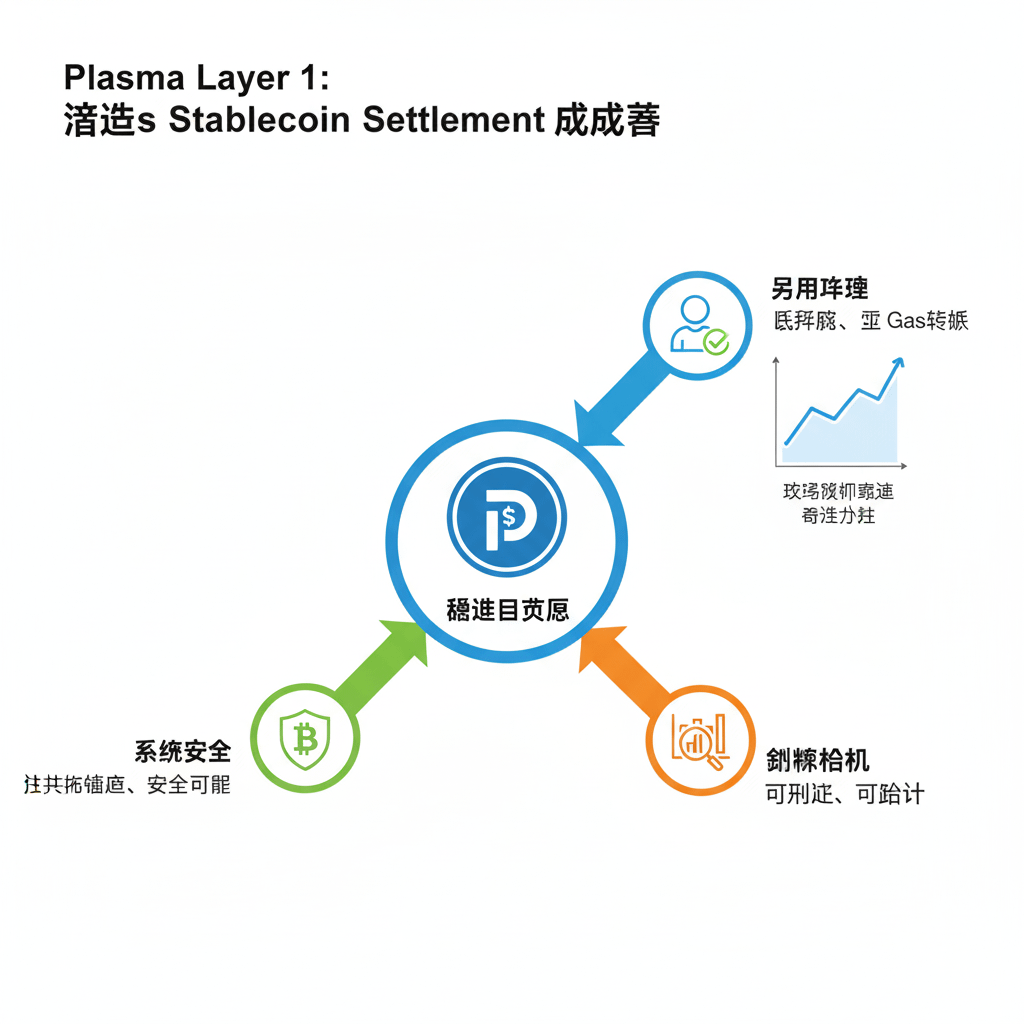

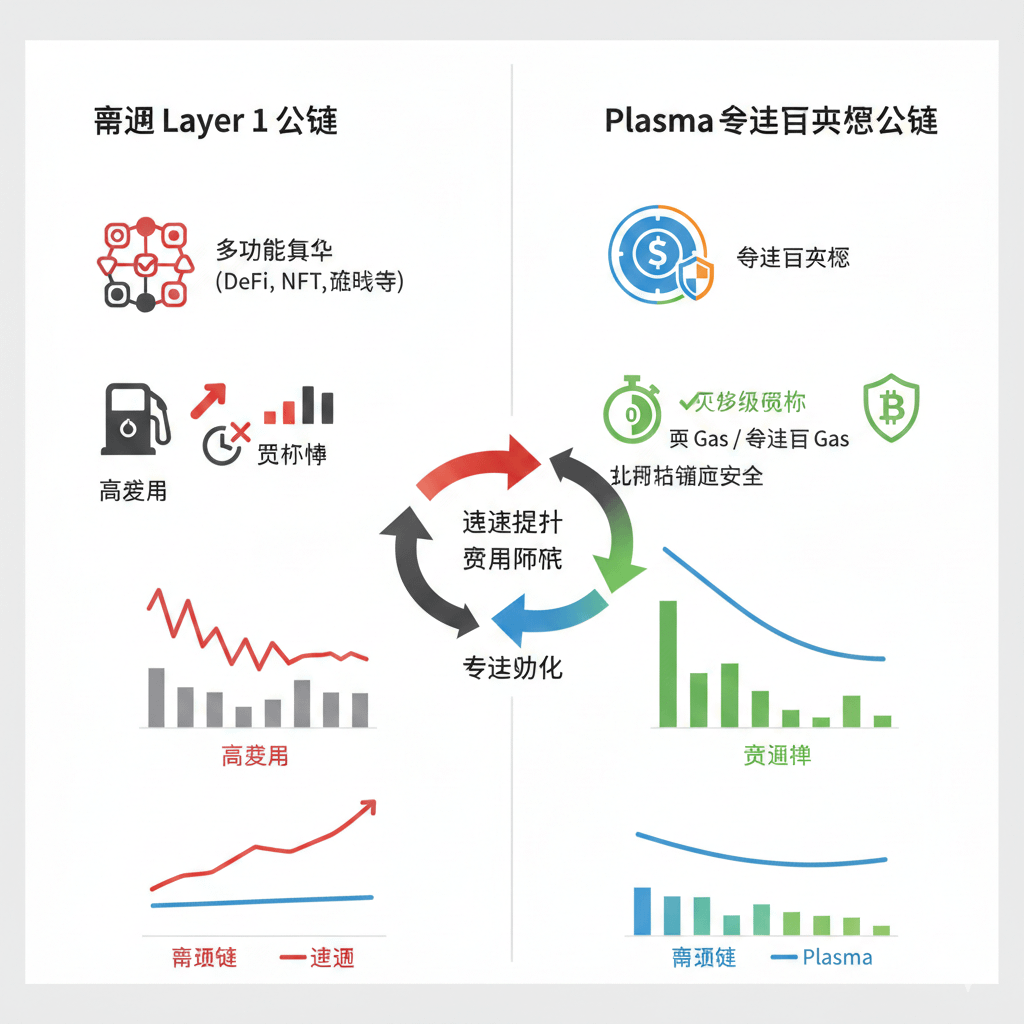

Today, most Layer 1 public chains want to be a "jack of all trades": DeFi platforms, NFT markets, gaming ecosystems, social networks... they want to do it all. Plasma's strategy, however, is entirely different. It does not chase trends and does not want to cover everything; instead, it has chosen a very clear track: stablecoin settlement.

At first glance, this may seem unremarkable. "Just a stablecoin?" you might think. But if you look at the enormous scale of stablecoin transactions every day—whether for trading, cross-border payments, financial management, or everyday transfers in certain countries—you'll understand the logic behind it. Stablecoins are not just ordinary tokens; they are at the core of liquidity in the digital economy. However, most blockchains were not originally designed for stablecoins; they were only added later.

Plasma completely disrupts this model. Here, stablecoins are not an accessory, but the core of the system.

From a developer's perspective, Plasma maintains a sense of familiarity. It is a fully EVM-compatible Layer 1 chain, implemented through Reth. This means Solidity developers can dive in directly, existing tools remain available, and auditing will not become complicated. For teams already operating in the Ethereum ecosystem, this significantly lowers the barrier to entry.

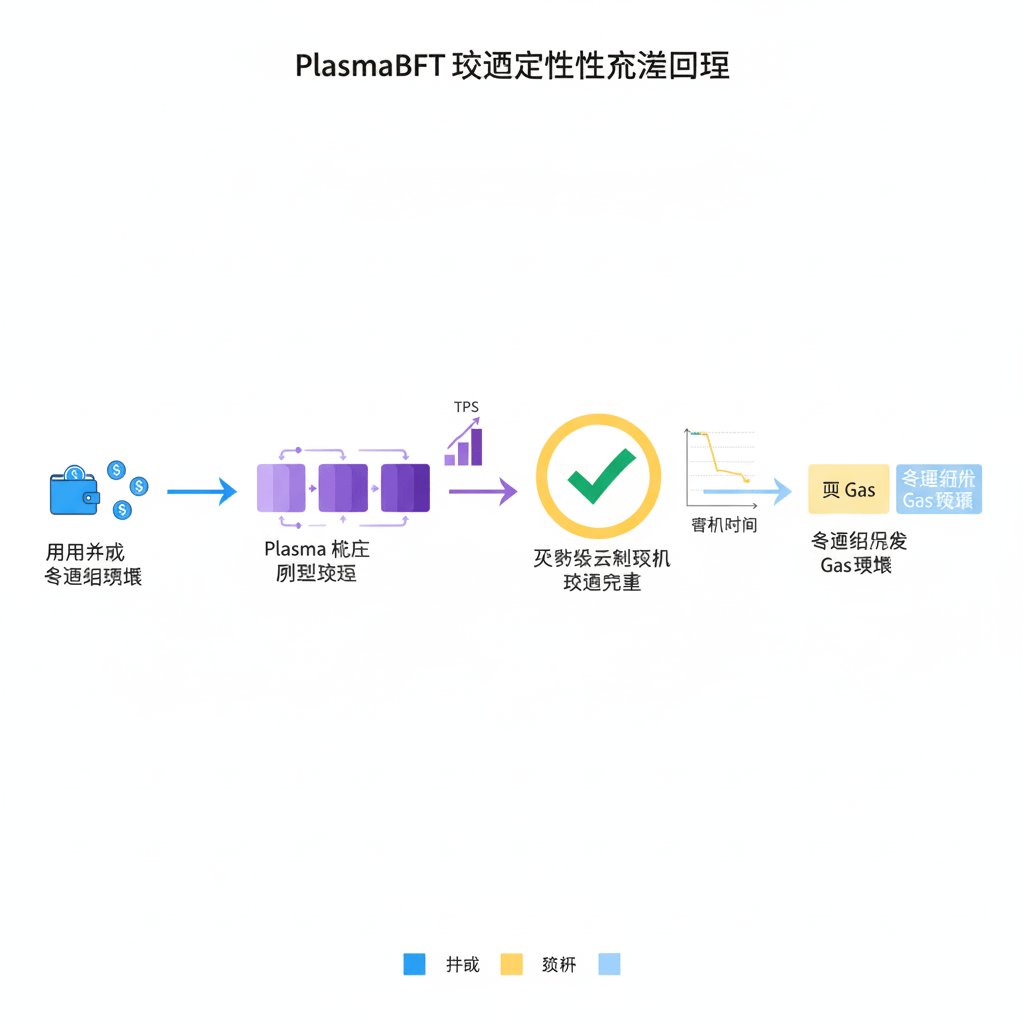

Plasma's speed is not aimed at exaggerated TPS figures, but at certainty. PlasmaBFT provides sub-second finality, meaning that once a transaction is completed, it is truly completed. This predictability is crucial for moving real stable value. You don't want transactions to be 'possibly completed' or 'just a moment', you need 100% certainty.

The fee design is also different. Many chains require holding volatile native tokens as Gas even for transferring stablecoins. This makes sense for speculative ecosystems; however, it is an unnecessary burden for actual payments and settlements. Plasma prioritizes a Gas mechanism based on stablecoins, even supporting USDT zero Gas transfers, allowing users to transfer without needing to hold additional tokens. Retail user experience is simplified, and institutional operations are smoother and more predictable.

In terms of security, Plasma also distinguishes itself. It has designed a security mechanism based on Bitcoin anchoring. Anchoring to Bitcoin provides additional trust and neutrality, which is crucial for chains handling real settlement volumes. This is not just a gimmick, but a key to ensuring reliability.

Plasma's audience is also very clear. The first category is retail users for whom stablecoins are already in actual circulation locally — they seek simplicity and low friction, not wanting a complex Gas mechanism to be a barrier. The second category is financial and payment institutions — they require predictable and auditable systems that do not exhibit anomalies during market fluctuations. Plasma finds the balance between the two, satisfying the needs of both.

Plasma's strategy is clear: focus on the secure circulation of stable value rather than chasing every hot trend. This specialization may seem narrower compared to a chain that commits to being 'everything for everyone', but history tells us that the success of infrastructure relies not on flashiness, but on reliability. Payment networks can grow because they do not crash when users depend on them.

Stablecoins have proven market demand. What is truly lagging is the infrastructure that supports them. Plasma's approach is to design from the ground up with stablecoins at the core, which is more efficient and reasonable than constantly patching a general-purpose chain.

Here, growth is neither dazzling nor eye-catching. It manifests as higher settlement volumes, smoother integrations, and users not needing to worry about which chain they are using during transfers. This is the ideal state for payments.

If you like, I can help you generate another version of content suitable for social media, using various graphics, colors, and trend lines, so that your followers can understand Plasma's core advantages at a glance.