Today marks a date etched in Bitcoin history: exactly 15 years ago, BTC surpassed the symbolic $1 milestone on Mt. Gox, transforming a nerdy experiment into a global financial revolution.

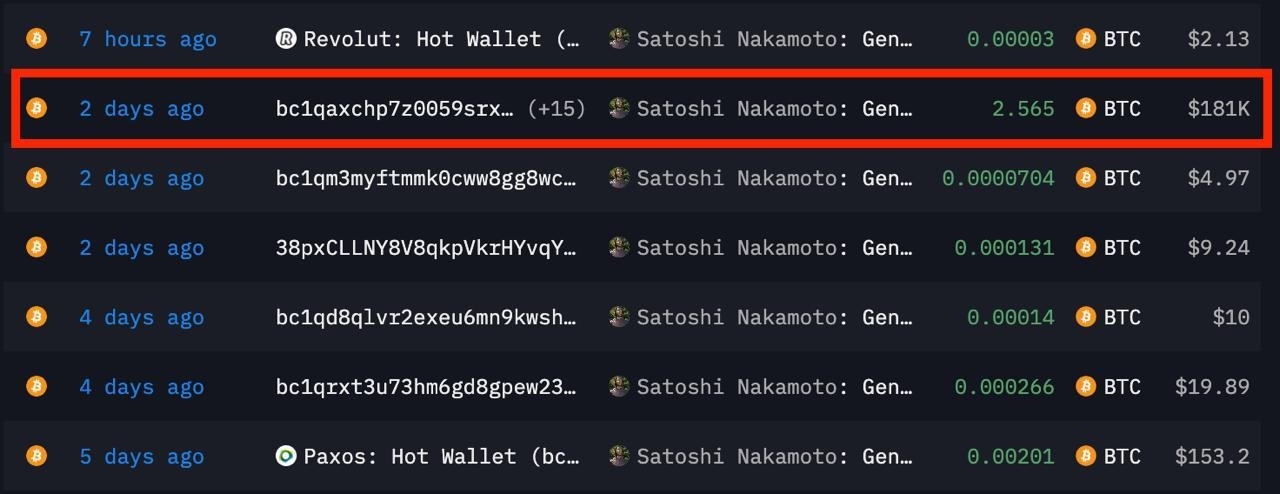

Last weekend, while the price hovered near recent highs, an unknown wallet sent 2,565 BTC roughly $181,000 to the Genesis address linked to Satoshi Nakamoto, a move that cannot be spent. The community interprets it as a tribute, a burn, or a symbolic signal.

1) The Initial $1: From Obscurity to Global Finance

February 9, 2011; Bitcoin hit $1 for the first time. It wasn’t just a spike; it was a signal: Bitcoin started being recognized as value, not just code.

Key points to highlight:

The era lacked liquidity and centralized exchanges.

This moment marked the transition from technical curiosity → financial asset.

It planted the first seed of what we now call “digital gold.”

2) The Mysterious Gesture: 2,565 BTC to Satoshi’s Address

An anonymous wallet sent 2,565 BTC to Satoshi’s Genesis address. This address is the very first mined wallet in Bitcoin’s history. The funds are functionally irretrievable, locked forever.

My strategic interpretation:

Cultural tribute: A homage acknowledging Bitcoin’s origins.

Symbolic burn: The digital equivalent of throwing money into a well, value destroyed deliberately to make a philosophical point.

Surprise signal / marketing: A cryptic message to the ecosystem.

3) Why This Is Not “Satoshi Awakens”

It’s important to neutralize sensational narratives:

Anyone can send BTC to any address; it does not prove Satoshi is active.

The private keys associated with Satoshi’s major addresses have remained dormant for over a decade.

4) Symbol vs. Reality — What This Says About Bitcoin

Narrative value > transactional value: Bitcoin has transcended its basic monetary function.

Deep-chain culture: The blockchain is not just infrastructure; it carries rituals, myths, and symbols.

A simple 2,565 BTC transaction etched on-chain creates more signals than a market move.

5) Strategic Lessons for the Future

💡 a) BTC as a narrative asset

Bitcoin thrives not just for economic reasons but for the story it tells — programmed scarcity + powerful mythology = persistent structural traction.

💡 b) Blockchain as a cultural artifact

Blockchain is not neutral infrastructure — it captures collective human behavior over time.

💡 c) Economic signals & market interpretation

Symbolic on-chain movements can shape perceptions of scarcity and engagement, impacting medium- and long-term price dynamics even without traditional financial logic.

In conclusion, Bitcoin is no longer just a payment protocol: it has become an economic mythology, and the sending of 2,565 BTC to Satoshi’s address is a sign of narrative maturity shaping its trajectory for years to come.