Recently, Worldcoin [WLD] emerged as a notable force in the cryptocurrency market, gaining strong bullish momentum and achieving double-digit gains.

However, this project to integrate artificial intelligence into cryptocurrencies is now facing challenges from the continuous sell-offs of Alameda Research.

Alameda Research Heats Up Selling Pressure

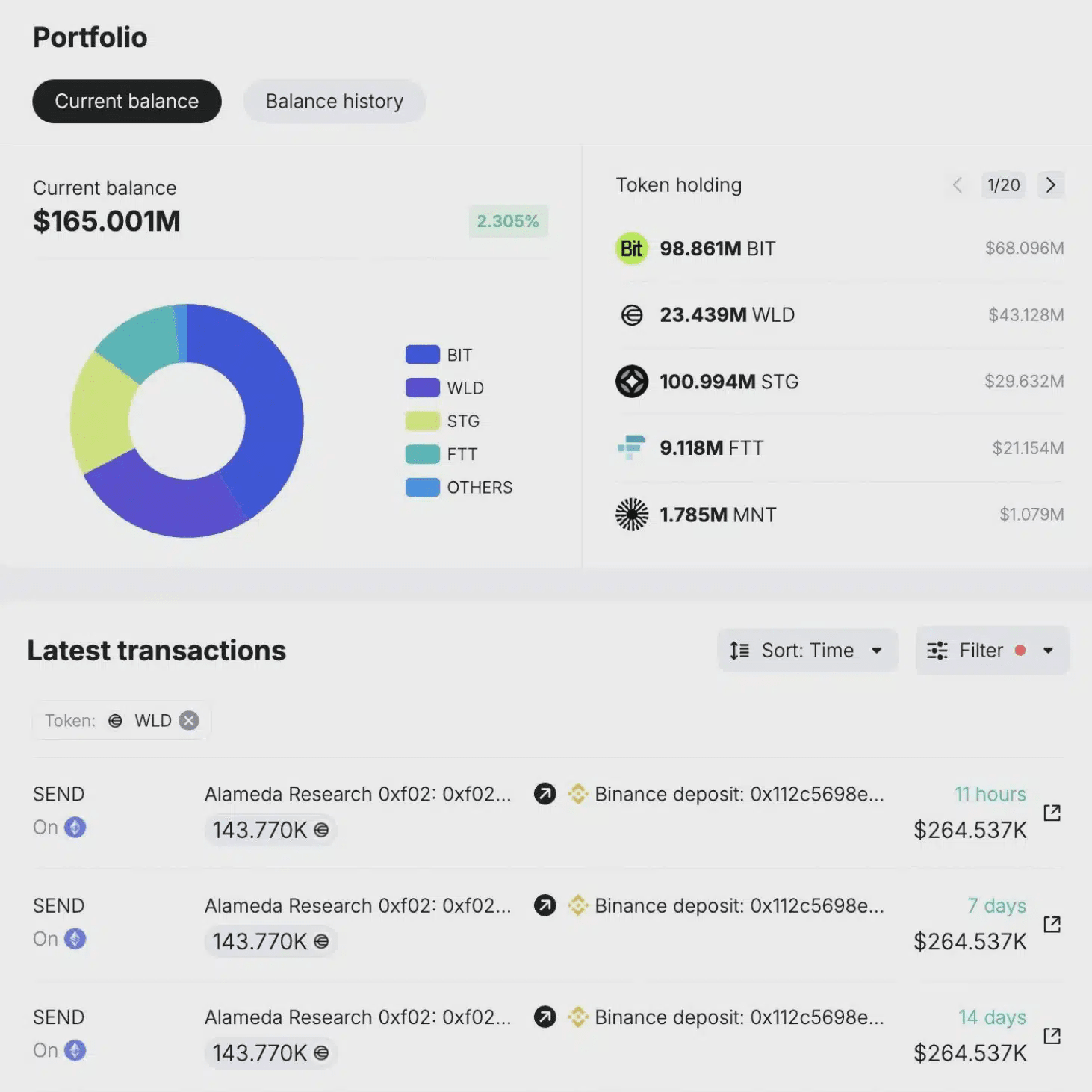

Blockchain data shows that Alameda Research, a major player in the market, is actively liquidating its WLD holdings.

In fact, this activity contributed to the currency's price falling by nearly 5% in just one day.

According to CoinMarketCap, Worldcoin has dropped 5.20% in the past 24 hours and is trading at $1.72 on the chart, raising investor concerns about the long-term viability of the token.

All of this happened because a cryptocurrency wallet associated with the FTX exchange went bankrupt and its sibling company Alameda Research was transferring large amounts of WLD.

What else?

To put things into perspective, over the past two months, Alameda Research’s on-chain wallet has transferred an impressive 1,560,000 WLD tokens to Binance, executing ten separate transactions at an average price of around $1,605.

This sell-off generated approximately $2.51 million, likely to prepare for upcoming compensation to FTX customers and creditors, especially as the bankruptcy estate prepares for payouts.

With a repayment plan recently approved by a judge overseeing FTX’s bankruptcy case, Alameda Research’s wallet is now periodically sending 143,770 Worldcoins every two weeks.

Source: Spot On Chain/X

Also confirming this, John J. Ray III, current CEO of FTX said:

“Looking ahead, we are prepared to return 100% of the bankruptcy proceeds with interest to non-government creditors through the largest and most complex bankruptcy distribution in history.”

With such a return strategy, if FTX and Alameda continue to pursue it, this could lead to large transfers of Altcoins to major exchanges like Binance and OKX.

Following the recent sale of Worldcoin to Binance, Alameda's wallet now holds 23 million 440 thousand WLD tokens.

According to data from SpotOnChain, this process could take around three years to fully liquidate at the current rate.

What do on-chain metrics say?

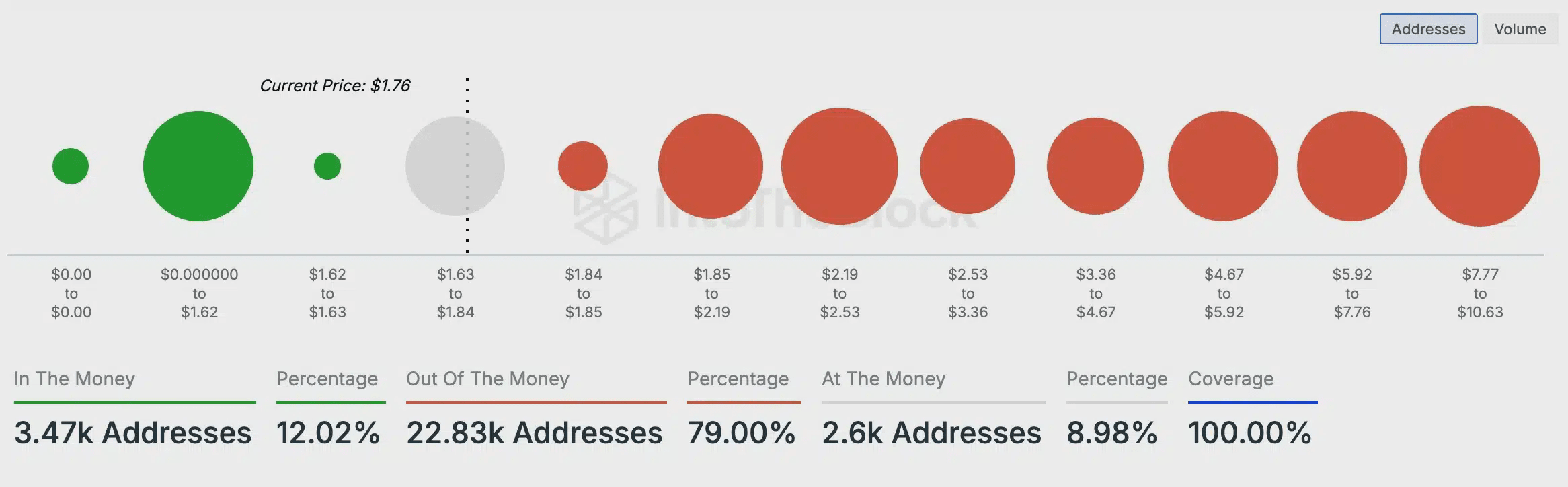

To further confirm the speculations about selling pressure, TinTucBitcoin analyzed data from IntoTheBlock and found that the majority (79%) of WLD investors are holding tokens worth less than their purchase price, indicating that they are “at a loss.”

Conversely, only a small percentage (12.02%) hold WLD tokens worth more than their purchase price, putting them in a “profit” position.

This indicates a bearish trend or that the value of Worldcoin is continuing to decline, partly due to Alameda Research.

Source: IntoTheBlock

#tintucbitcoin #Write2Win #AirdropGuide #BinanceTurns7 #MarketDownturn