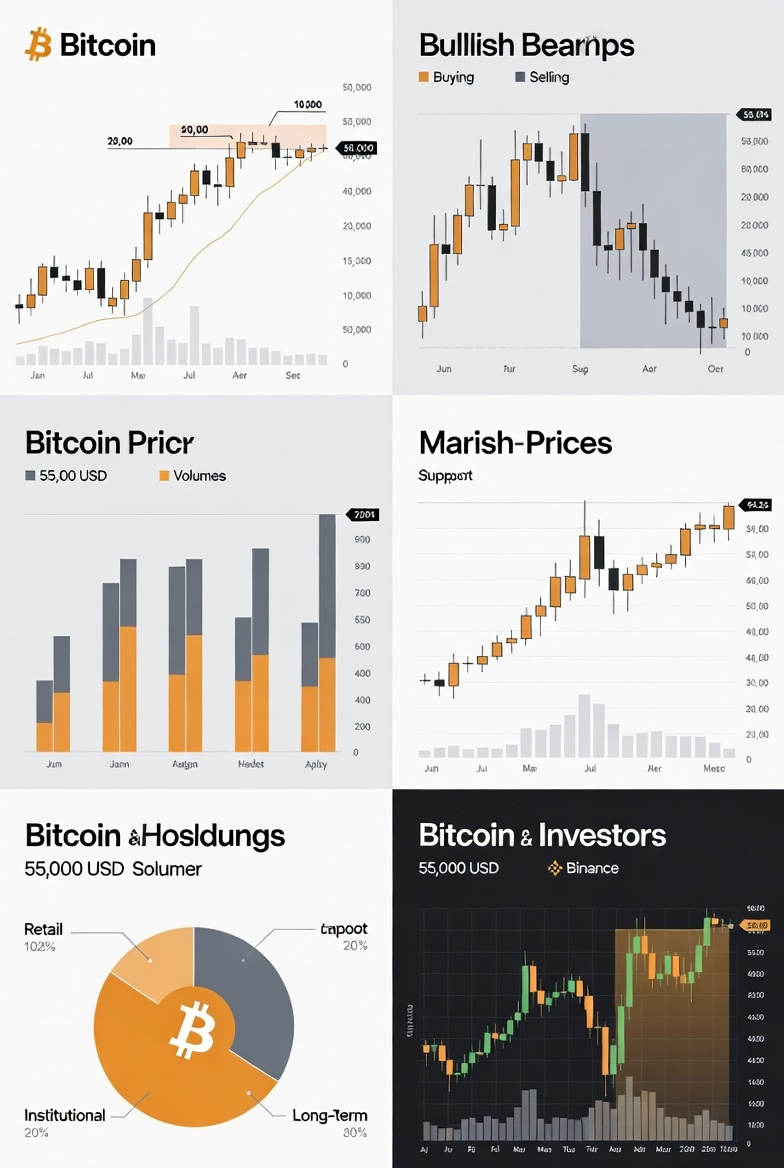

The possibility of Bitcoin pulling back to $55,000 is currently one of the most hotly debated topics in the crypto market. In mid-February 2026, Bitcoin was trading in the range of approximately $66,000 – $67,000 (down ~2-3% in the last 24 hours). Since the peak of ~$126,000 in October 2025, there has already been a correction of about 45%, and many analysts consider the $55,000 level to be a critical support zone.

Why is the USD 55,000 level so important?

This level is often called the "make-or-break" (life and death line) for several reasons:

- Technical indicators: The 200-week simple moving average (SMA) is around ~$58,000. A break below it would lead to the next support zone of $52,000 – $55,000 (also supported by the MVRV Extreme Deviation and Fibonacci retracement levels).

- On-chain metrics: According to Glassnode and other analyses, this zone corresponds to the mid-range valuation and could be a potential buy zone for long-term investors.

- Psychological and historical level: Such corrections (40-50% retracements) have occurred frequently in previous cycles. A drop from the 2025 peak to 55k would represent a ~55-56% correction, which is considered possible in a weak market cycle (1.8x growth) model.

- Prediction markets: Platforms like Polymarket show a probability of falling below USD 55,000 in 2026 of over 60% (some data goes as high as 78%). On the other hand, the probability of a short squeeze to USD 84,000 is around ~44%.

What can be done for #Binance users?

1. Risk management is a priority

The current price is ~67,000 USD. If you are considering placing a stop-loss, the 65,000 – 66,000 USD zone (last week’s support) could be a good level. A break below 55,000 USD could intensify the liquidity hunt and panic selling.

2. Watch as a buying opportunity

Many long-term investors see $55,000 and below as a "rare discounted buying window." If you are using a DCA (dollar-cost averaging) strategy, this zone can be attractive for additional buying.

3. Alternative scenarios

- Bullish reversal: If there is a close above 69,000 – 71,000 USD, a quick rebound to 80,000+ could occur with a short squeeze.

- Bearish extension: If 55,000 USD is broken, some analysts indicate a range of 45,000 – 50,000 USD (even 50 thousand in the summer months) as a target.

Conclusion

The statement "Bitcoin could go as high as $55k" is a very realistic scenario in the current market structure, but it doesn't necessarily mean it will happen. Macroeconomic factors (Fed rate decisions, liquidity), ETF flows, and institutional behavior will determine the direction of this move.

If you are trading on Binance, as usual:

- Be careful if you use leverage (high liquidity risk)

- Risk only the portion of your portfolio that you can afford to lose

- Follow both technical and fundamental analysis together

The market is still in the decision phase — 55k could be both a support and a "structural breakdown" test. Good luck! 🚀