Explained here 👇

I’ve been thinking about it for a while, and the numbers look great.

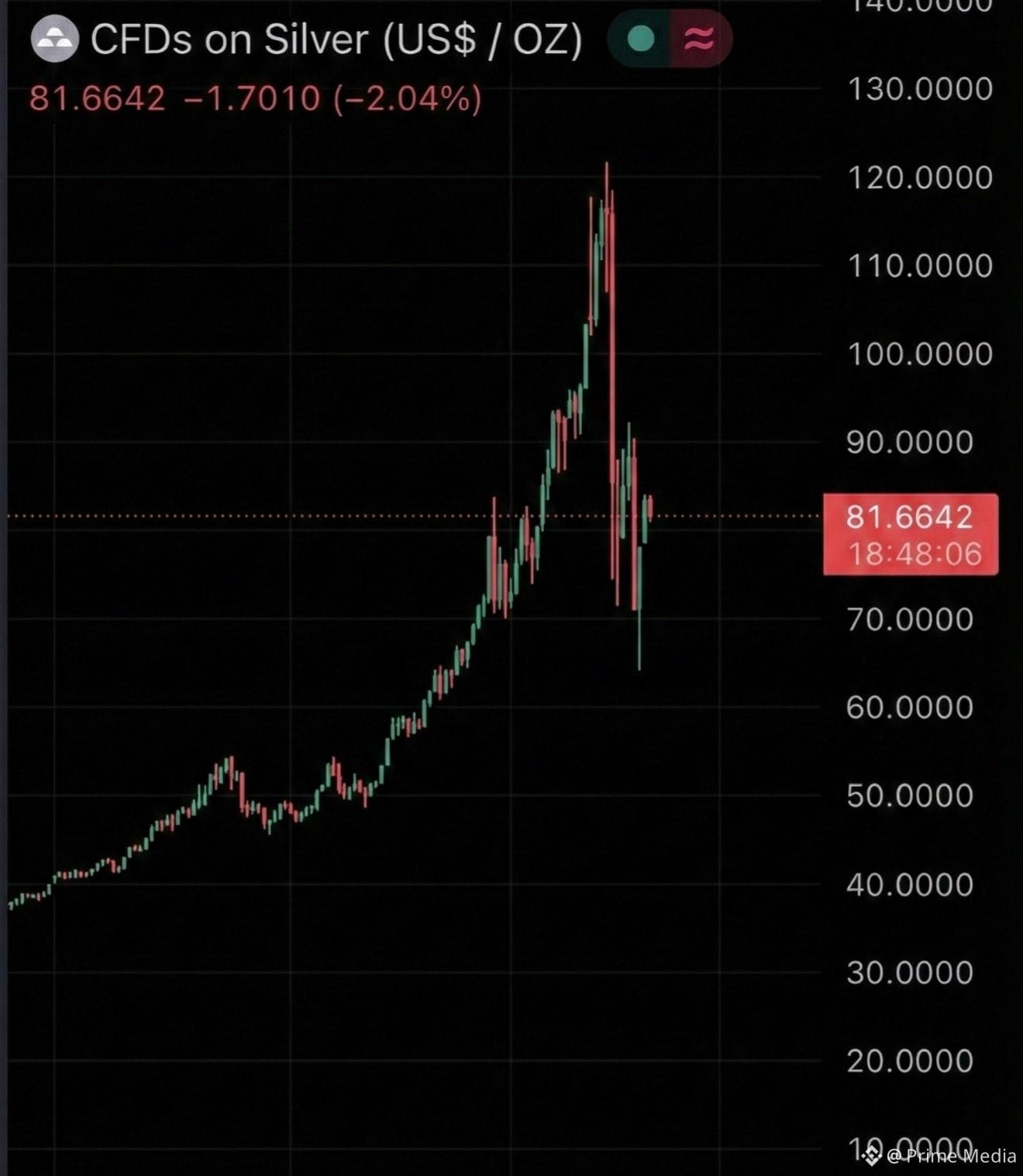

I truly believe we’ve reached numbers that are too good to ignore, and the data support my claim.

The paper vs. physical disconnect in silver has reached an extreme.

I’m monitoring the flow of funds for the capitulation signal that finally breaks the suppression mechanism.

Here’s the data regarding the hidden war between the east and west:

WHY CHINA NEEDS IT CHEAP

Most retail investors operate under the assumption that China wants silver to moon.

INCORRECT.

China is the global manufacturing engine. Silver is their raw fuel. Solar, EVs, tech components, they all require physical silver.

If price rips, their margins die. Industrialists there are desperate to keep silver suppressed below $50.

They are positioning for a gold/silver ratio of 200. It’s a suppression play, plain and simple.

THE WHALE SHORT

We now have confirmation of a Chinese hedge fund shorting 450 metric tons of silver.

However, the same entity is aggressively long physical gold.

He’s betting on the spread. He wants gold to fly while pinning silver down.

Western desks are facilitating this, executing orders that keep the price stagnant despite demand.

THE FED PIVOT: STRIKE PRICE

The United States has designated silver a critical mineral.

Here is the logic regarding the US industrial base.

If silver stays cheap, US processing facilities cannot compete with Chinese labor costs. It’s mathematically impossible.

Discussion from the incoming administration (Vance, Bessent) suggests a floor price strategy.

They need silver expensive to incentivize domestic production.

THE GLOBAL REVALUATION EVENT

There is zero incentive left for any sovereign entity to suppress gold.

BRICS: dumping treasuries for hard assets.

Europe: needs a revaluation to balance the central bank books.

USA: facing $38T in debt.

The only way out is a revaluation of the 8,000+ tons of US gold to market rates.

THE SUPPLY SHOCK

Inventory on the Shanghai exchange has hit a 10-year low.

Official data claims 900 tons. Real-time channel checks suggest less than half that remains.

Physical demand is draining the vaults. When the physical delivery requests hit, the paper shorts blow up.

It relies on the inevitable snap-back of the ratio.

They cannot decouple silver from gold forever because the physics of the market don't allow it.

1. Gold: Will be revalued to solventize sovereign debt.

2. Silver: Will violently catch up as the paper short is forced to cover.

Metals are a generational play, a true store of value.

But don’t rely on an ETF or a contract, hold the physical asset.

If it’s not in your safe, it’s not your money.

Btw, I’ve been here for more than 20 years, and I’ve called every top and bottom of the last decade.

When I make a new move, I’ll say it here publicly because I want you to win.

A lot of people will wish they followed me sooner.