Presenting my Multibit_Bridge thesis and why $MUBI is my biggest bet on the multi-billion dollar BRC-20 market.

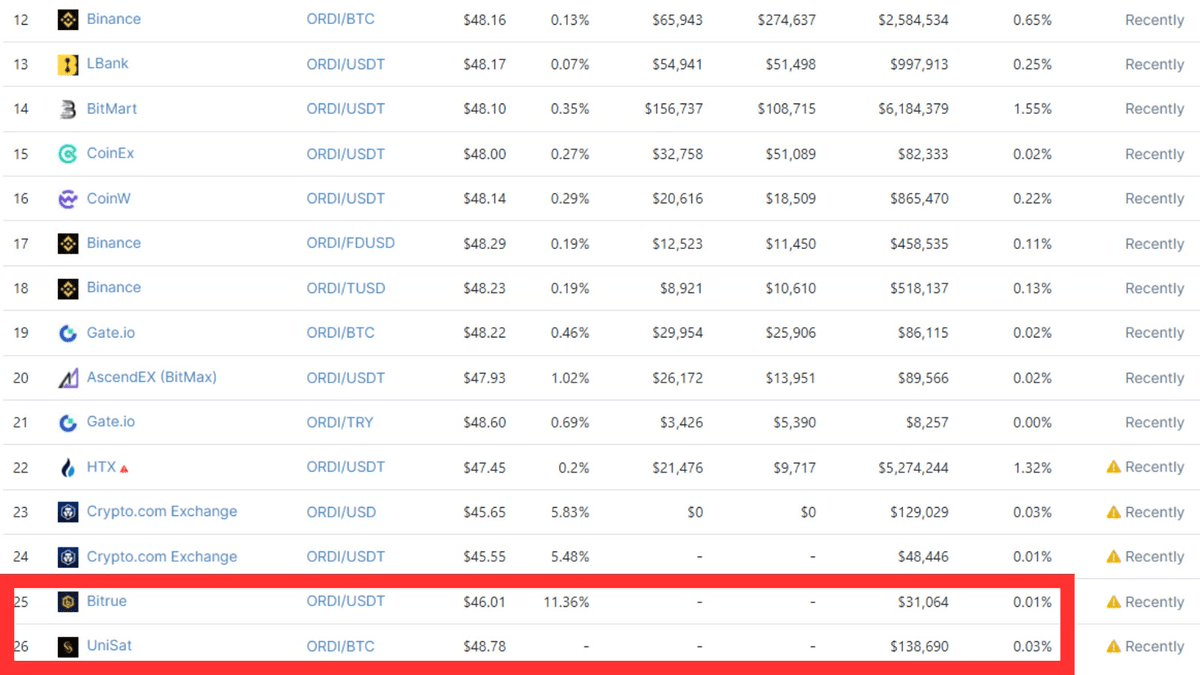

The largest problem the BRC-20 network currently faces is liquidity. Many BRC-20 pairs simply do not trade with sufficient liquidity for any sizeable trades. This can be seen by how $ORDI which has over $300m CEX vol daily has only < $200k vol on unisat_wallet.

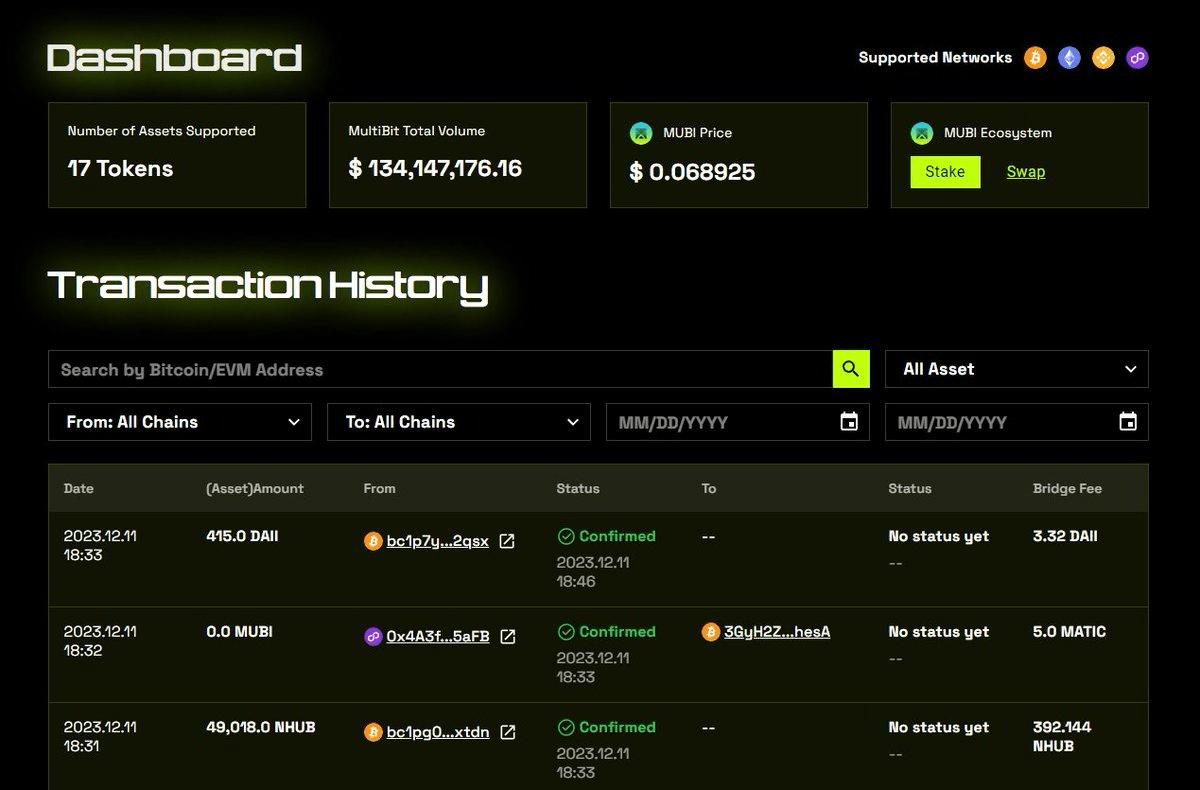

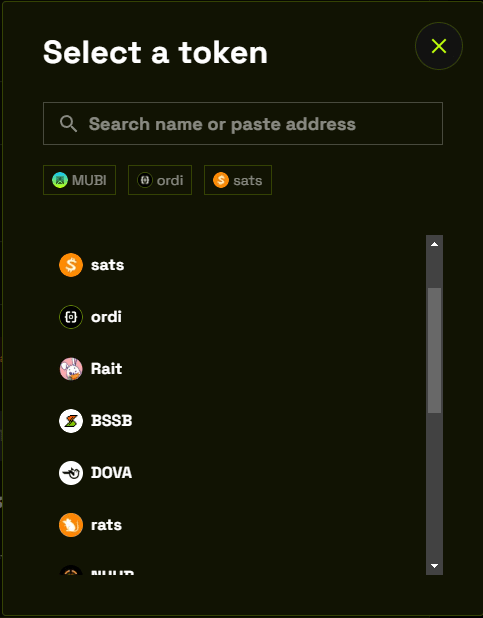

Multibit Bridge solves this very easily by allowing these BRC-20 tokens to be bridged over to ethereum, $MATIC or $BNB to leverage deeper liquidity pools in those networks. It constantly supports new tokens (Now 17) and has facilitated > $134m in bridge vol in a month.

It aims to be the one-stop shop for everything BRCfi:

Ordinals AMM in the works to allow for direct swapping of $ORDI tokens

Ordinals stablecoin backed by $ORDI as collateral for capital efficiency

Ordinals liquidity farming to enhance liq in pools

You can observe that the entire roadmap laid out by Multibit_Bridge focuses on offering deeper liquidity to BRC-20 tokens.

While trading BRC-20 tokens on CEX is easier, listings take time trending BRC-20 tokens can tap on the existing liq channels multibit_Bridge provides.

Catalysts for Multibit_Bridge include:

Upcoming $BTC spot ETF approval (Soon)

CEX exchange listings

Ordinals as a narrative (Easy for Normie $BTC maxis to grasp)