Most crypto conversations chase noise. New memes. Sudden pumps. Loud promises.

Plasma sits in the opposite corner—silent, technical, and strangely focused on something simple: moving stablecoins fast, cheaply, and reliably. That focus might sound boring. But in real markets, boring infrastructure often wins. Built for One Job—And Built Well

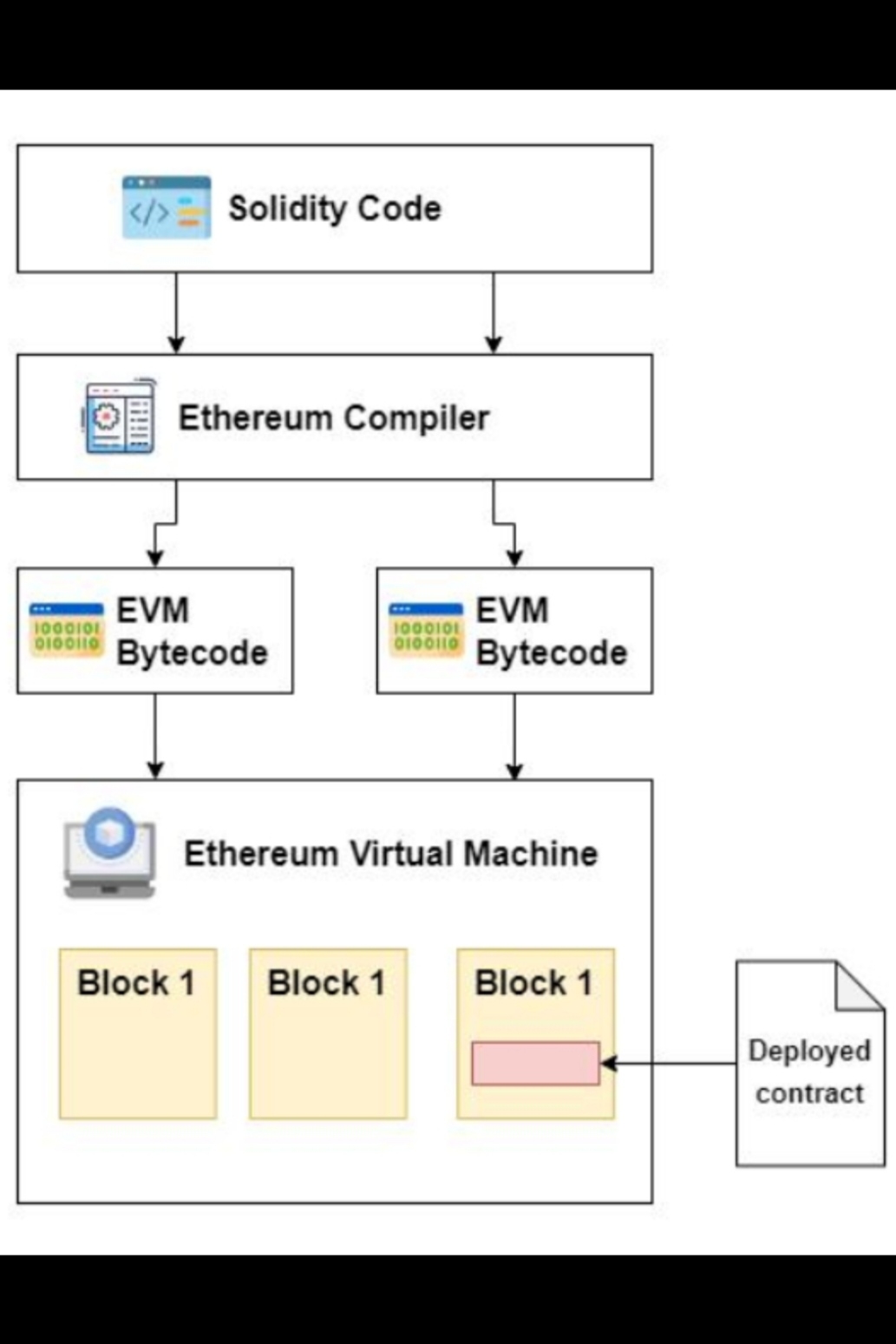

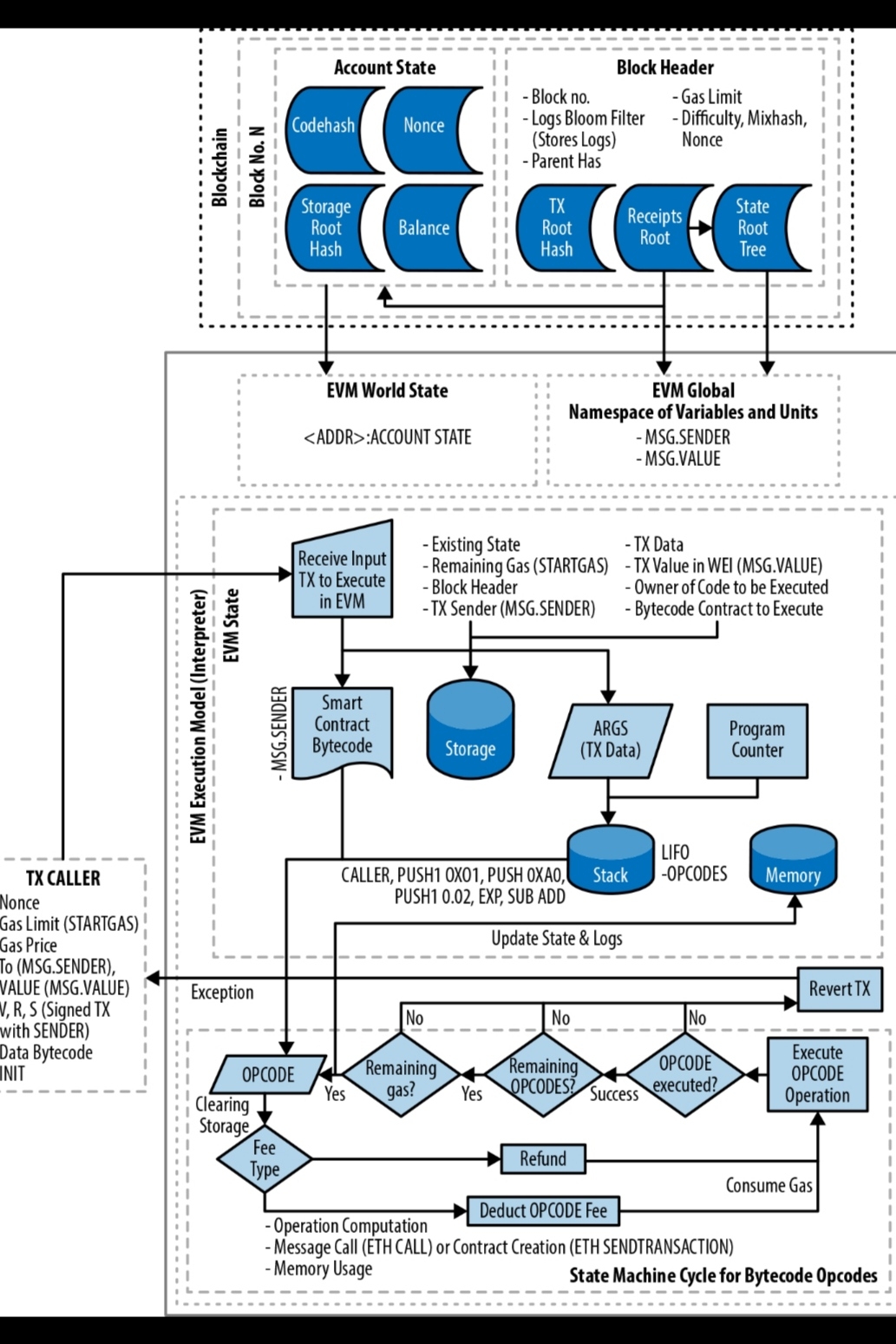

Plasma isn’t trying to be everything at once. It’s a Layer-1 chain designed around stablecoin settlement, which already sets it apart from the endless list of “general-purpose” blockchains fighting for attention. The design philosophy is clear: Sub-second finality so transfers feel instant Gasless or stablecoin-denominated fees instead of volatile native tokens in EVM compatibility to make migration easy for developers Bitcoin-anchored security to borrow trust from the strongest network in crypto Each of these choices removes friction from real usage.

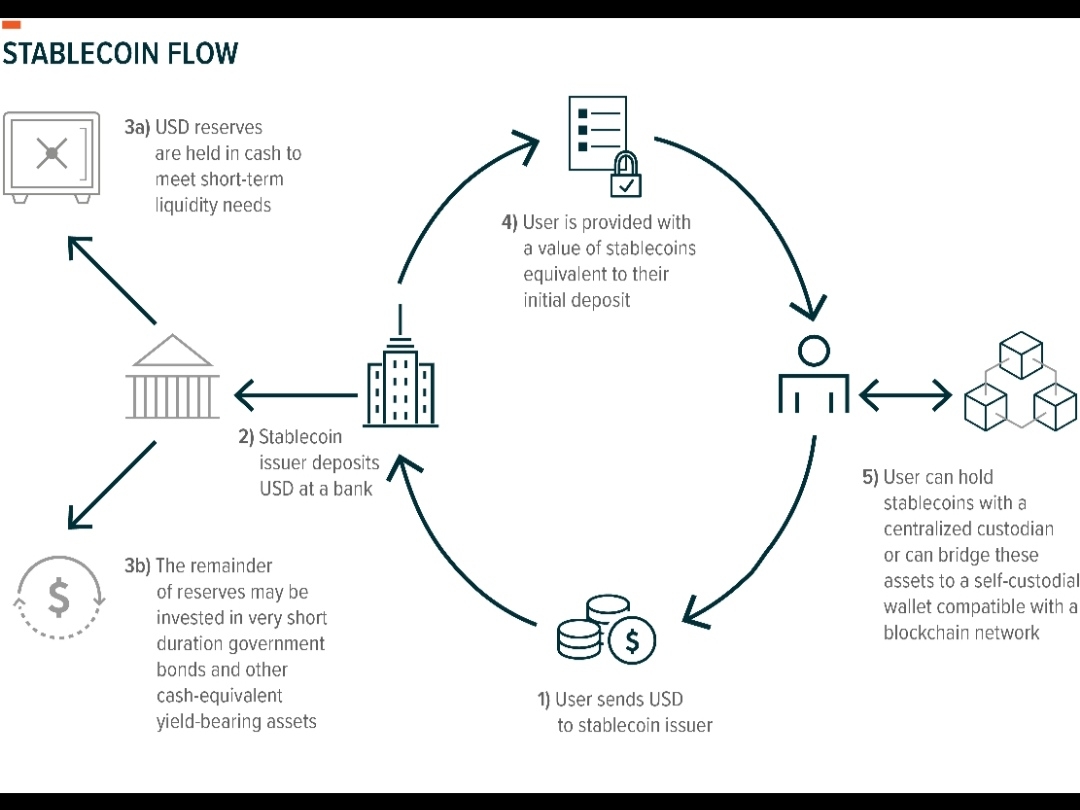

Not theoretical usage. Actual payments, remittances, and on-chain settlement. And that difference matters more than hype cycles. Why Stablecoins Needed Their Own Chain Stablecoins quietly became crypto’s most important product.

Trading pairs depend on them. DeFi liquidity depends on them. Cross-border transfers increasingly depend on them. Yet most stablecoins still move on chains not optimized for them. That mismatch creates problems:

Congestion during market volatility High or unpredictable gas fees Slow confirmations when speed matters most Plasma’s core idea is simple:

If stablecoins dominate usage, give them dedicated infrastructure. Not glamorous. But extremely logical.

EVM Compatibility Without the Usual Pain

Developers rarely want to start from zero.

That’s why Plasma’s EVM compatibility is more important than it first appears.

It means:

Existing smart contracts can migrate with minimal friction

Wallet support becomes easier

Liquidity bridges faster

In practice, this lowers the psychological barrier for builders.

And in crypto, psychology often decides adoption before technology does.

Bitcoin Anchoring: Borrowed Trust, Real Impact

Security narratives in crypto usually revolve around new consensus tricks.

Plasma takes a different route.

Instead of reinventing trust, it anchors security to Bitcoin.

That approach does two subtle but powerful things:

Signals seriousness — aligning with the most battle-tested network

Reduces perceived risk for institutions watching from the sidelines

Institutional adoption rarely begins with innovation.

It begins with trust.

Plasma seems to understand that.

Payments, Not Speculation

Many chains secretly rely on speculation for survival.

Token trading drives activity.

Activity drives fees.

Fees create the illusion of usage.

Plasma flips the order.

It starts with payments and settlement—real economic activity—

and lets everything else grow on top.

If this model works, the long-term effect could be significant:

More predictable on-chain volume

Less dependence on bull-market hype

Clearer regulatory narrative around utility

That’s the kind of foundation markets usually reward slowly…

then all at once.

The Quiet Risk No One Talks About

Still, nothing in crypto is guaranteed.

Plasma’s biggest challenge isn’t technology.

It’s attention.

Infrastructure projects often struggle because:

They’re less exciting than meme tokens

Adoption takes time

Liquidity follows narratives, not logic

So the real question isn’t whether Plasma works.

It’s whether the market becomes mature enough to care about what works.

History suggests that shift eventually happens.

But timing is always uncertain.

Where Plasma Could Fit in the Next Cycle

If the next growth phase of crypto revolves around:

Real payments

Institutional settlement

Stablecoin regulation clarity

…then Plasma’s positioning suddenly makes sense.

Not as a hype leader.

But as background infrastructure—the kind that quietly processes value while headlines focus elsewhere.

And strangely, those background layers often become the most valuable pieces of the stack.

Final Thought

#Plasma doesn’t try to impress.

It tries to function.

In a space obsessed with speed, noise, and narratives,

a chain focused purely on efficient stablecoin movement feels almost out of place.

But markets have a pattern.

First they reward excitement.

Later they reward usefulness.

If that second phase truly arrives,

@Plasma may already be waiting there—

quietly doing the one thing it was built to do.