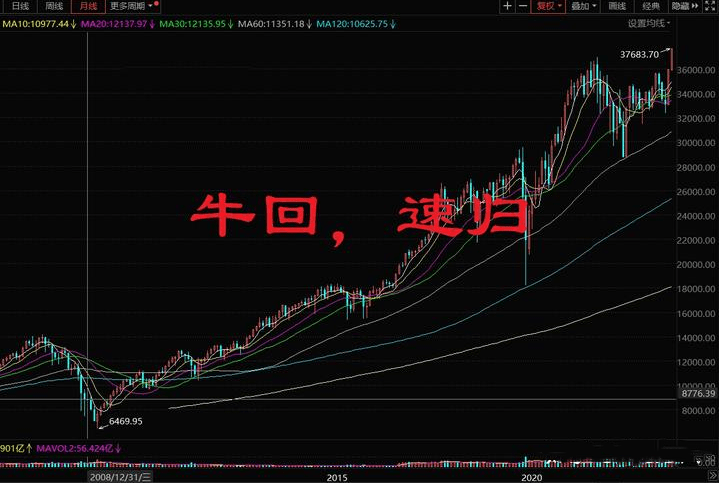

I have published several articles about the bull market, but I have never explained it thoroughly. Today, I will continue to talk about it while the market is good. In the next 20 years, the stock market will have a big opportunity. This is an investment opportunity similar to the 10-year gold bull market, the 15-year US stock bull market, and the 20-year real estate bull market. Therefore, I still have to say more, and I will continue to say it later.

US dollar harvest

With the popularization of self-media, everyone basically knows what is going on with the dollar tide harvesting the world. I also wrote an article "Vernacular dollar hegemony, US debt crisis. From the shallow to the deep, I guarantee you can understand it." We all know that because of China's existence, the effect of the dollar harvest has been greatly reduced. The crazy interest rate hikes in the United States in the past year have only caused crises in Sri Lanka and Argentina, while the major economies are still holding up. This is true, but the effect is discounted, which does not mean that there is no effect. The dollar still hit Hong Kong stocks, A shares, and real estate. The logic of the dollar harvest is that interest rates are cut, a large amount of US dollars flow into a certain market, create market prosperity, drive up prices, and then raise interest rates at high levels to cash out capital and withdraw; when asset prices are under pressure and collapse, the dollar will release liquidity through interest rate cuts and come back to buy high-quality assets. So what stage is the current dollar harvest cycle in? Now it is in the stage where asset prices are collapsing and the dollar is about to start buying at a low level. The Federal Reserve has made it clear that it will not raise interest rates, but it will stay at a high level for a while. Hong Kong stocks have been bleeding, China's real estate market is facing a series of crises, and A-shares have been falling and repeatedly breaking the psychological bottom line of stockholders. The plan of American capital is to let the Chinese economy collapse, and then use a large amount of green paper to buy high-quality assets at the bottom. They hold a large proportion of the equity of our core enterprises. BlackRock Group, which swallowed up the Ukrainian state-owned enterprises, may be the top three shareholders or even the controlling shareholders of companies such as Bank of China, Kweichow Moutai, CATL, CITIC Securities, Ping An of China, Tencent, Xiaomi, Baidu, SMIC, Great Wall Motors, and Yili Group. However, judging from the current situation, such a thing will obviously not happen. China is not South Korea, so China's Samsung will not become an asset of Wall Street. There is no need to wait for the US dollar to come in. Our country will take action to cover the bottom. Let's review what the country has said and done in the past six months? The proportion of social security entering the market has been increased, restrictions on major shareholders' reduction of holdings, reduction of transaction fees, cultivation of domestic smart funds, etc., etc. There are too many to list one by one. We have not seen the impact yet, and A-shares seem to be immune, but these are all trumpets for expanding the capital market.The real estate bull market of more than 20 years was built on the basis of system reforms such as tax sharing, loan purchase and loan construction. Now, A-shares are undergoing similar reforms. A-shares used to be a tool for corporate financing and for large shareholders to get rich; however, in the context of a financial power, in the context of domestic demand being the future growth potential, and in the opportunity of equity finance replacing land finance, the ecology of A-shares will also be subverted.

A-shares plummet

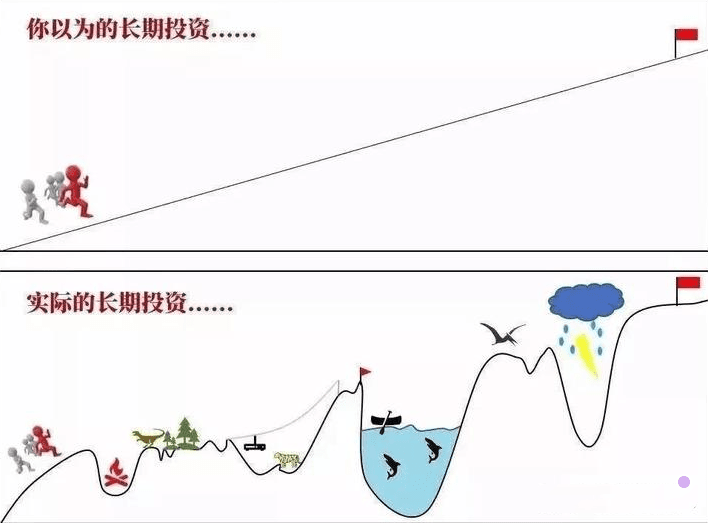

You may say, I also think there is a bull market, but the decline of A-shares has shattered my fantasy again and again. In fact, you are not wrong. It's just that the cycle of ups and downs may be too short. Let's take a look at the cycle of the Federal Reserve's interest rate. A cycle takes at least 40 to 50 years.

The United States once called for a rescue of the market when the Dow Jones Index was over 8,000 points, and then continued to fall for more than four months, bottoming out at over 6,000 points, and then began a 15-year, 6-fold bull market.

There has always been a saying about the policy bottom and the market bottom in A-shares. After the policy bottom, there is often another market bottom. The interval between them is often several months, such as the one in 2005.

If you have 10 billion, you will think that such a decline is perfect.

Grinding it on the bottom is normal.

Must catch up

The last part of a bull market is often crazy, we call it accelerating to the top, because when it is crazy, everyone will forget the risks and only be greedy. On the contrary, the last part of a bear market is often crazy, accelerating to the bottom, because only when retail investors are desperate will they hand over their bloody chips.

This is inevitable. Some people say that we know this is the bottom, but we just don't sell. The reality is that if most people don't sell, then they will continue to test the bottom and continue to play out the crisis. Once you sell, it will take off, and you will regret it, thinking that it would be better if you didn't sell it at that time. The reality is that if you don't sell, it won't take off. Your selling is the prerequisite for it to take off.

Investing is risky, so be cautious when entering the market.

This is a true statement. I think 2024 will start a big bull market. But I objectively realize that there are still several very significant risks in the real world.

War risk: The risk is highest in the South China Sea, followed by the Korean Peninsula and the Straits; the possibility of war between Russia and Ukraine is high, with Ukraine actually giving in, but the possibility of further expansion cannot be ruled out; the spillover of the Palestinian-Israeli conflict has already occurred, and more anti-US organizations may emerge.

Debt risk: The resolution of local debt is far from over, and the thunder of real estate is still ringing in our ears. The number of bankrupt bosses, speculators whose loans have been withdrawn, buyers who have defaulted on their payments, unemployed middle-aged people, and uncollectible debts are all increasing.

Health risks: After the COVID-19 pandemic, there seem to be more viruses, residents are more likely to get sick, and it is more difficult to recover from illness. It seems that this situation will not pass in just one or two years.

Technology risks: The already severe job market will face a dimensionality reduction attack from AI+robots. China's population advantage may soon face its first major challenge in history. When the United States uses robots to upgrade its manufacturing industry, we must also be able to keep up, otherwise revival will become an ideal.

Risk, return and liquidity are an impossible triangle.

There is no absolutely safe chance.

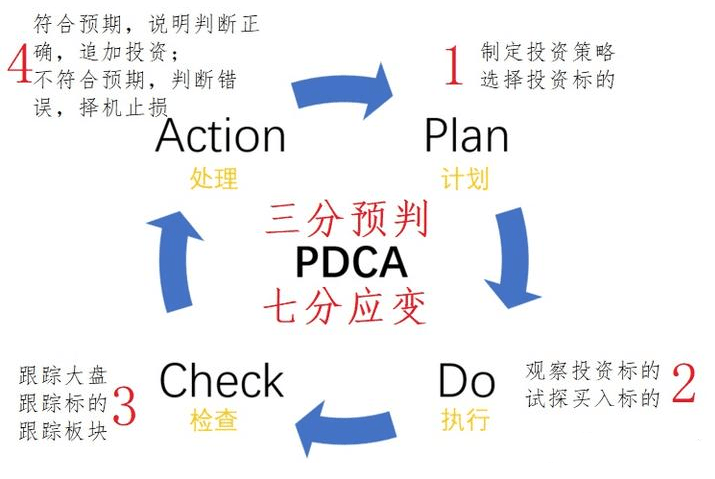

Three parts prediction and seven parts response; the prediction framework is the basis for response.

Every crisis is an opportunity for wealth transfer. I am serious about stock trading. I used to say that I don’t want to trade stocks anymore because I don’t feel the social value. But now it is different. Stock trading is no longer speculation or profiteering. It is to activate the capital market, support a strong financial country, and most importantly, make money without doing anything.

Grow throughout your life and progress together.

Invest in the cryptocurrency circle, follow Brother Yu, and share with Heyue Fresh Daily Mima for free.