If you survived this week in crypto with your portfolio and your sanity intact, congratulations. You earned that weekend.

Bitcoin just went through one of the most violent seven-day stretches in recent memory. We're talking a $17,000 nosedive in barely 24 hours, a bounce that looked like it might actually stick, and then a rejection right at the level where everyone was watching. Meanwhile, Ethereum clawed its way back above $2,000 after looking like it might completely fall apart, and altcoins are trying to convince us that the bottom is in.

Let's break down what actually happened and what matters heading into next week.

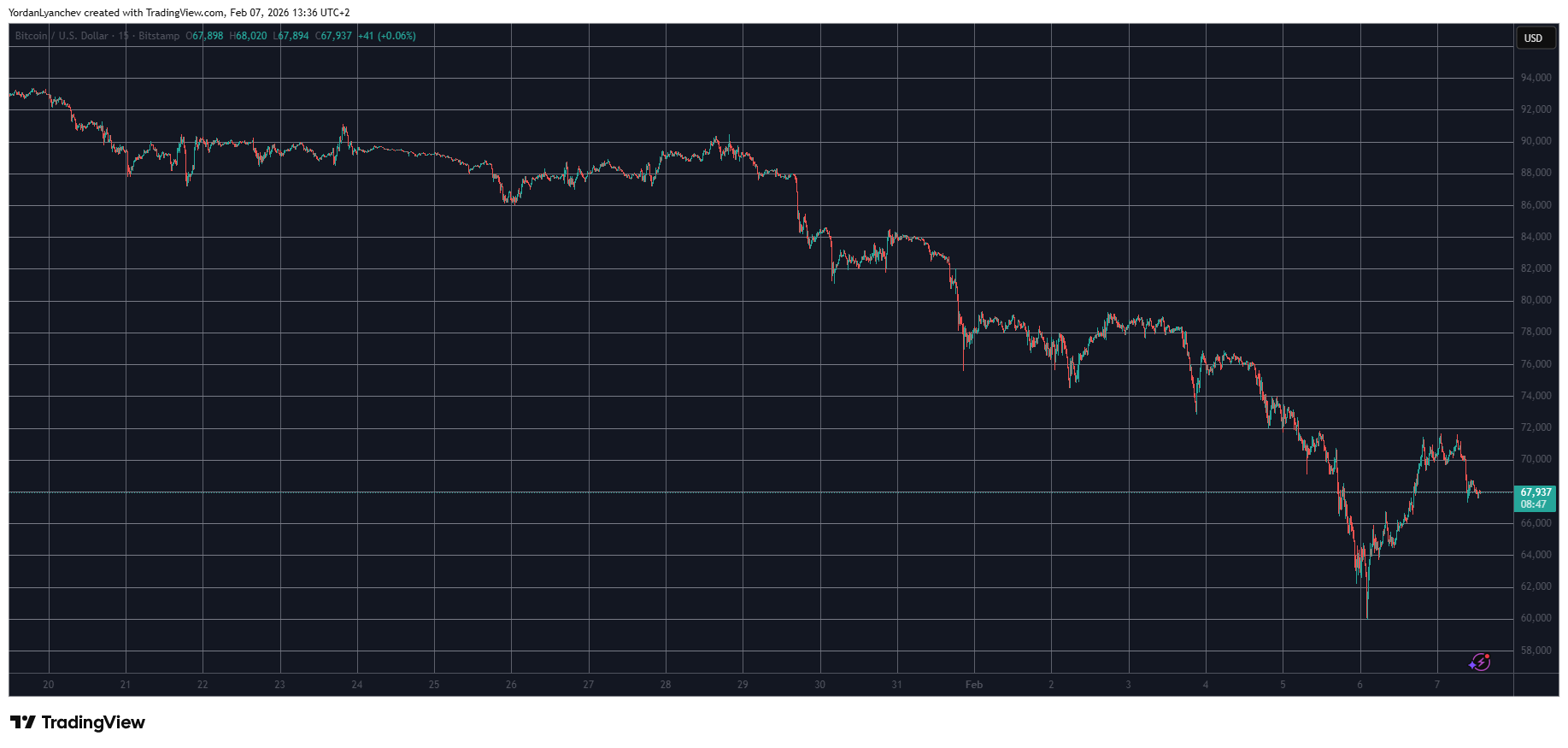

Bitcoin's Rollercoaster: $84K to $60K to $72K to... $68K

Start from last Saturday. Bitcoin was sitting around $84,000 when sellers showed up out of nowhere and dragged it below $76,000. On a weekend. That alone should have been a warning sign that something bigger was brewing.

Monday confirmed it. $BTC slipped under $74,000 early in the week, but the real damage came Thursday into Friday morning. The kind of move that makes you check your screen twice. Bitcoin went from $77,000 to $60,000 in just over a day its lowest price since before the November 2024 election. Thousands of leveraged traders got wiped out. Billions in liquidations. The kind of flush that only happens when the market runs completely out of buyers at every level on the way down.

Then came the snapback. Friday evening, Bitcoin ripped higher by nearly $12,000, pushing all the way to $72,000. For a moment, it felt like the recovery was real. But that level rejected hard twice and sellers pushed it back down to around $68,000, where it's sitting now.

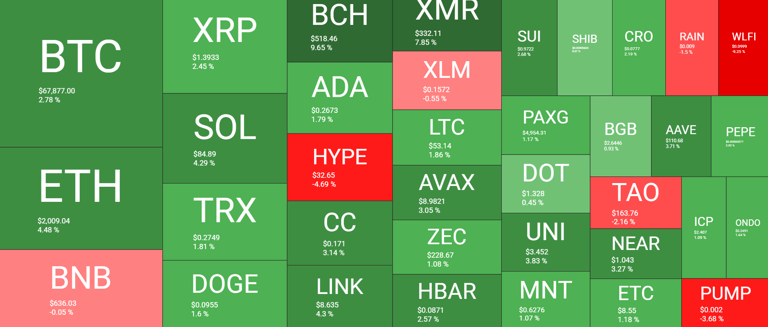

Market cap is hovering at $1.36 trillion. Dominance has actually slipped to 56.6%, which tells you altcoins caught a bid on the bounce too.

Ethereum Reclaims $2K But Let's Not Pop Champagne Yet

ETH got absolutely hammered this week. It dropped from above $3,000 to under $2,700 in the span of a few days, and during the Thursday-Friday bloodbath, it got dragged even lower. The kind of price action that makes long-term holders go quiet on social media.

But here's the thing it bounced. $ETH is back above $2,000 as of this writing, sitting around $2,010. Is that a victory? Depends on your timeframe. On the daily chart, it looks like a relief rally. On the weekly chart, it still looks like a car crash. But reclaiming that psychological $2K level matters for sentiment, even if the recovery has a long way to go.

Altcoins: Green Daily, Red Weekly The Classic Trap

The altcoin picture is a mixed bag, and you have to be careful about which chart you're looking at.

Solana, Bitcoin Cash, and Monero are all posting solid daily gains. $XRP , Tron, Dogecoin, and Cardano are in the green too. That feels good after watching everything bleed for a week straight.

But zoom out and the weekly charts are still ugly. Most of these coins bounced off multi-year lows hit during Friday's flush. Being "up 8% today" means a lot less when you're still down 25% on the week.

On the flip side, not everything is recovering. HYPE which had been one of the hottest names in the market is down nearly 5% today and trading below $33. PUMP and WLFI are also still bleeding among the larger caps.

The Bigger Picture

Total crypto market cap has recovered over $100 billion from Friday morning's bottom and now sits around $2.4 trillion. That sounds impressive until you remember how much was lost getting there.

Here's what this week really proved: leverage is still the market's biggest enemy. The speed of the drop from $77K to $60K wasn't driven by fundamental panic it was a liquidation cascade. Forced sellers creating more forced sellers. Once the leverage got flushed, the market found its footing almost immediately.

The $72,000 rejection is the level to watch now. If Bitcoin can reclaim it with conviction early next week, this whole episode might end up being one of the best buying opportunities of 2026. If it can't, and we start grinding lower from $68,000, then Friday's $60,000 low is going to get tested again.