Just a year ago, clicking 'hide small balances', made my entire crypto portfolio disappear... Today, it hit $420k. Over $100k was made just last week.

My secret?

A set of cognitive biases. I've studied hundreds of them before I formed 10 that I use daily.

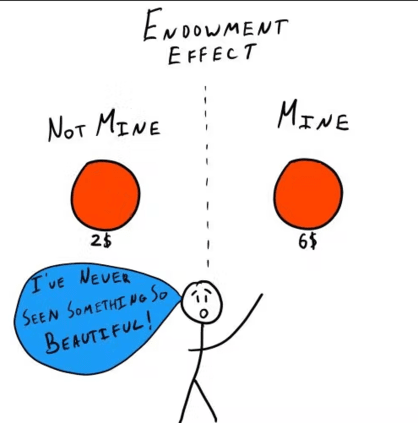

1/➮ Endowment Effect

(Valuing more what you own) This phenomenon, leads to an irrational attachment to ur bags, making it hard to sell them. To challenge this bias, ask yourself: "Would I buy this coin now if I weren't already holding it?" If the answer is NO - sell it.

2/➮ Recency Bias (Prioritizing recent events)

Don't let recent price swings dictate ur moves. BTC's sharp fall doesn't guarantee further decline, nor does a sudden surge ensure more gains. Zoom out the chart: see long-term potential, not just what happened few hours ago.

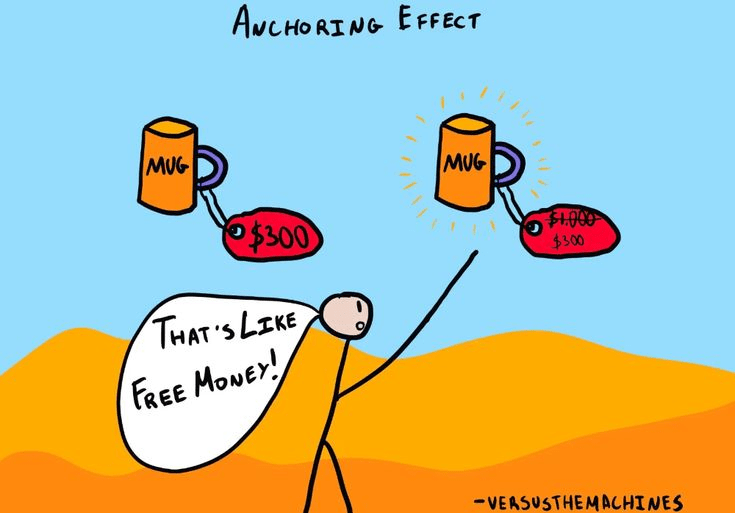

3/➮ Anchoring bias (Primary value influence)

Many have experienced this: You see BTC at $17k and think it's a good price, but before you can buy, it jumps to $20k. Realistically, the price is still reasonable, and it's unlikely to return to $1k.

However, knowing you could have bought cheaper stops you from buying. Then the price rockets to $45k, and u realize that u're idiot... Focus on the present, assess whether it is worth it now. In 2010, u could have bought 5,000 BTC for a pizza, do u expect that to happen again?

4/➮ Bandwagon Effect (Following popular trends)

Bought tokens because of the hype, but they crashed right after? Any token acts like a Ponzi scheme; once it reaches its peak, it will drop because early buyers want to cash out. Simply put: buy fear, sell greed.

5/➮ Gambler's Fallacy (Misinterpreting random sequences)

The fact that Bitcoin has been falling oh 1h time-frame doesn't always mean it'll rise soon, or vice versa. Many market moves are independent, focus on analysis, not just assumptions. Check big time-frame first.

6/➮ Sunk Cost Fallacy (Ignoring losses, continuing investments)

Bought a coin for short-term speculation based on smth, it didn't pay off, but u kept holding? This space changes rapidly. If narrative shifts - sell; if idea doesn't pan out - sell Adapt quickly here, or die.

7/➮ Overoptimism Bias (Unrealistically high expectations)

Being overly confident, often resulting in risky bets. Don't overlook risks, assuming ur bags will consistently grow. I turned 130k into 8k primarily due to this bias.

To avoid that: create risk management rules, and ALWAYS follow them. I never risk more than 1% of my net worth on a single trade/asset. I either set stop losses or simply don't buy more than 1% of my current net worth. Exceptions: long-term holding bags (eth/btc).

8/➮ Framing Effect (Word choice affects judgment)

Imagine being told, "This coin could double!" versus "This coin might drop by half." Both suggest volatility, but the first sounds enticing while the second scary. This is the framing effect in crypto.

To avoid it, ignore the hype or fear and base decisions on thorough research and analysis, not just on how information is framed. Remember, a coin's real value isn't in its presentation!

9/➮ Self-Serving Bias

Blaming ur cat for selling Bitcoin low but taking full credit when taking profit from eth? Self-serving bias: successes are ur genius but failures someone else's fault. Remember, even ur cat knows it's about balanced responsibility, not just lucky clicks.

10/➮ Status Quo Bias (Sticking to known paths)

Holding XRP cause it's what you know, ignoring other coins? Congratulations, u're in a trap 1: 99,9% old alts are losing ETH over the long term. Holding them is already REKT. 2: New alts always have bigger potential on new cycle