Preconditions for a large-scale market decline

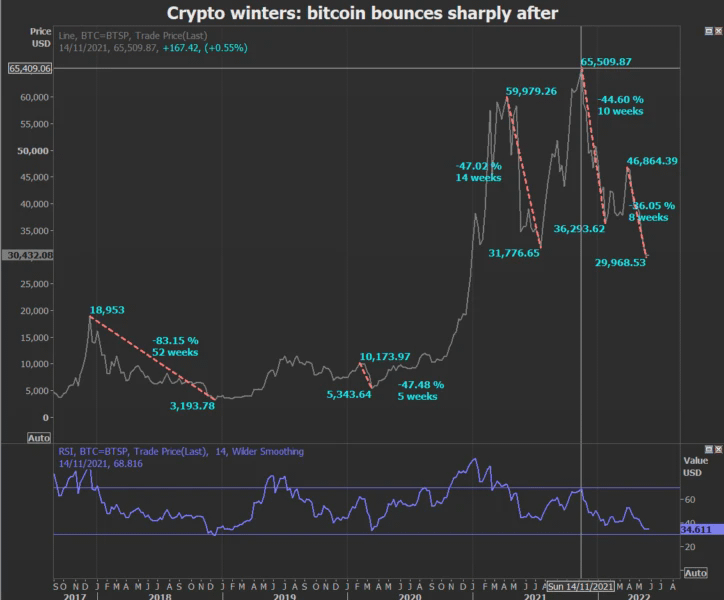

Although much has changed since the last crisis, the stagnation period of 2022 served as a backdrop for events that many considered fatal for the industry. Active growth began in 2020, when a significant influx of capital led to price increases to peak levels in November 2021. Over ten months, the value $BTC grew from $8300 to $64000.

High-yield financial products took center stage in attracting investors. Major companies offered attractive interest rates on deposits in bitcoins or stablecoins. However, this model began to break down under the influence of macroeconomic factors.

The Federal Reserve System of the United States has begun raising interest rates to combat inflation, which has limited consumers' access to liquidity. The stock market has faced a deep correction. These factors have led investors to withdraw funds from the most risky assets. As a result, a situation has arisen comparable to a mass withdrawal of bank deposits.

Chain reaction and collapse of institutional players

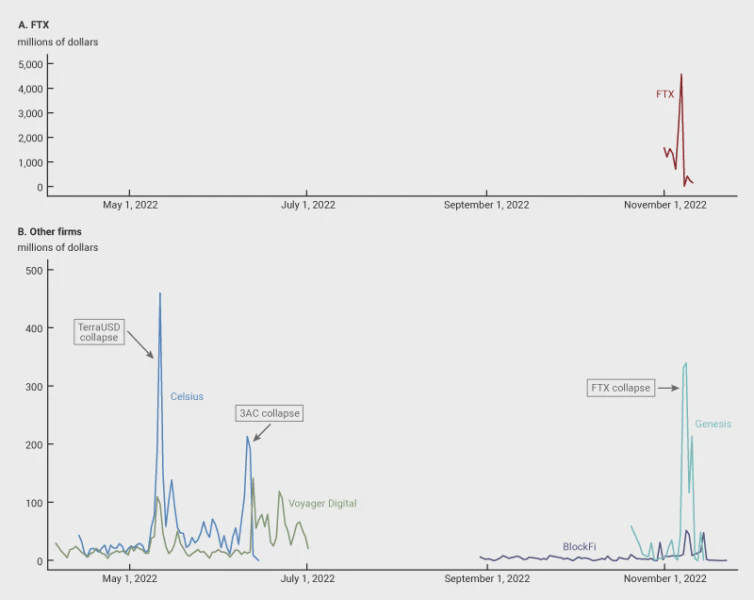

The first shock was the collapse of the stablecoin TerraUSD (UST) in May 2022. According to an analysis by the Federal Reserve Bank of Chicago, Celsius and Voyager Digital platforms faced a client funds outflow of 20% and 14%, respectively, within just 11 days after the incident.

Following this, the hedge fund Three Arrows Capital (3AC), which managed assets totaling about $10 billion, went bankrupt. Falling prices and risky trading strategies led to the complete loss of the organization's assets.

The most resonant event was the collapse of the FTX exchange in November 2022. Within 48 hours, clients withdrew 37% of assets. In the same month, Genesis and BlockFi platforms recorded a reduction in investments of 21% and 12%, respectively. In total, at least 15 companies related to digital assets ceased operations in 2022. These events revealed the structural vulnerability of business models in the face of a sharp liquidity shortage.

Features of modern market dynamics

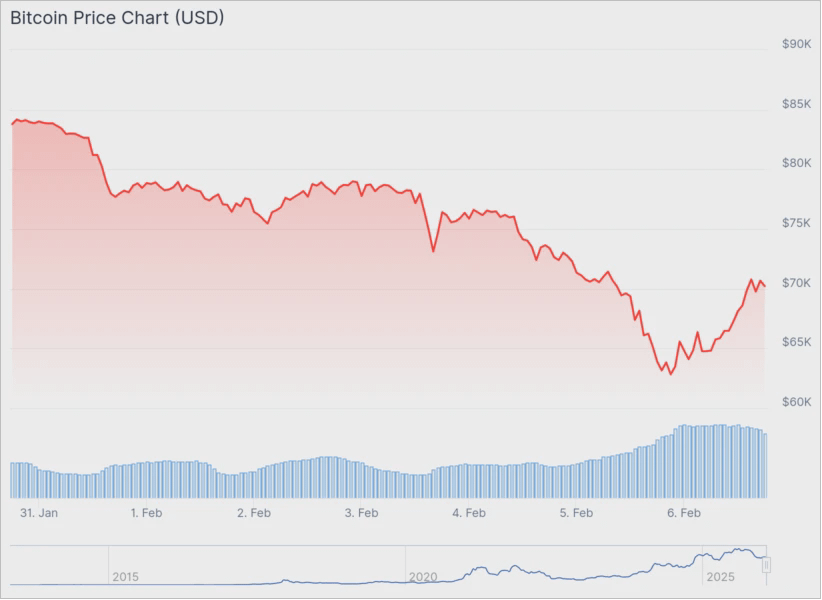

This week, Bitcoin and Ethereum lost almost 30% of their value. This led to a reduction in unrealized value on digital asset balances amounting to $25 billion. The synchronous decline of cryptocurrencies, stocks, and even such defensive instruments as gold and silver indicates a global liquidity shock.

In the context of margin calls, traders primarily liquidate the most liquid positions. Therefore, the current situation can be viewed as a technical reset of the market rather than a complete loss of confidence. On Friday, Bitcoin recovered to $70000 against the backdrop of positive statistics for the U.S. consumer sector.

Nevertheless, the behavior of the asset indicates the presence of structural problems. Bitcoin cannot regain upward momentum even under favorable conditions. The current decline is primarily driven by sales from long-term holders. When highly convinced investors dispose of assets, growth attempts lose credibility in the eyes of the mass market.

Hidden signs of institutional pressure

In addition to price movements, early indicators of stress are already emerging at the institutional level. Gemini has decided to reduce its operations and exit certain European markets. While this does not indicate insolvency, such a move reflects adaptation to a tough regulatory environment.

Furthermore, the Polygon project underwent a large wave of layoffs, cutting about 30% of its staff. This is already the third such reduction in the last three years. Historically, similar operational changes were observed at the end of 2021, long before the industry's open failures.

Corporate treasuries are drawing special attention. MicroStrategy, holding the largest portfolio of bitcoins, has come under pressure again after the price dropped to $60000. The company's shares showed a decline, and the market capitalization of the organization fell below the value of its cryptocurrency reserves.

It is noteworthy that MicroStrategy's management has deviated from its promise never to sell assets. In November, CEO Fong Lee first acknowledged the possibility of liquidating part of the bitcoins under certain crisis conditions. The current negative signals are less obvious than in 2022, but their hidden nature may indicate the beginning of a profound transformation in the industry.