The crypto market is never short of "the boy who cried wolf" stories—every once in a while, rumors erupt like a virus, sending the price of a cryptocurrency soaring and plunging.

Recently, First Squawk, a major international financial news outlet, broke the news on social media: "China has completely banned cryptocurrency trading, mining, and related services," triggering a wave of panic selling. This "breaking news" was quickly retweeted by accounts with millions of followers, such as #Investing.com and Rawsalerts. Unfortunately, it was later discovered that the news was completely untrue! #比特币流动性危机

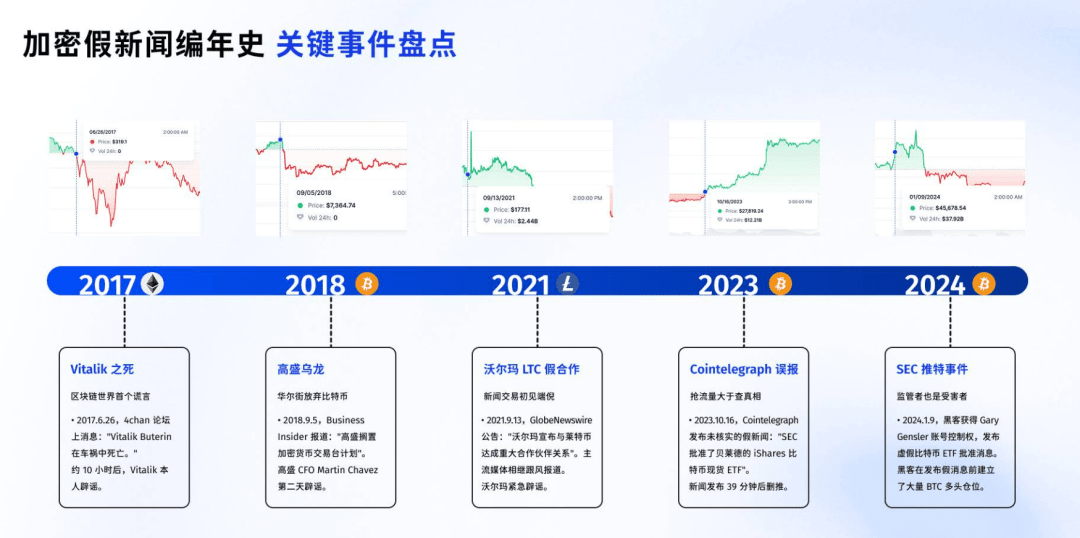

Old-timers have long been tired of fake news about China's "ban," but once enough people believe it, it can quickly sway market sentiment and distort price trends. Today, we'll review the biggest fake news stories that have shifted the market over the past decade, exploring how the industry evolved from "unconventional" to "professional," and the evolving tactics behind them.

"The Wolf is Coming": How is fake news becoming more "professional" every year?

Information in the crypto world is highly fragmented, making it difficult to distinguish true from false. A single piece of unverified news can easily cause billions of dollars in financial fluctuations within minutes.

In 2017, it was just "amateur players making fun of it on 4chan"

In 2018, even the well-dressed Wall Street tycoons made headlines.

In 2021, someone used official articles to "cheat" the entire network, and the options layout conspiracy surfaced

In 2023, mainstream media also threw verification procedures behind in order to "grab traffic"

In 2024, even the SEC's official X account was hacked by "social workers"

The "threshold for fabricating rumors" has been rising. Let's replay the highlights of these "fake news" one by one - not only is it fun gossip, it is also a must-learn for asset security📚

2017: Vitalik’s “death” rumor — a selfie on the blockchain dispels the rumor

🔥 Event Replay

On the afternoon of June 26, 2017, an anonymous 4chan account posted:

“I heard Vitalik Buterin died in a car accident, everyone quickly sold ETH!”

The post had no source, not even the location of the accident. Yet, within hours, ETH plummeted from $317 to $216, a nearly 32% drop. In the Telegram group, cries of "Is this true?" and "Run!" echoed.

🎭 Rumor-busting drama

The real Vitalik Buterin posted a photo of himself holding a screenshot of the block number and hash of that day, refuting the "death news".

The block number in the screenshot is: 4500000, and the corresponding hash is: 0xabcdef…

Use the “immutable” feature of blockchain to tell you, “I am still alive and well!”

🤔 The inspiration behind this

Early fake news makers mostly relied on "pranks" for fun

Retail investors are extremely sensitive to information and will stampede at the slightest sign of trouble.

Blockchain data itself can be the most powerful truth verification tool

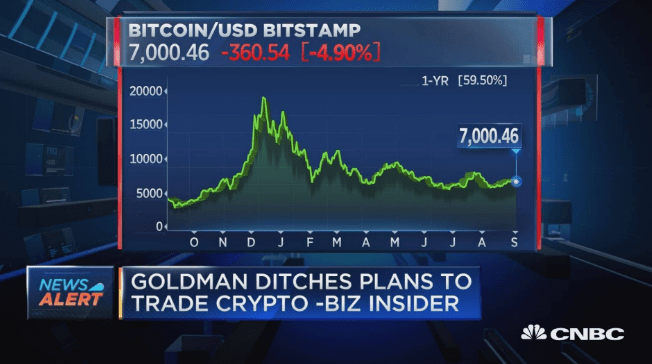

2018: Goldman Sachs’ blunder – Does Wall Street also love to “talk big”?

🔥 Event Replay

On September 5, 2018, Business Insider published an “exclusive” report:

Goldman Sachs has shelved plans for a cryptocurrency trading desk – is Wall Street abandoning Bitcoin?

In the bear market panic, this news was like a "doomsday bomb". The next day, BTC and mainstream cryptocurrencies fell by more than 6%, and the market value evaporated by about $12 billion in an hour.

🎭 The truth is revealed

Less than 24 hours later, Goldman Sachs CFO Martin Chavez gave a bewildered response at the TechCrunch conference:

"I only learned about this 'decision' yesterday and it's completely fake news."

🤔 The inspiration behind this

Professional media's "exclusive revelations" are more lethal

"According to insiders" is enough to move people's hearts.

The amplification effect of news is stronger in a bear market, especially when it comes from traditional financial giants

2021: Walmart x Litecoin? A "Perfect Crime" Made Easy

🔥 Event Replay

At 9:30 a.m. on September 13, 2021, an announcement suddenly appeared on GlobeNewswire (a global news release distribution system):

Walmart and Litecoin establish payment cooperation, starting in October, you can use LTC to place orders!

Announcement template, official logo, CEO quote, investor relations email address - clean and concise, professional enough to be convincing.

LTC price instantly surges 30%

Trading volume surged, with many mainstream media outlets vying to report on it.

The Litecoin Foundation's official account also made an appearance and forwarded the post.

🎭 The truth is revealed

A few hours later, Walmart officially denied the rumor:

"We have never issued this statement. There is no such thing."

The real culprit behind this? The investigation shows:

Abnormal call option trading quietly increased 48 hours before the announcement

Manipulators profited millions at peak prices through 'news trading'

🤔 The inspiration behind this

"Official press releases" can also be forged, and the high degree of imitation is hard to guard against

News trading becomes a new method of premeditated crime

Call option data is a "leading indicator" and can amplify gains when combined with news.

2023: Cointelegraph's "quick talk" leads to a precipitous rise and fall

🔥 Event Replay

On October 16, 2023, a screenshot leaked from a Telegram group:

“Bloomberg Terminal: SEC has approved BlackRock iShares Bitcoin Spot ETF”

Just 7 minutes later, Cointelegraph, one of the world’s largest crypto media outlets, quickly retweeted the post on X (formerly known as Twitter):

“Breaking: SEC Approves BlackRock Bitcoin Spot ETF!”

The market immediately soared: BTC jumped from $27,900 to $30,000, an increase of more than 7%, and short positions in the derivatives market were liquidated for $81 million.

🎭 The truth is revealed

39 minutes later, Cointelegraph urgently deleted the tweet and issued an internal investigation:

"The social media editor overstepped his authority and the process got out of control. We deeply apologize."

Unfortunately, the 45-minute ups and downs cycle has caused panicked retail investors to lose all their money.

🤔 The inspiration behind this

The media is better at "preemptive strike" than at verifying the truth.

Under flow pressure, accuracy is often sacrificed

Once the price fluctuates, it becomes a cover for "market verification of fake news"

2024: SEC official X was hacked by "social engineering", and a tweet ruined the world

🔥 Event Replay

In January 2024, the SEC’s official account X posted:

“SEC Approves First Bitcoin Spot ETF!”

The BTC price instantly soared from $46,600 to $47,680.

🎭 The truth is revealed

The SEC responded pragmatically: “We are cooperating with the FBI’s investigation.”

According to a subsequent FBI investigation, the attacker gained control of the account through a SIM swap attack. Bitcoin prices rose from $46,600 to $47,680 after the fake news was released, but fell to $45,627 after the rumor was debunked.

In October 2024, the FBI arrested suspect Eric Council Jr. He had built up a large long position, waiting for a "social engineering attack" and betting on the "rising price brought by official tweets."

🤔 The inspiration behind this

Even regulators have "blind spots"

The impact of social engineering attacks on the crypto market cannot be underestimated

Building positions + social engineering + dumping: Financial crime models are becoming increasingly mature

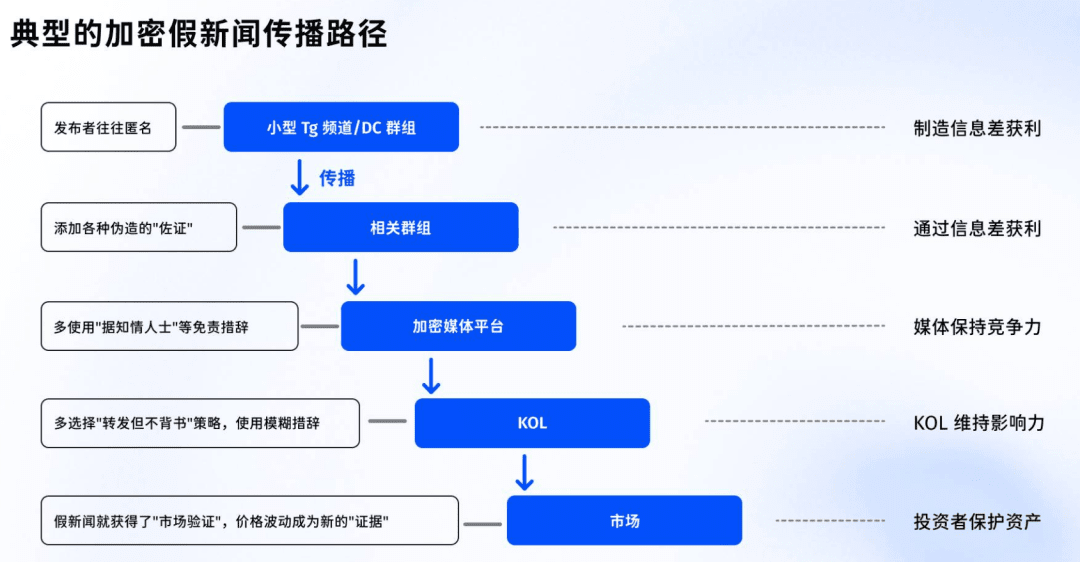

The "Five Lines of Defense" Model for the Spread of Fake News

First level: Telegram/Discord small groups

Post anonymously without any consequences

The second layer: encrypted KOLs and community influencers

Add "it is said" or "insider" when forwarding to reduce risks

The third layer: Industry media grabs headlines

"Exclusive" and "Breaking" labels urge clicks

Fourth layer: mainstream financial media, Weibo/Twitter influencers

One person spreads it to ten, ten spread it to a hundred, giving it an "official" color

Fifth level: Market reaction self-verification

Stock price/coin price changes become "factual evidence"

With each level down, the cost of truth increases exponentially, while the cost of rumors is almost zero.

How to "add bulletproof vest" to your position?

On-chain verification:

After Vitalik’s death, everyone learned the importance of “looking at blockchain data”

Second confirmation from official channels:

SEC, Walmart, etc., be sure to search for announcements on official websites or authoritative channels

Options/derivatives data monitoring:

Unusual call/put option trading is often a leading indicator of "inside information"

Multi-source cross-validation:

When you see a breaking news, check whether three or more channels are consistent.

Pay attention to "fall first and then talk" and "rise first and then delete":

The clever act of "first throwing a rumor and then refuting it" is often intentional.

Conclusion: Rumors are profitable, but caution is the only way

Over the past decade, the evolution of fake news in the crypto world has been a perfect textbook example:

From "prank" to "Wall Street" and "official" take turns to play

From "personal CPU" to "computing power + social engineering attacks"

Each of us could become the next loser who is caught in a panic. Only by increasing vigilance and strengthening our ability to discern information can we maintain our positions in times of crisis.

Finally, I'll give you an old saying:

“Rumors stop with the wise, and accurate information can make you money.”

I hope you can remain calm and composed next time you face the "big news" that shocks the entire Internet 😉

Many people understand the trend, but not many people follow the right rhythm.

The cryptocurrency world is changing rapidly, with both opportunities and risks. Learning to strategically enter and exit the market and protect your principal is the key to steady progress, wealth, and growth. ✍️

Remember to DYOR and do a good job of risk management. I wish you all a smooth sailing in the cryptocurrency world! 🌊

Like 👍 and repost, follow me, and I'll show you more about the cryptocurrency world! Let's cheer together!