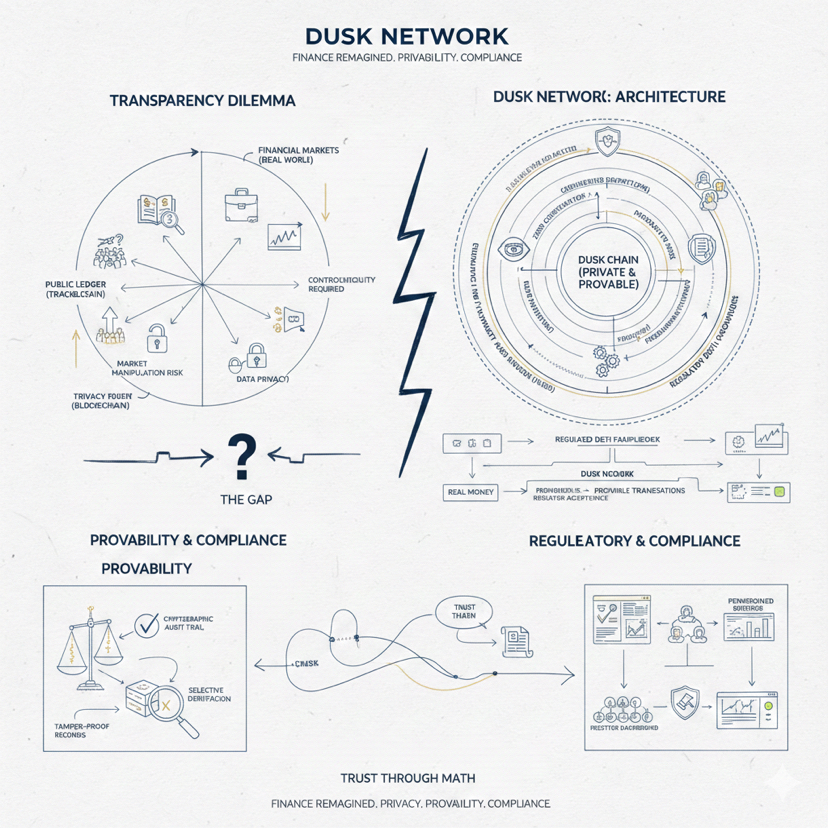

Dusk Network feels like it was designed by people who actually understand how finance behaves when real money, real rules, and real risk management are involved, because the entire idea starts with a problem most blockchains ignore, which is that transparency is not always a virtue when you are dealing with markets, participants, and portfolios that cannot afford to broadcast every move in public, and at the same time you still need provability, controlled disclosure, and a clear path to compliance if you ever want regulated systems to take the technology seriously.

What pulls me in is how Dusk treats privacy as infrastructure rather than decoration, since it is not presented as a feature you toggle on when you feel like it, but as something that is meant to live at the core of how transactions and smart contracts work, and that is where the Phoenix transactional model comes in, because the project talks about it as the foundation for bringing privacy and anonymity to transfers and smart contract execution, which matters because once privacy is native you can build consistent rules around it, you can design better user experiences around it, and you can avoid the messy reality where privacy is bolted on later and never fully matches the rest of the system.

The story becomes even more serious when you look at why they built Zedger and why they keep centering the Confidential Security Contract standard, because security tokens and regulated assets are not just tokens with a new label, they carry restrictions, lifecycle events, issuer actions, compliance requirements, and audit expectations that do not disappear simply because the asset moves on-chain, so Dusk is trying to solve a very specific challenge, which is how to support instruments that behave like real securities while still protecting the sensitive details that markets and institutions cannot expose, and that is why the privacy preserving layer is paired with a framework that is meant to handle regulated logic without forcing every participant to operate in full public view.

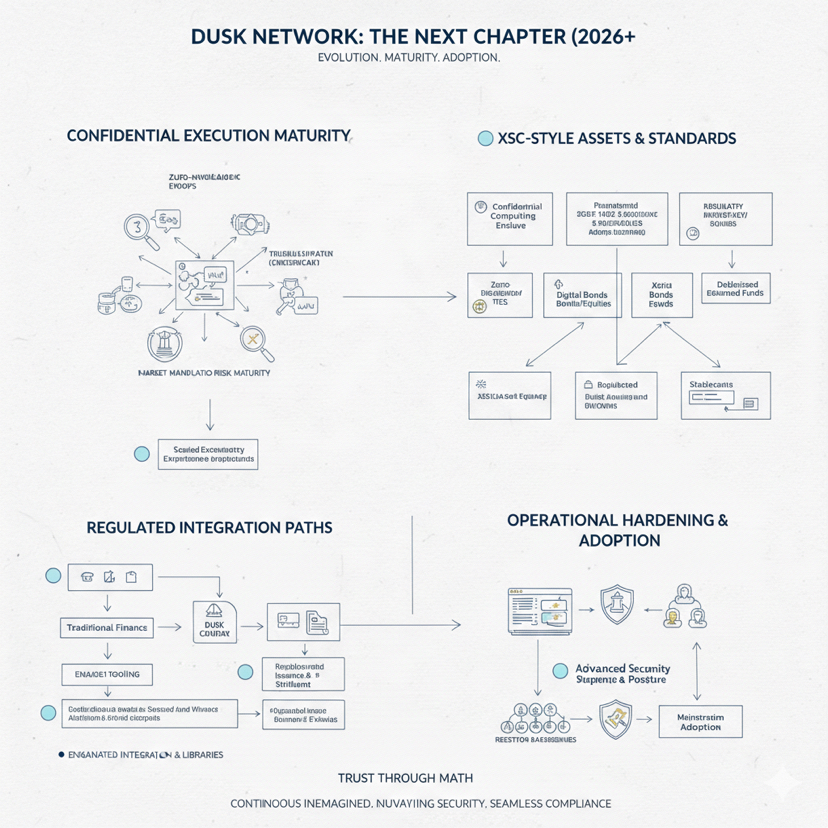

This is also why the project matters in the bigger picture, because tokenization is moving beyond a talking point, and the next wave is not just about putting an asset on-chain, it is about settling it with confidence, enforcing rules without friction, and giving institutions a reason to trust the infrastructure, and Dusk is aiming to be the kind of chain that can support institutional grade financial applications and compliant DeFi without pretending the world is a clean room where regulation, reporting, and accountability do not exist.

When you look at the project as a whole, it reads less like a typical crypto narrative and more like a long-term infrastructure build, where the real work is happening in the execution environment, the transaction model, the asset standards, and the tooling that makes all of it usable, and that kind of direction is not always the loudest, but it is usually the one that survives, because financial infrastructure is judged by reliability and discipline, not by how many slogans can fit into a tweet.

The token side fits into that same logic, because the DUSK token exists as the network asset that connects usage, incentives, and security economics, and the Ethereum contract you shared represents an access point that helps liquidity and distribution in a broader ecosystem, while the deeper thesis still lives on the native chain where the confidentiality stack and the regulated-asset design are meant to shine, and that dual reality is common for serious networks because adoption often starts where liquidity already exists, but long-term value accrues where the network is actually being used as settlement infrastructure.

What I like most about Dusk is the balance it is trying to hold without collapsing into extremes, because it is not chasing privacy for secrecy alone, and it is not sacrificing privacy to satisfy transparency maximalism, instead it is aiming for privacy with auditability, confidentiality with control, and programmability with standards that make sense for financial instruments, which is exactly the combination you would expect if the goal is to host regulated assets and institutional workflows rather than just experimental apps.

Looking forward, the most realistic next chapter is steady expansion of what the stack can support in practice, which means a more mature confidential execution environment, stronger standards and tooling around XSC style assets, deeper integration paths that make regulated issuance and settlement easier, and continued hardening of operational surfaces that matter in the real world, because the projects that win in this niche are the ones that keep shipping, keep tightening their security posture, and keep making the system easier to adopt without compromising the core design.

My takeaway is that Dusk is building for the world that is coming, not the world that is convenient, and that world is one where markets move on-chain but still need to behave like markets, with privacy that protects participants, rules that protect integrity, and auditability that protects legitimacy, and if Dusk keeps executing on Phoenix, Zedger, and the Confidential Security Contract direction with the same disciplined focus, it has a clean lane to become one of the more credible foundations for regulated tokenization that does not force institutions to choose between confidentiality and compliance.