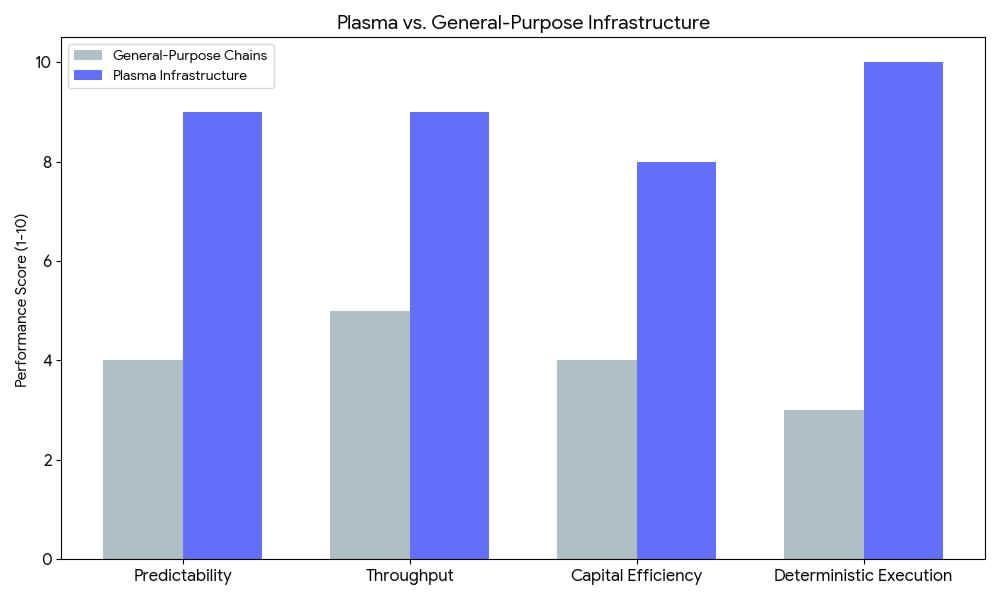

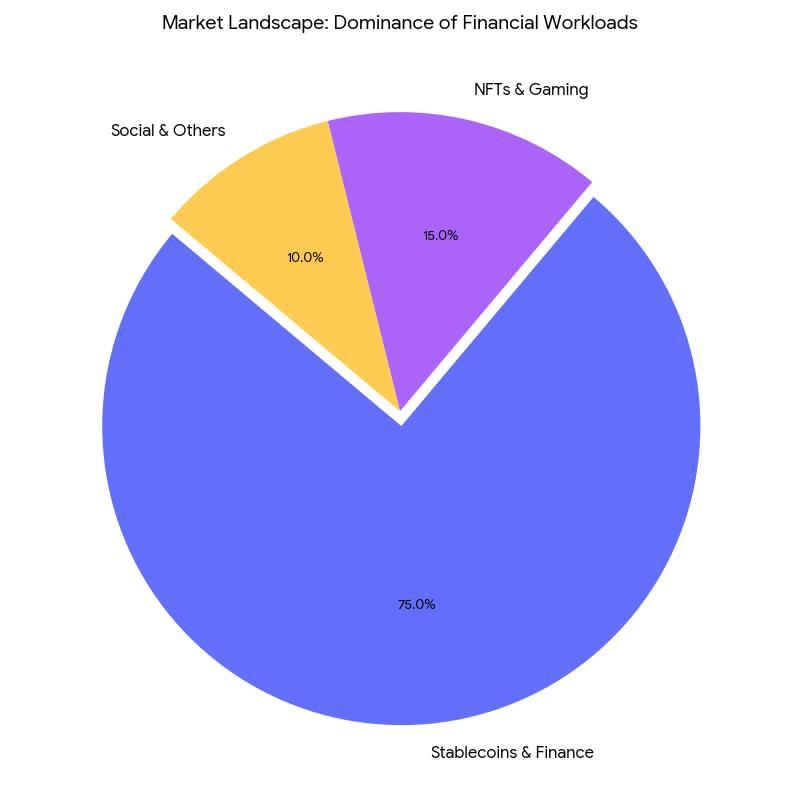

As blockchain adoption matures, the limitations of existing infrastructure are becoming increasingly visible. While early networks prioritized decentralization and programmability, modern on-chain activity is dominated by financial use cases that demand a different set of guarantees: predictable costs, high throughput, capital efficiency, and verifiable settlement. Many Layer-1 blockchains and rollup-based architectures struggle to meet these requirements simultaneously.

Plasma is designed to address this gap. Rather than attempting to serve all possible use cases, Plasma focuses on building infrastructure optimized for high-volume financial activity, particularly stablecoin-based payments and settlement. This specialization reflects a broader shift in the industry toward application-aware blockchain design.

The Core Problem: Financial Workloads on General-Purpose Chains

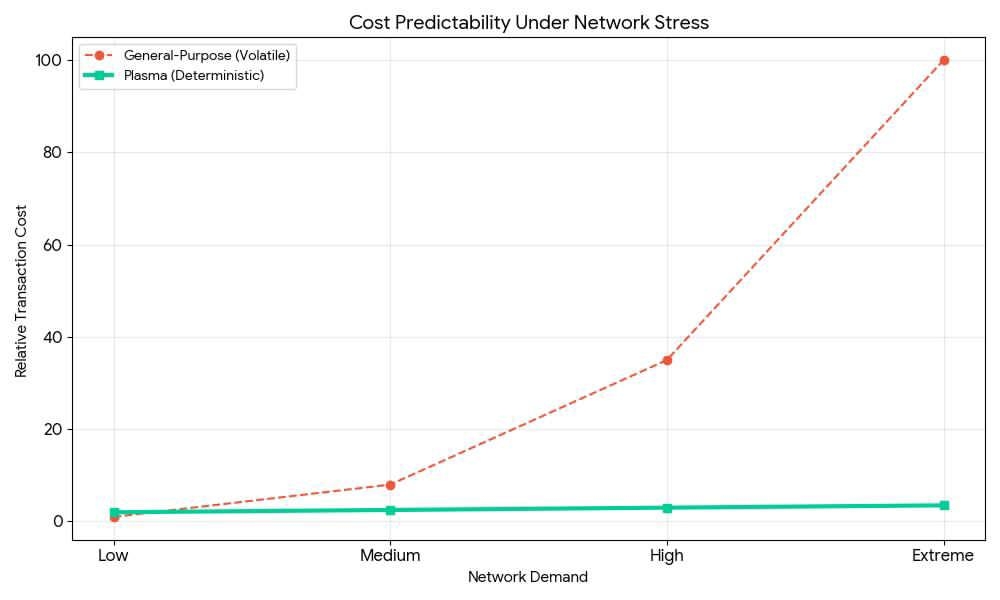

General-purpose blockchains face inherent trade-offs. When demand spikes, fees become volatile, execution slows, and user experience degrades. Rollups improve scalability but introduce new complexities, including delayed finality, fragmented liquidity, and reliance on external data availability assumptions.

For institutions and long-term market participants, these characteristics translate into operational risk. Financial systems require consistency and auditability, not just theoretical decentralization. Plasma approaches this problem by rethinking blockchain architecture around financial primitives rather than arbitrary computation.

Plasma’s Architecture and Design Philosophy

Plasma is a purpose-built blockchain optimized for transactional throughput and deterministic execution. Its architecture prioritizes efficiency at the protocol level, reducing unnecessary computation and data overhead that often accompany generalized virtual machine environments.

Key design principles include:

Deterministic execution, ensuring predictable transaction outcomes and costs.

High-throughput processing, tailored for sustained financial workloads rather than bursty demand.

Protocol-level efficiency, minimizing reliance on layered abstractions or external execution environments.

By vertically integrating execution and settlement, Plasma avoids many of the coordination and latency issues associated with multi-layer designs, while preserving cryptographic verifiability.

Structural Differentiation from Layer-1s and Rollups

Unlike traditional Layer-1s that must balance diverse and often competing workloads, Plasma is optimized around a narrow but economically significant use case. Compared to rollups, Plasma reduces dependency on external settlement layers and minimizes cross-layer complexity.

This structural focus enables Plasma to deliver more predictable performance characteristics—an essential requirement for payment systems, trading infrastructure, and institutional treasury operations.

Institutional and Real-World Relevance

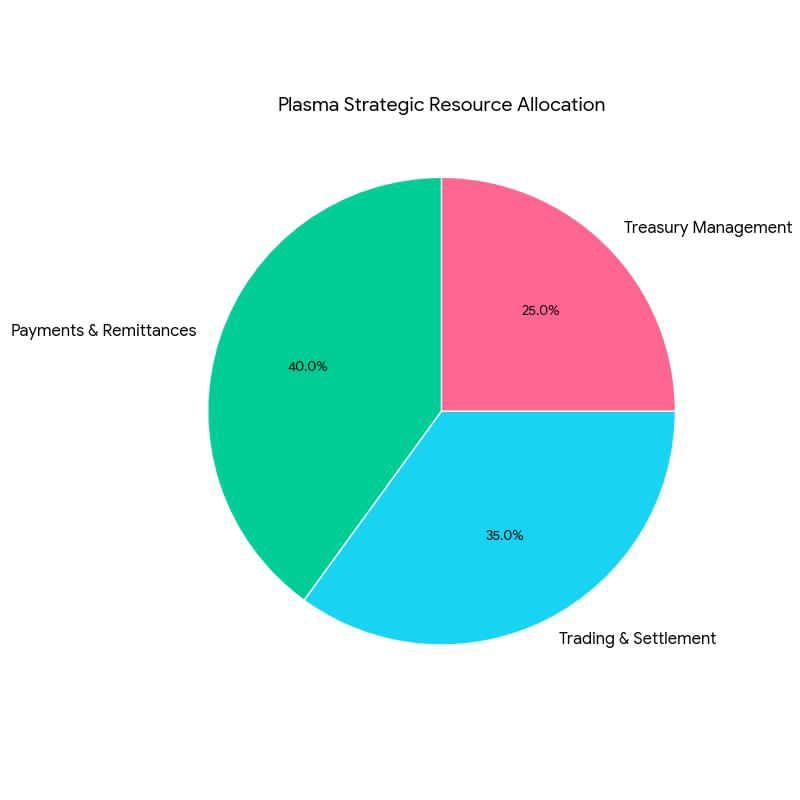

The majority of on-chain volume today flows through stablecoins and financial applications. Plasma is designed to support this reality by providing infrastructure suitable for:

Payments and remittances with low latency and stable fees

High-frequency settlement and trading workflows

Treasury and liquidity management for on-chain capital

For institutions evaluating blockchain infrastructure, Plasma offers a clearer operational model than generalized networks prone to congestion and cost volatility.

Transparency, Verification, and Trust Minimization

Plasma emphasizes verifiable execution and transparent state transitions. Users and institutions can independently verify system behavior without relying on centralized intermediaries or discretionary governance.

These properties are critical for enterprise adoption, where auditability and minimized trust assumptions are often prerequisites for deployment.

Ecosystem and Adoption Potential

By narrowing its scope, Plasma lowers barriers for developers building financial applications. Tooling and incentives are aligned around real usage rather than speculative activity, supporting sustainable ecosystem growth.

Interoperability with existing blockchain ecosystems further enhances Plasma’s ability to integrate into the broader on-chain financial stack.

Strategic Positioning

Plasma does not attempt to replace generalized blockchains. Instead, it complements them by providing specialized infrastructure for scalable, capital-efficient finance. As the blockchain sector evolves toward real-world adoption, such specialization may prove essential.

By solving a well-defined problem—high-performance, verifiable financial settlement—Plasma positions itself as foundational infrastructure rather than a niche experiment.