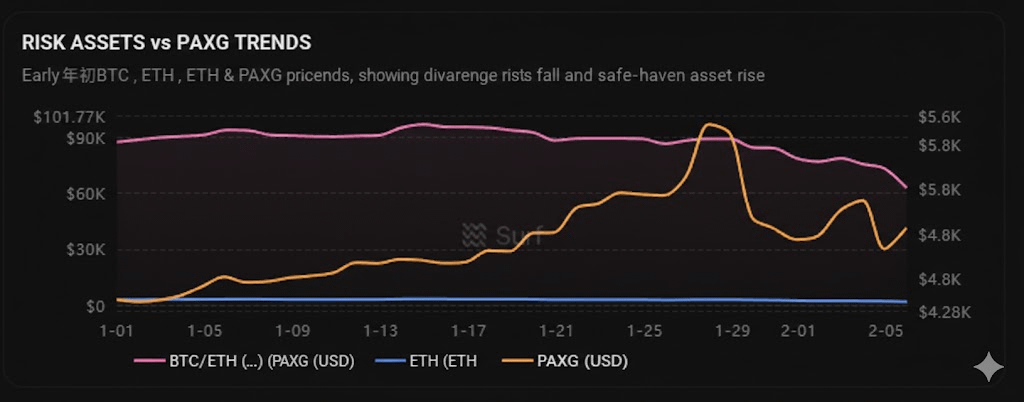

We just witnessed one of the most violent "decoupling" events in recent memory. If you were looking at your portfolio in late January 2026, you either saw a sea of red or a golden lifeline. While Bitcoin and Ethereum were busy falling down an elevator shaft, gold (via PAXG) was climbing a mountain.

Let’s break down the play-by-play of this 2026 early-year disaster—and why it changed the way we look at "digital gold."

The Timeline of the Crash

Phase 1: The Honeymoon (Jan 1 - Jan 14)

The year started with a classic "everything rally." BTC was pushing toward $97k, and ETH was looking strong at $3,300. Even PAXG was up about 6%. Everyone was happy, leverage was high, and the vibes were immaculate. It felt like 2026 was going to be the year of the moon mission.

Phase 2: The Cracks Form (Jan 15 - Jan 26)

On January 15th, the music stopped. BTC and ETH hit their local ceilings and started drifting. But look at Gold. While crypto was wobbling, PAXG smashed through the $5,000 psychological barrier. This was the first real sign that the "smart money" was moving into the bunkers.

Phase 3: The Vertical Breakout (Jan 27 - Jan 29)

This is where it got weird. On January 28th alone, PAXG surged nearly 7% to hit a peak of $5,537. Meanwhile, BTC was bleeding out at $84k and ETH was struggling to stay above $2,700. It wasn't just a dip anymore; it was a total divorce. Crypto was being treated like a tech stock on leverage, while Gold was being treated like the last safe house on earth.

Phase 4: The Bloodbath (Jan 30 - Feb 6)

Then came the "Warsh Shock." When Trump nominated Kevin Warsh for the Fed, the market went into a full-blown seizure. BTC crashed over 35% from its highs, bottoming out near $62k. ETH was even worse, losing nearly half its value. Gold pulled back too—liquidity was being sucked out of everything—but it remained significantly higher than where it started the year.

Why Did This Happen?

Why did the "Digital Gold" ($BTC ) fail to track the "Physical Gold" ($XAU )?

Geopolitical Chaos: Between trade war threats with Europe and wild claims about Greenland, the world got scared. In times of actual war and trade bans, people want bars of metal, not speculative code.

The Fed Factor: The Warsh nomination signaled a hawk in the nest. Higher-for-longer rates suck the life out of high-risk assets like ETH, but they drive people into "hard" stores of value.

The Liquidity Trap: When the big players got margin called on their crypto longs, they had to sell. This created a "liquidation cascade" that gold simply doesn't suffer from in the same way.

The Hard Lesson

This wasn't just a bad week; it was a reality check. BTC is an amazing offensive asset, but Gold is still the king of defense.

If your portfolio was 100% crypto, you got mauled. If you had even a 10% slice of PAXG or physical gold, you had the dry powder to survive. The "Great Divergence" of 2026 proved that in a world of political insanity, diversification isn't just a boomer meme—it’s survival.

The take-home? Watch the fund flows, not the memes. When Gold starts making new highs while BTC stalls, the exit door is getting crowded. Don't be the last one through it.

Should I dive into the specific whale wallet movements that anticipated the Jan 28th gold surge, or look at how the $ETH /BTC ratio is predicting the next recovery?