In the Web3 and blockchain payment sector, @Plasma has quickly become a hot topic of discussion among communities and investors, thanks to its Layer 1 infrastructure designed specifically for stablecoins. #Plasma The blockchain not only attracted over $7 billion in stablecoin liquidity after its mainnet launch in September 2025 but is also viewed by the market as a strong competitor challenging TRON's position.

The following are the three core issues currently receiving the most attention from Plasma:

1. Disruptive 'Zero Fee USDT Transfer'

Traditionally, transferring USDT on Ethereum or TRON requires paying expensive or volatile gas fees. The biggest highlight of Plasma ($XPL ) is its built-in Paymaster sponsorship mechanism, allowing users to experience 'zero fee' USDT transfers. This technology significantly lowers the threshold for cross-border remittances and micro-payments, especially causing a great response in high inflation areas like Southeast Asia and South America, and is seen as a 'killer app' for driving cryptocurrency towards mainstream adoption.

2. Innovative token economics and burning mechanism

XPL, as its native token, introduces a base fee burning mechanism similar to Ethereum's EIP-1559. With the increase in stablecoin transaction volume, more XPL will be burned, creating a long-term deflationary effect. Additionally, Plasma's staking delegation feature offers about 5% annualized rewards, further attracting long-term holders seeking stable returns.

3. High-performance and trust-minimized cross-chain technology

Plasma employs an optimized PlasmaBFT consensus mechanism, achieving over 1000+ TPS and sub-second transaction confirmations. What excites the technical community even more is its trust-minimized Bitcoin bridging feature (pBTC), allowing Bitcoin holders to participate directly in stablecoin liquidation and DeFi applications within the Plasma ecosystem without sacrificing security.

Market analysis perspective:

The current market sentiment often views XPL as an 'undervalued liquidation pipeline.' Although early prices experienced significant volatility, with the digestion of unlocking pressure in early 2026, along with Bitfinex and deep collaborations with giants, XPL is transforming from a mere token into a global digital payment infrastructure.

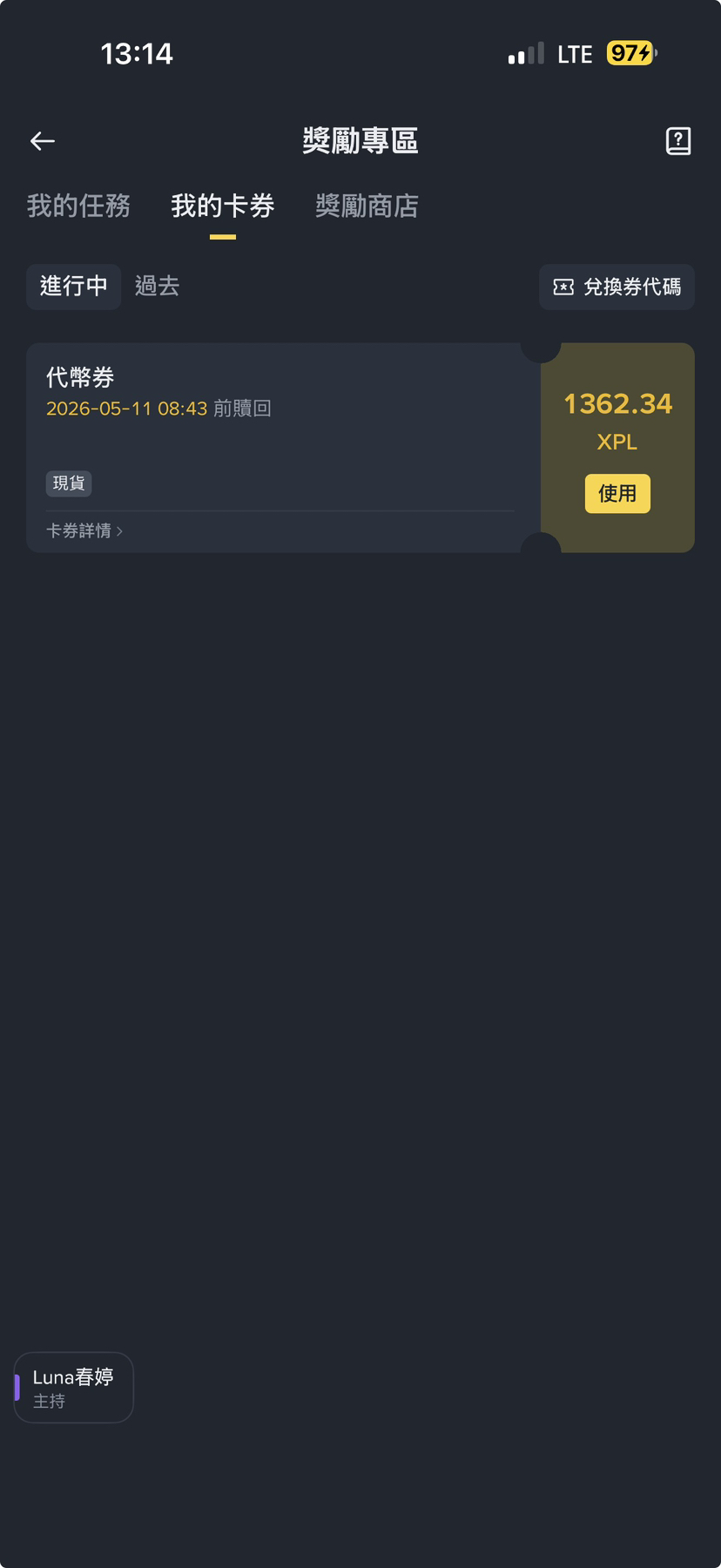

$XPL has started issuing tokens, receiving over 1,000 this round

Has everyone checked the rewards section?