The latest data has come out, and the probability of the Federal Reserve lowering interest rates in March is only 19.9%, which means that the Federal Reserve is very likely not going to take action in March and will have to maintain this high interest rate.

Seeing this data, many short-term friends have lost their minds, thinking that interest rates won't go down, the dollar will still rise, and gold will definitely fall.

Are you thinking the same way?

If you think this way, then you've really fallen into the pit that Wall Street has dug for you.

Have you noticed a very strange phenomenon?

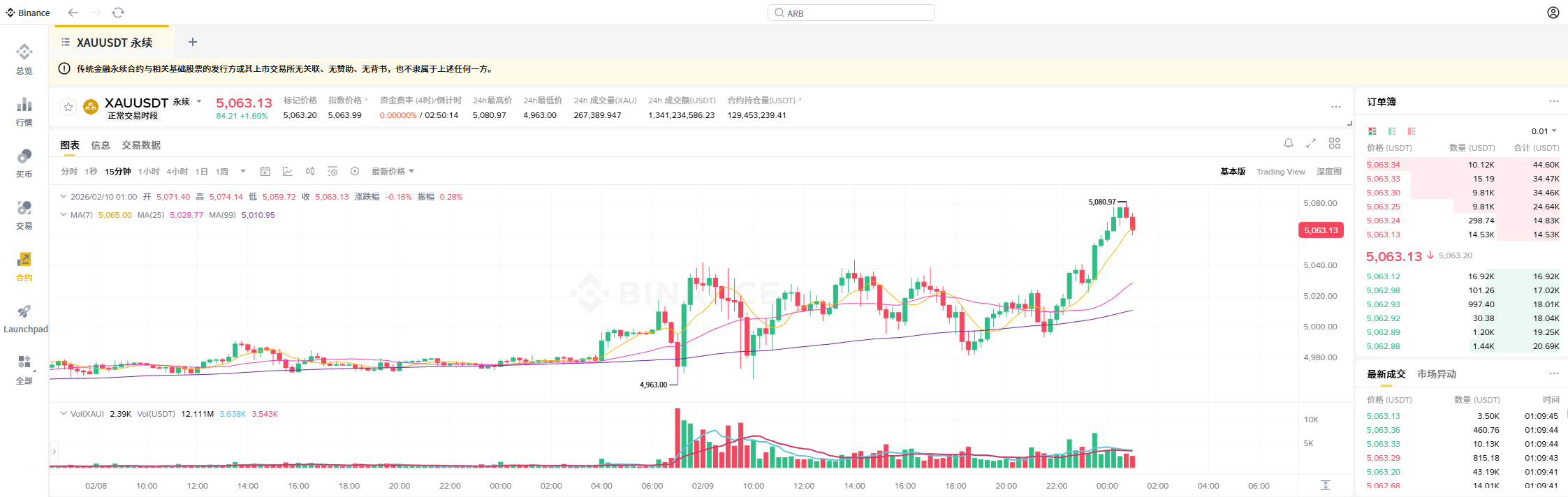

In theory, textbooks say that when dollar interest rates are high, everyone will deposit dollars to earn interest. Who would still buy non-interest-bearing gold? Gold should be crashing, right? But if you look back at the current market, has gold fallen? It hasn't only not fallen; instead, it has firmly stood its ground and seems to be pushing upwards.

It's like heavy snow falling outside, with temperatures at minus 30 degrees, and the trees at your doorstep are not only not frozen but are actually blooming.

What does this indicate? It indicates that the fire underground has long been burning.

Even friends who understand a little logic should be suspicious by now. Why is gold not playing by the usual rules this time? Why is the dollar index rebounding while gold refuses to drop? To be honest, this is not a market failure at all, but rather the underlying logic has completely changed.

Today, I want to share a revolutionary perspective with everyone: the Federal Reserve's stubbornness to not cut interest rates is not really about combating inflation; that’s just pretty talk for ordinary investors.

Its true purpose is a thorough conspiracy, using high interest rates to forcibly prolong the life of the dollar, masking the fact of the complete collapse of the dollar's credibility. This process is precisely forcing gold to ignite an epic bull run.

Everyone needs to understand that the current macro environment is completely different from forty years ago. The Federal Reserve used to be the central bank for central banks globally; when Powell sneezed, the whole world caught a cold.

But now the Federal Reserve's sword of interest rate hikes is already rusty; in fact, this sword is now pointed at their own throat.

First, you need to understand why the Federal Reserve dares not cut interest rates. Pay attention to my wording: dares not, not that it doesn't want to. Mainstream media keeps shouting that it’s because the economy is too good and inflation is too stubborn, so it cannot lower rates, but I tell you, it’s all nonsense. The real core reason is simply the staggering 38 trillion dollars, even nearing 40 trillion dollars, of massive debt in the United States.

The current federal benchmark interest rate is between 5.25% and 5.5%. What does this mean? It means that more than half of the U.S. government's annual fiscal revenue has to be used to pay interest. It's like earning 10,000 dollars a month, and the credit card interest alone needs to be 8,000 dollars. How can one live? Would one dare to borrow more? But the U.S. government has no choice; it must borrow. If it doesn't, the government has to shut down.

But here’s the problem: who is still buying U.S. Treasuries now? China is selling, Japan is selling, Saudi Arabia is selling, and central banks around the world are voting with their feet. Everyone isn't foolish; they know this scam can't go on, so the Federal Reserve is trapped in a deadlock.

If it cuts rates now, it would indeed relieve interest pressure, but that would instantly cause the yields on the dollar and U.S. Treasuries to plummet, and those international capitals that were already planning to flee would run faster than rabbits. The dollar exchange rate would collapse directly, and imported inflation would blow American citizens to the sky. But if it doesn't cut rates and continues to tough it out like now, the consequences are even more serious; high interest rates are like a poison, slowly killing the U.S. banking sector and commercial real estate.

Does everyone still remember how Silicon Valley Bank collapsed in 2023? It was because they bought too many U.S. Treasuries, and when interest rates rose, the prices of those Treasuries plummeted, leading to direct losses that bankrupted the institution. Do you think this matter is over? Not at all. Currently, U.S. banks are sitting on hundreds of billions of dollars in unrealized losses, all due to high interest rates.

The Federal Reserve is currently walking a tightrope, with a potential dollar collapse on one side and a financial crisis on the other. It can only choose to tough it out, pretending to be calm and in control of inflation, while in reality, it's just buying time.

What does this have to do with gold? It has a lot to do with it. Since the Federal Reserve is pretending and stalling, what will smart money do? The top institutions on Wall Street and central banks around the world have a god's-eye view; they know better than anyone that the Federal Reserve's hard stance is unsustainable. So you will see that, although CME data shows a low probability of interest rate cuts in March and the dollar index is still rebounding, the global central banks' buying of gold has never stopped.

Have you all seen the data from the World Gold Council? Global central banks have been net buyers of gold for 14 consecutive years, and the current proportion of gold reserves has reached 19.1%, hitting a new high since 2004. What does this concept mean? It's like the richest person in your village suddenly starts hoarding rice and canned goods. Do you think they are doing it to profit from rice trading? Definitely not; they feel a change is coming, and it's for survival.

These central bank bigwigs are crystal clear; regardless of whether the Federal Reserve cuts interest rates, the collapse of the dollar's credibility is an irreversible trend. Cutting rates leads to soaring inflation and dollar depreciation, and not cutting rates is also a dead end. The only way out is gold. Gold has no nationality, no counterparty risk; it is not anyone's liability. In this era of rampant fiat currency, gold is the only honest money.

At this point, you might still have some doubts. Why has gold been fluctuating recently? Why hasn't it just shot up? Good question; this involves the manipulative tactics of the big players. Do you think gold prices aren't rising because there are no buyers? You're completely wrong. The current fluctuations are precisely because buying pressure is too strong, while Wall Street market makers are desperately suppressing prices and accumulating assets.

Think about it. If gold prices suddenly shot up to 5300 or 5500, who would be in the most pain? It would be those large institutions that haven't had the chance to convert their dollars into gold, and those sovereign funds that haven't completed their asset swaps. They need time and a relatively stable price window to complete this monumental asset relocation.

So the hawkish statements from the Federal Reserve, combined with Wall Street investment banks' bearish reports, are actually just distractions. They shout that gold is going to drop and the dollar is making a comeback, while secretly accumulating bloody chips beneath the surface.

What is the most common mistake retail investors make? It's trading stocks based on news. When they see good non-farm payroll data, they think gold will drop. When they hear Powell speak firmly, they rush to cut losses, only to find that just after they sell, gold prices start to rise. One must learn to see through the phenomenon to grasp the essence. Have you noticed the recent interesting flow of funds in gold ETFs? Although there was some outflow a few months ago, as soon as gold prices break a certain key level, there is immediately a huge influx of funds supporting it, especially from buyers in Asia, which is simply bottomless.

Who used to hold the power to price gold? In New York and London, when the dollar rose, gold fell. But now, if you still watch the dollar index to trade gold, you might end up losing your pants. Now it's the East rising and the West falling, with Eastern buyers grabbing pricing power in this market. Have you noticed the premiums on the Shanghai Gold Exchange? They have long been significantly higher than international gold prices, which indicates what? It shows that physical gold is extremely scarce, and everyone is scrambling for it, while the paper gold market in Europe and America is still playing digital games, trying to suppress gold prices with infinitely short paper contracts. But paper cannot ultimately contain fire. When the moment for physical delivery arrives, and everyone no longer wants that paper contract, only hefty gold bars, you will witness an epic short squeeze. By that time, a gold price of 5100 dollars will only be an appetizer.

Even if we take a step back and say that if the Federal Reserve really performs a miracle and curbs inflation while stabilizing the economy, would gold still drop? That's too naive. Don't forget, aside from the crises of the Federal Reserve, there is another super large thunderstorm: geopolitical issues. Is the world peaceful now? Missiles are flying over the Red Sea, the Russia-Ukraine conflict is still ongoing, and the Middle East is a powder keg, ready to ignite. Each of these geopolitical conflicts is a booster for gold.

@Plasma The difference in scores on the leaderboard is too great; do they do nothing but study this and write posts?