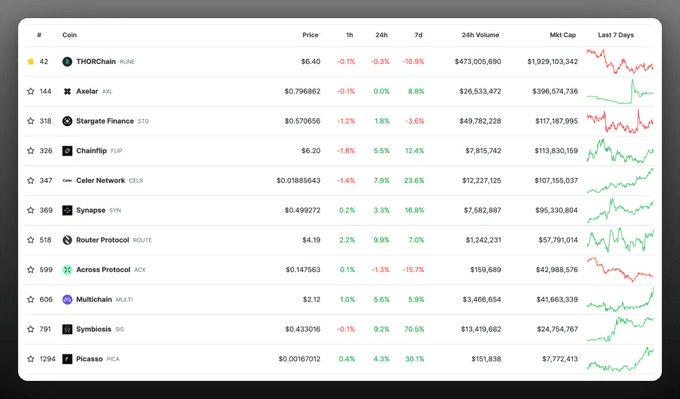

7/➮ Cross-Chain Narrative: Since liquidity in this bull run will largely flow into DEXs, it will often be necessary to trade in different networks, and cross-chain bridges are really a must-have.

✧ routerprotocol | $ROUTE

✧ StargateFinance | $STG

✧ THORChain | $RUNE

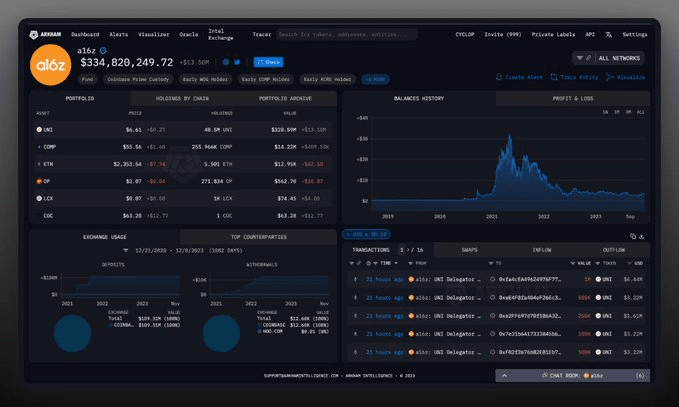

I also looked at their on-chain holdings via ArkhamIntel, they hold only: $UNI $COMP $ETH $LCX $COC.

In general, we can't really track much on-chain, but we can look at the projects they've invested in, and they haven't launched yet.

Investing in good projects before they're listed is key to 100x returns in a bull market. Finding them early, you getting opportunity to participate in public/private sales or getting airdrop if you keep track of all updates.