#Bitcoin is currently trading on two different clocks at the same time: long-term power-law mean reversion, and short-term moves driven by macro and liquidity.

Short-term (macro clock): $BTC is tightly coupled to risk assets. 30-day correlations remain elevated with Nasdaq at +0.731, S&P at +0.727, HYG at +0.665, and even VIX at +0.543, with recency-weighted correlations still around +0.58 for both Nasdaq and S&P. Lead–lag analysis shows equities and credit tend to move first: S&P and Russell lead BTC by ~1 day, HYG by ~2 days, VIX by ~3 days, Nasdaq by ~4 days, and DXY by ~10 days. In practice, when equities or credit soften, BTC usually follows shortly after. Short-term direction is therefore macro-led, not narrative-led.

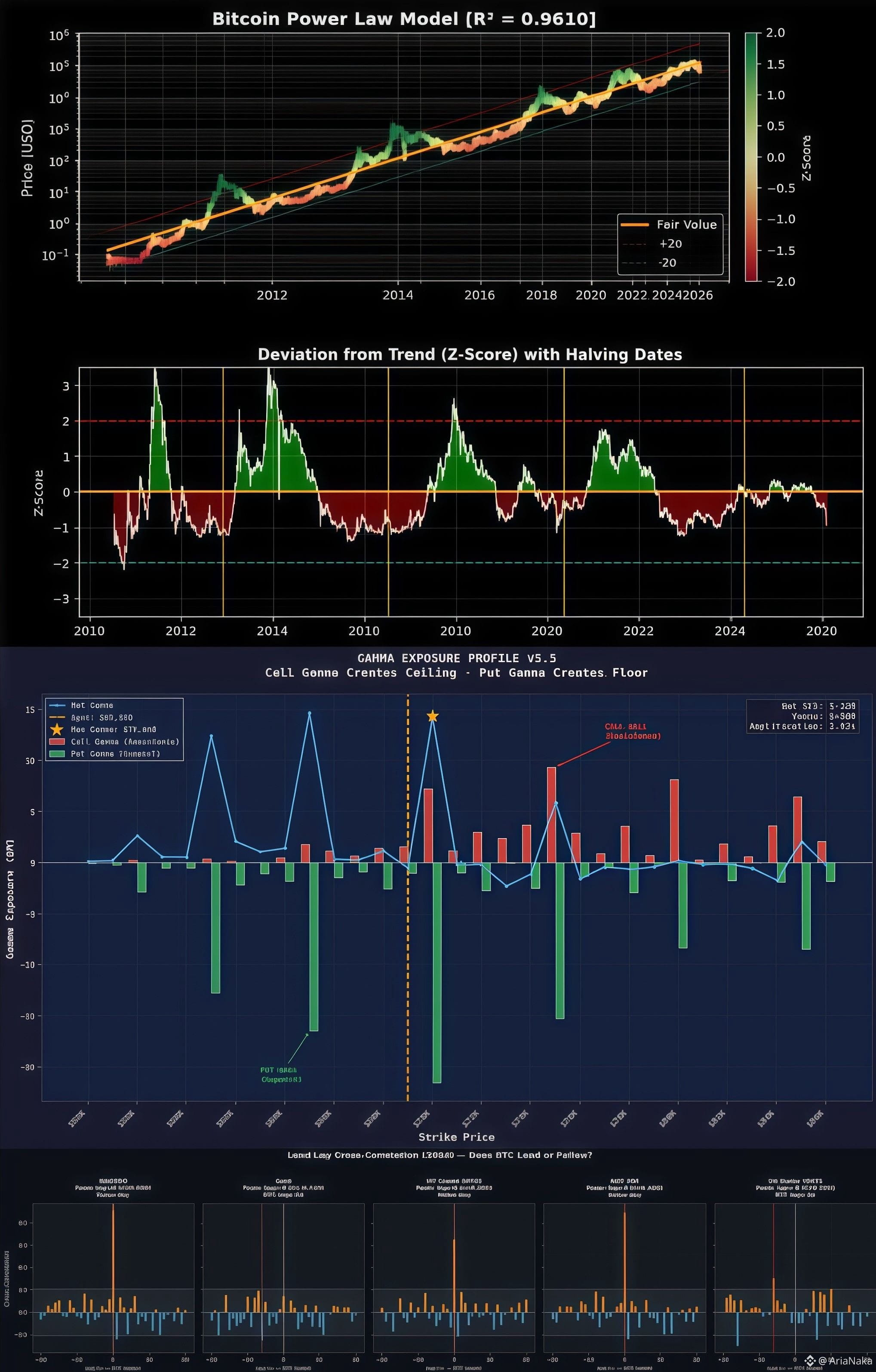

Microstructure (options & gamma): Spot is around $69,318 with the gamma flip near $68,692 and max gamma pin at $70,000. The main downside support sits at the $65,000 put wall, while upside resistance clusters near the $75,000 call wall. Net GEX is negative at -$32M, squeeze score is 58/100, and 30-day realized volatility is elevated at 80.2%. A large portion of gamma expires soon, with 15.4% on Feb 13, 20.8% on Feb 27, and 26.1% on Mar 27, and each expiry meaningfully increases breakout odds. Below or around the gamma flip, price action tends to be choppy to bearish, while sustained acceptance above $70K opens a cleaner path toward $75K.

Long-term (valuation clock): Power-law fair value is currently around $122,915 versus a market price near $69,243, implying a -$53,672 gap or roughly -43.7%. The Z-score sits at -0.82, signaling oversold conditions relative to the long-term trend, with a mean-reversion half-life of about 133 days. A projected reversion path places BTC near ~$111,751 by 2026-06-20, ~$142,452 by 2026-10-31, and ~$166,516 by 2027-03-13.

Short-term price action remains macro-fragile, while long-term valuation stays structurally bullish.

Near-term chop does not invalidate the long-term repricing math it is noise within a large valuation dislocation.

#AriaNaka #RiskAssetsMarketShock