At 8 PM tonight's ESP, many friends are asking if it's a big deal and whether to participate. This article will help clarify for everyone.

First, the basic information:

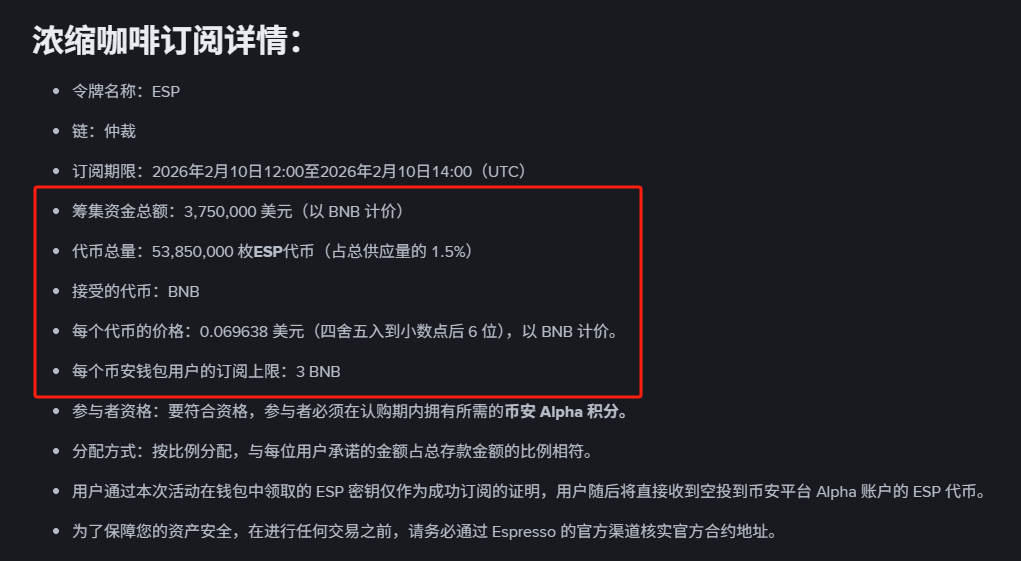

Each person can invest in 3 BNB, and the project side took 1.5% of the shares to participate in the new investment, with a new investment unit price of 0.07u per piece. This means that without oversubscription, it needs to reach a total of 3.75 million u, which is about 6000 BNB.

Based on the previous situations, when the threshold is relatively low, the market can raise about 220,000 BNB.

The fifth phase of ZAMA raised 225,000 BNB;

The fourth phase of SENT raised 143,000 BNB;

The third phase of FOGO raised 316,000 BNB.

The profit this time is very low, the public offering price is 0.07u, but now the pre-market contract price is 0.088u, which means the profit margin is only 25.7%. (If the coin price rises, that's another story, but referring to previous cases like FOGO, ZAMA, etc., which all broke, it is estimated that this time it will not rise significantly, and there is even a risk of breaking.)

If the profit margin is only 25.7%, then if Binance wants to guarantee everyone a profit of 30u, it must require everyone to deduct at least 120u in costs, meaning the oversubscription can only be up to 15 times at most. (If the oversubscription multiple is too high, like 30 times, then everyone will be deducted 60u in costs, with only 15u profit, and An An would be overwhelmed by everyone's complaints.)

The key point is that An An also needs to reserve some safety buffer, because the current pre-market price of 0.088u is in a situation where everyone has not hedged yet. Once TGE starts, it is estimated that a lot of hedgers will emerge, and the coin price will have to drop further.

To control the oversubscription multiple below 15 times, it is necessary to keep the incoming BNB below 90,000, which means less than 30,000 participants. Therefore, An An must set a high threshold, around 235 points, so that the oversubscription multiple does not become high.

Now we just need to wait for An An to announce the threshold to accurately estimate the profits. Here I present three scenarios for everyone:

Threshold 220 points, estimated to have 200,000 BNB for the new issue, oversubscription 34 times, average cost deduction 57u, profit 15u; (the possibility is very low)

Threshold 230 points, estimated to have 90,000 BNB for the new issue, oversubscription 15 times, average cost deduction 120u, profit 31u (the possibility is relatively high)

Threshold 235 points, estimated to have 60,000 BNB for the new issue, oversubscription 10 times, average cost deduction 186u, profit 50u.

The current new issues are becoming increasingly disappointing, so everyone shouldn't have too high expectations.

Or rather, everyone hopes that in a few years the market will improve, and the price of new coins can go up a bit. The current pre-market price indeed looks a bit unattractive, the new issue price is 0.07, and the pre-market price might drop to 0.08, isn't this just a pure public offering play?