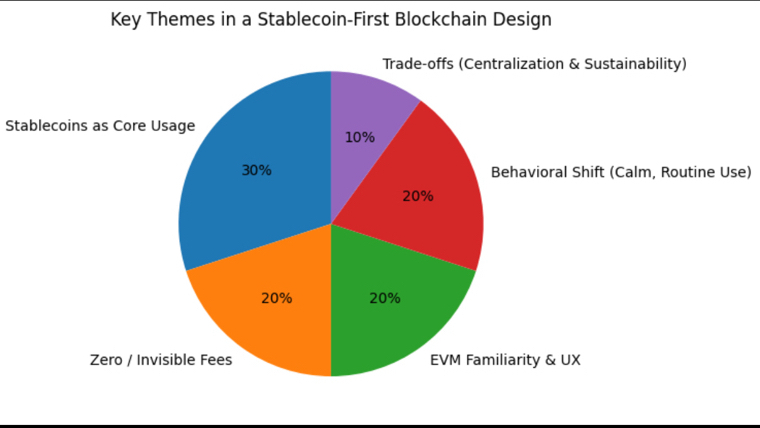

when i hered about Plasma looking for a new narrative. I wasn’t hunting yield, novelty, or some grand reimagining of crypto. What caught my attention was quieter than that: the way stablecoins weren’t treated as a side feature or a bridge to “real” crypto activity, but as the thing the system was actually built around.

That sounds obvious until you realize how rare it is.

Most blockchains still behave as if volatile native tokens are the main character and stablecoins are just guests passing through. Fees are priced in the native asset. UX decisions are optimized for token holders. Stablecoins exist, sure—but they feel bolted on, tolerated because the market demanded them, not because the architecture truly embraced them.

Plasma feels like an inversion of that mindset.

And the more I used it, the more I realized how much of crypto already revolves around stablecoins anyway—just without admitting it.

If you strip away the noise, most real crypto activity isn’t speculative trading or governance voting. It’s people moving dollars. Paying. Settling. Parking value. Bridging between ecosystems. Avoiding volatility. Whether they call it USDT, USDC, or something else, stablecoins are the backbone of actual usage. They’re the reason crypto works at all for people who don’t want to gamble every time they click “send.”

What Plasma seems to do differently is accept this reality upfront instead of pretending it’s temporary.

Zero-fee stablecoin transfers are the most obvious expression of that philosophy, but they’re also easy to misunderstand. It’s tempting to frame them as a gimmick or a growth hack. In practice, the bigger impact is psychological. When fees disappear—or when they’re abstracted away so completely that you stop thinking about them—your behavior changes.

I didn’t realize how much mental friction fees created until they were gone.

On other chains, even cheap ones, there’s always a pause. You calculate. You wait. You batch transactions. You ask yourself if it’s worth moving now or later. That tiny hesitation shapes how crypto is used. It turns money into something you tiptoe around instead of something you just move.

On Plasma, that pause fades. Sending a stablecoin starts to feel less like “doing a crypto transaction” and more like… sending money. No spreadsheet math. No gas optimization. No second-guessing whether the fee is higher than the amount you’re moving.

It sounds boring. And that’s kind of the point.

Boring is what financial infrastructure is supposed to be.

What surprised me more than the zero fees was how familiar everything else felt. Plasma didn’t ask me to learn a new mental model. It didn’t force a custom wallet flow or some experimental abstraction layer that breaks muscle memory. It’s EVM-compatible, and that matters more than people like to admit.

Familiarity is underrated in crypto discourse, but when real money is involved, it’s everything. The same wallet. The same signing flow. The same assumptions about how transactions behave. That continuity lowers risk—not just technical risk, but cognitive risk. You’re less likely to make mistakes when the environment behaves the way you expect.

Plasma seems to lean into that rather than fighting it. Instead of reinventing UX for the sake of novelty, it optimizes around the tools and habits people already trust. That’s not flashy, but it’s practical.

What really stands out is how the fee model reinforces the stablecoin-first philosophy. Paying fees in the same asset you’re sending sounds like a small detail until you experience the alternative again. Having to hold a volatile token just to move a stable one is one of crypto’s strangest design quirks. It forces users into exposure they didn’t ask for and adds another layer of operational complexity.

Plasma removes that mismatch. Stablecoins aren’t just passengers—they’re native to how the system thinks about value, settlement, and cost. The chain doesn’t treat them as something to be converted into “real” tokens to function properly. They are the unit of account.

That shift subtly reframes what the network is for.

Instead of optimizing for speculation first and payments second, Plasma feels designed for reliability, predictability, and routine usage. It’s closer to financial plumbing than financial theater. The UX doesn’t hype you up. It doesn’t promise life-changing upside. It just… works.

And that raises an uncomfortable question for the rest of crypto: if this is what usability looks like, why do so many chains still prioritize everything else?

Of course, this approach isn’t free of trade-offs, and it would be disingenuous to pretend otherwise. Treating stablecoins as first-class citizens inevitably pulls in questions about centralization. Fiat-pegged assets rely on issuers, custodians, and regulatory frameworks. Designing a network around them means accepting that reality rather than escaping it.

There’s also the question of sustainability. Zero-fee transfers don’t magically pay for themselves. Somewhere in the system, costs exist—whether subsidized, abstracted, or offset by other economic mechanisms. Plasma’s model challenges the assumption that every user interaction must directly fund the network through gas, but that doesn’t mean the economics disappear. They’re just handled differently.

Still, I think there’s something refreshingly honest about that trade-off.

Crypto has spent years pretending it can be simultaneously permissionless, decentralized, user-friendly, free, and infinitely scalable with no compromises. In practice, every system chooses what it optimizes for and what it’s willing to sacrifice. Plasma seems to choose boring reliability over ideological purity or speculative excitement.

And maybe that’s why it feels different to use.

When you stop optimizing UX around token hype, you start designing for behavior that looks a lot like traditional finance but with fewer intermediaries and faster settlement. That’s not revolutionary in a headline-grabbing way, but it’s meaningful in day-to-day reality. It’s the difference between a network you read about and one you actually rely on.

I don’t find myself “excited” when I use Plasma. I find myself calm. That’s a strange thing to say about crypto, but it feels accurate. There’s no adrenaline spike. No sense that I’m timing a market or navigating a maze of incentives. Just a tool doing what it’s supposed to do.

In a space obsessed with narratives, Plasma’s stablecoin-first design almost feels anti narrative. It doesn’t try to convince you that stablecoins are a stepping stone to something better. It treats them as the end state for a huge class of users and designs accordingly.