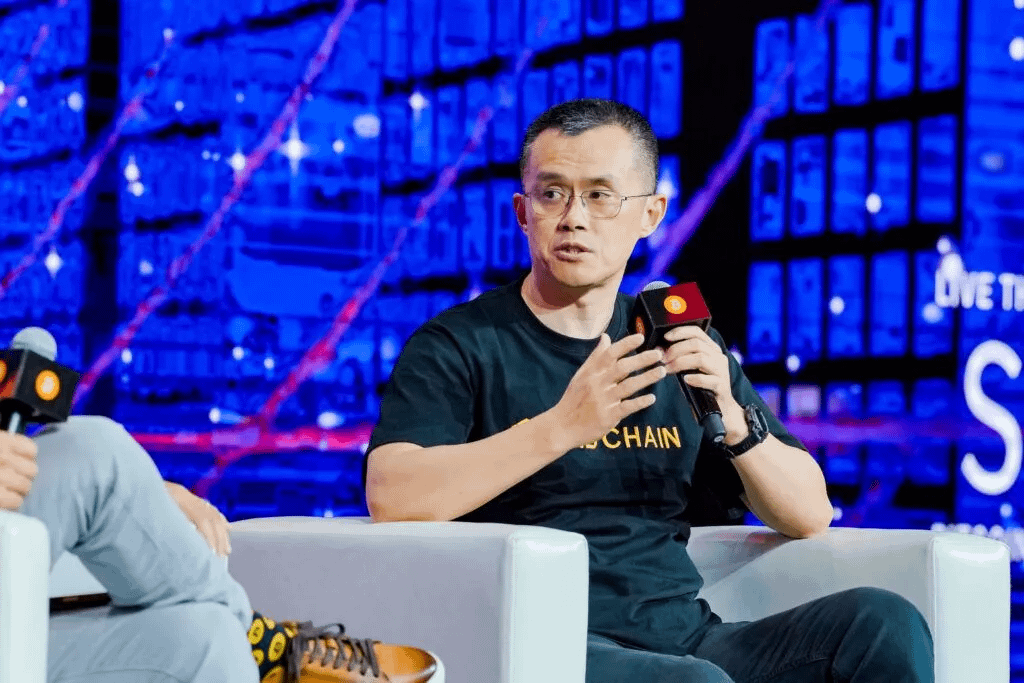

Changpeng Zhao, the founder of Binance, has recently attracted attention by suggesting that Bitcoin could enter a supercycle in 2026. This means the historical four-year boom and bust pattern could be replaced by a sustained period of growth that lasts longer and reaches higher levels than past cycles. CZ has emphasized that this is a structural shift rather than a precise price prediction. He believes that factors such as institutional adoption, broader global acceptance, and clearer regulatory environments could change the way Bitcoin behaves in the market.

Why the Super Cycle Concept Matters

The supercycle idea is not just about short-term price increases. It suggests a deeper transformation in the market.

Breaking the four-year cycle

Bitcoin has historically followed a pattern tied to its halving events. Prices tend to peak roughly every four years and then correct sharply. CZ suggests that this pattern may no longer determine Bitcoin’s trajectory.Institutional influence

Institutional money flowing into Bitcoin through exchange-traded products, corporate treasury allocations, and long-term investment could provide sustained demand that is not tied to halving events.Regulatory and macro trends

A more supportive regulatory environment and global acceptance could help sustain growth beyond short-term speculative spikes

CZ Softens the Tone Too

Even though the idea made big headlines, CZ didn’t double down blindly. In more recent comments, he openly acknowledged that the market’s current environment and sentiment are fragile a reminder that a super cycle is possible but still far from guaranteed.

This doesn’t look like a “confirmed event” so much as a framework for thinking about markets if structural conditions improve.

What This Means For Prices (And What It Doesn’t Mean)

It doesn’t mean CZ is predicting a specific outcome like “Bitcoin will hit $X by date Y.”

Rather,

He suggests that traditional timing signals may not apply in the same way.

More adoption, regulatory clarity, and macro support could sustain growth beyond what we saw before.

Some analysts in the broader space have repeated optimistic price targets (e.g., speculative targets like $200K+), but those come from other voices, not CZ directly.

What Would Confirm a Super Cycle?

For many traders and analysts, a true super cycle ultimately would need to show real evidence over time, such as:

Sustained institutional inflows (not just hype).

Bullish price structure that doesn’t collapse after rallies.

Growing adoption metrics in real usage, not only speculation.

Macro conditions that favor risk assets over extended periods.

Important Considerations

A super cycle is a theory, not a guarantee.

Price movements are influenced by many factors including global markets, regulation, liquidity, and investor psychology.

Short-term price moves can still be volatile and unpredictable.

CZ’s comments are best understood as a perspective on how market dynamics might be evolving, not as a forecast etched in stone.

Summary

CZ believes Bitcoin may enter a super cycle in 2026 driven by institutional adoption regulatory clarity and broader market changes. He has also acknowledged uncertainty and cautioned against treating this as a certainty. A true super cycle would require sustained evidence over time including institutional capital inflows stable price trends and growing adoption.