Two months ago, he was called "God of Timing," accurately selling at the highest point, with paper profits in the tens of billions.

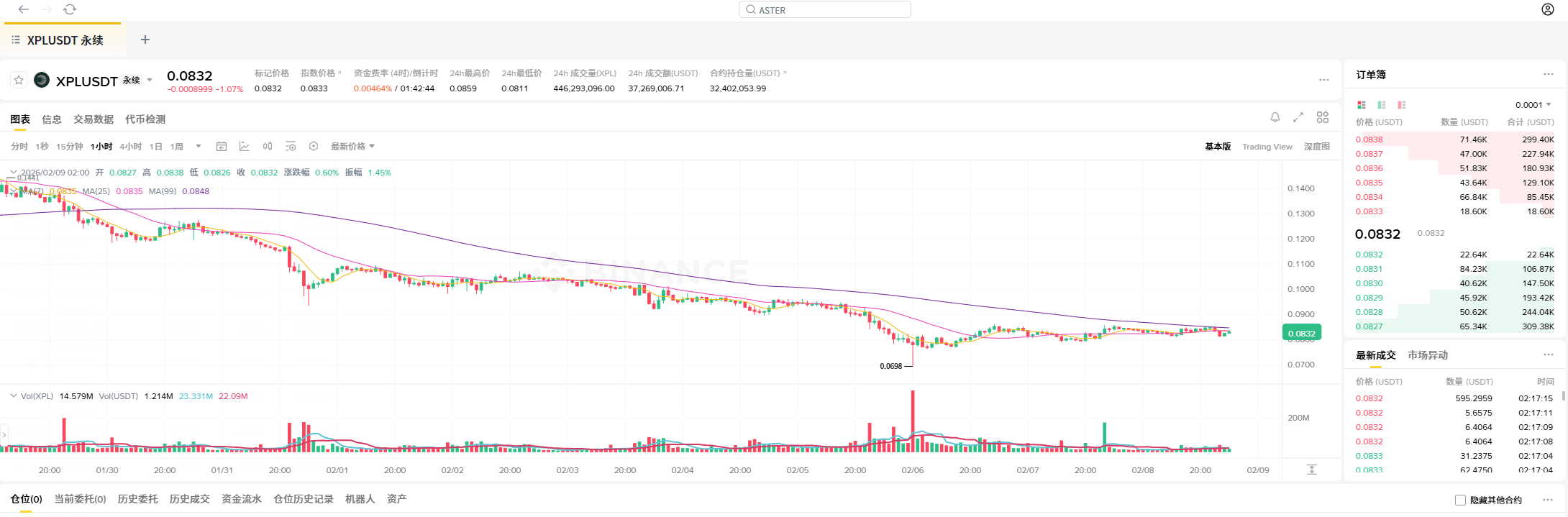

Two months later, the same person stared at the screen in the early morning, watching his 700 million dollars gradually evaporate, forced to sell 96% of his position at the worst price.

He doesn't not know what to do, but he can't do it.

His name is Yi Lihua, English name Jack Yi, one of the earliest members of the Chinese crypto community, commonly referred to in the circle as "Boss Yi."

Today we will fully review this matter and clarify one question: how does a top hunter gradually become the hunted?

Yi Lihua entered the crypto industry in 2015; that year Bitcoin was less than $500, and Ethereum had just recently launched. The entire industry was in a primitive stage, and those who could enter at that time needed a spirit of adventure and sensitivity to new things.

He initially made investments and founded LD Capital, specializing in early-stage rounds of blockchain projects, investing in EOS, Quantum Chain, VeChain, all of which surged dozens to even hundreds of times during the bull market of 2017.

In the industry, he has a respected status, not a social media influencer making money by shouting out predictions, but a founder of an institution that has invested real capital and achieved results.

Moreover, Yi Lihua did not come from a wealthy background; he had no background in his early years and is considered a grassroots success story.

Such people often have a characteristic: a strong desire for wealth and an almost religious belief in 'going long'.

Because their life experiences tell them that only by continuously betting and holding can they hope to turn things around. This mindset is a significant advantage in a bull market, but at certain moments, it can also become a fatal weakness.

In 2025, Yi Lihua shifted his focus from the primary market to the secondary market, starting to trade cryptocurrencies directly in the market. In April of that year, the price of Ethereum dropped to $1385, a new low since 2022.

Those at the bottom panicking and cutting losses feel that the crypto industry might be finished, but Yi Lihua went against the tide and began to build a large position.

His logic was clearly stated in the research report published at the time, that the legislation for stablecoins in the United States is progressing, and the most important infrastructure for stablecoins is Ethereum.

If stablecoins become widely adopted, both the usage and value of Ethereum will significantly increase. In May, on-chain analysts noticed that an address was frequently buying large amounts of Ethereum; at that time, it was still unknown who it was until Yi Lihua himself claimed those addresses on the X platform, saying it was his institution Trend Research operating, which was rare at that time.

Most institutions and large holders try to hide their positions, not wanting the market to see them, but Yi Lihua chose to be open; he calls this 'transparent trading'. He believes in his judgment and is willing to let everyone see what he is doing.

In the following months, Ethereum indeed started to rise, from $1385 to $2000, then to $3000, all the way up to around $4900 in August.

Just when market sentiment was at its peak, Yi Lihua made a surprising decision: he liquidated his positions.

He sold all the Ethereum he had previously bought, and the timing was just near the peak of that round of increases.

This was followed by the '1011 incident', where the market experienced severe fluctuations and prices dropped significantly, but Yi Lihua perfectly avoided this disaster.

That operation earned his account billions of dollars in profit, and the entire Chinese crypto community was discussing him, saying he is the true 'top-taker master', which he also believes.