Today, watching various communities explode, Bitcoin just touched $70,000 and then retracted. The screen is filled with exclamations like “run from the bait,” mixed with fear of Bithumb’s error and regulatory black swans. Some even brought out the script from 2021, confidently saying this is a “careful layout” to trap the last batch of retail investors.

Looking at these statements, I just want to say: most people are trembling at the bad news in the media, yet ignoring the most chilling on-chain data – retail investors are selling in extreme panic, while the wallets of the whales are quietly expanding. When you think this is a wave to escape, smart money is turning this into a hunting ground.

Bid farewell to 'persecutory delusions'

This rebound has been characterized by many as a 'trap', with reasons being the frightening macro data, tightening regulations, and that seemingly shaky support at 65,000. This way of thinking is a typical 'prediction dependence syndrome'. You think it's a bait, you think it's going to crash, but that's just your feeling.

In mature trading logic, we do not guess the thoughts of the big players. Let's look at the objective data: although the sentiment index has dropped to the freezing point of '7', this is precisely the extreme of a contrarian indicator. On-chain data shows that MicroStrategy and ETF's holding cost constitute the bottom support, while ETH's whales are moving coins into cold wallets. What does this mean? It means that while you panic and cut losses, the real buyers are eagerly waiting at lower levels. Those who are obsessed with guessing 'is it a false breakout' are the providers of liquidity.

Fibonacci's cold-blooded hunting

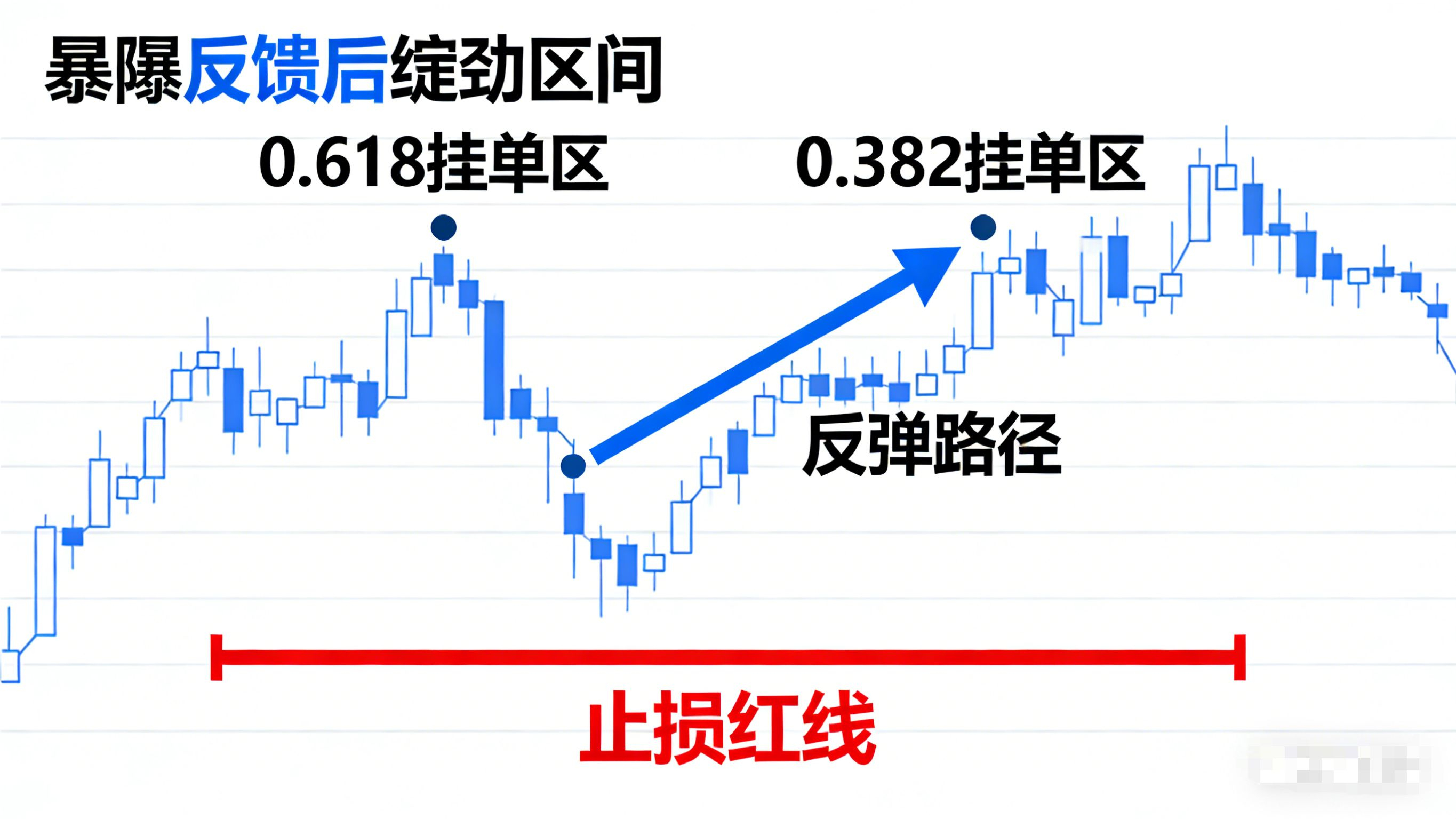

Instead of guessing coins at the 70,000 mark, why not turn this into your battlefield? In the face of such severe up-and-down pinning market conditions, we do not need to predict whether the next second will rise or fall; what we need is **'Fibonacci grid'**.

Since the market is in turmoil, set the high point (like 70,000) as 1 and the recent panic low as 0. Don't chase that 70,000 breakout; that's what gamblers do. What you need to do is like a crocodile, opening your mouth at these retracement levels of 0.618, 0.5, and 0.382.

The logic of placing orders is not because I think it will definitely rise, but based on a survival-first formula: calculate your stop-loss distance (like breaking below a recent low), then backtrack to determine your position size. If BTC breaks below key support, this trade only lets you lose 2% of your total capital, but if this is just a jump after a deep squat, you can achieve even a 3:1 or better risk-reward ratio.

Follow the footsteps of 'smart money'

If you are still staring at those so-called 'negative news', then you will always be the one getting harvested. Look at ETH, although the price is weak, the whales are accumulating, which is a typical 'price and capital flow divergence'.

In our system, this is the precursor to **'resonance pursuit'**. When retail investors sell off due to regulatory panic, but market makers and whales are protecting key positions, this is the best entry signal. Don't try to short at the highest point, and don't try to buy at the lowest point. Use AI to assist in judging extreme emotional values, coupled with capital flow direction; be greedy when others are fearful, but this greed must come with a 'bulletproof vest'—strict stop-loss.

Final words

Stop being entangled in whether it is 'baiting'. The market doesn't care about your fear; it only respects chips and rules.

Real trading is boring: identify structures, calculate risks, execute orders. Turn off those anxiety-inducing news, open your risk control sheet, and calculate how much you would lose if it breaks below a recent low. If the loss is within your tolerance, then shut up, place your orders, and sleep. While others are torn apart by emotions, what you need to do is calmly wipe your weapons and prepare to harvest the next wave of bloody chips.$BNB $XRP $USDC #何时抄底? #全球科技股抛售冲击风险资产 #BTC何时反弹? #沃什美联储政策前瞻 #摩根大通看好BTC