#whalebtc #bitcoin #metrics $BTC

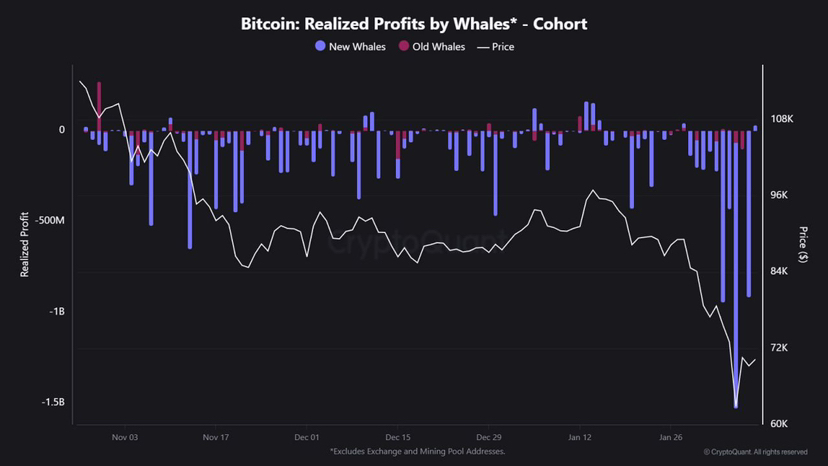

An extremely interesting situation is forming in the market: large players are realizing billion-dollar losses, but at the same time are increasing positions.

— Recent large purchases were made in the region of $96K, after which the decline began:

• February 3 — -$944M

• February 4 — -$431M

• February 5 — -$1.46B

• February 6 — -$915M

👉 As a result, the average new cost price of the 'whales' has shifted to around $90K.

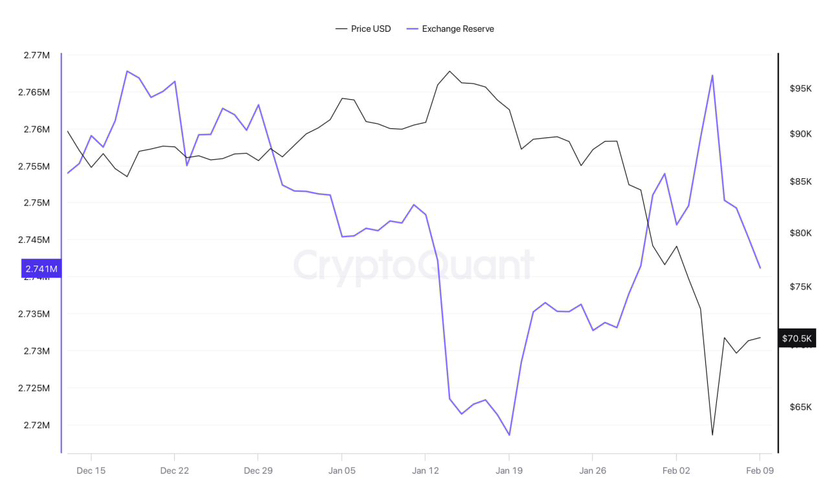

— According to Bitfinex, over the course of a day, exchange balances decreased by 4,000 BTC, while large wallets accumulated about 66,000 BTC in the range of $60K–$68K.

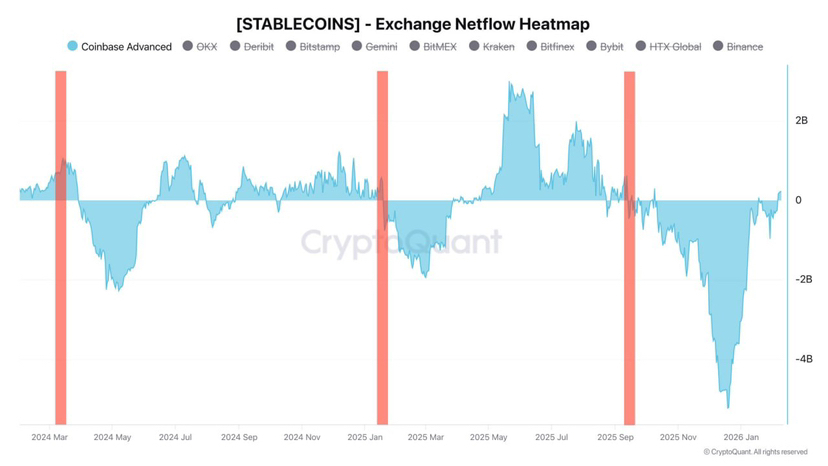

— Liquidity in the market continues to decrease: issuers are increasingly burning stablecoins, their capitalization is falling — and without liquidity, sustainable growth of BTC is virtually impossible.

— On Coinbase Advanced, after a significant outflow of -$5.2 billion, there is currently only +$224 million in inflow — this is not enough for a trend reversal.

When coins are mass-transferred from hand to hand — the market seeks a fair price. The losses of major players do not always indicate weakness — often it is part of a strategy to reset positions before the next move.

But there is a nuance: if the price returns to the range of $60K–$68K, current buyers may become future sellers, increasing pressure.

— A liquidity shortage may limit any rebounds

— Repeated tests of the lower ranges remain likely

— Macroeconomic data from the US (inflation and labor market) can sharply increase volatility

The strongest accumulation phases rarely look 'comfortable'. They are usually accompanied by fear, losses, and doubts — it is during such periods that the base for the future trend is formed.

Whales are already losing money, but continue to accumulate — this resembles preparation for the next cycle rather than capitulation.

However, without an influx of new liquidity, the market may remain in a turbulence zone for some time.

This is not financial advice.