In July 2025, Bitcoin reached a new ATH above 124,000 USD, reigniting the debate over whether the world's first cryptocurrency can break the magical barrier of 125,000 USD in the current bull cycle. With institutional capital inflows via ETFs, growing interest from whales, and favorable regulatory changes in the USA, all indicators point to the potential for further growth. But will these fundamental factors be enough to push Bitcoin above 125,000 USD?

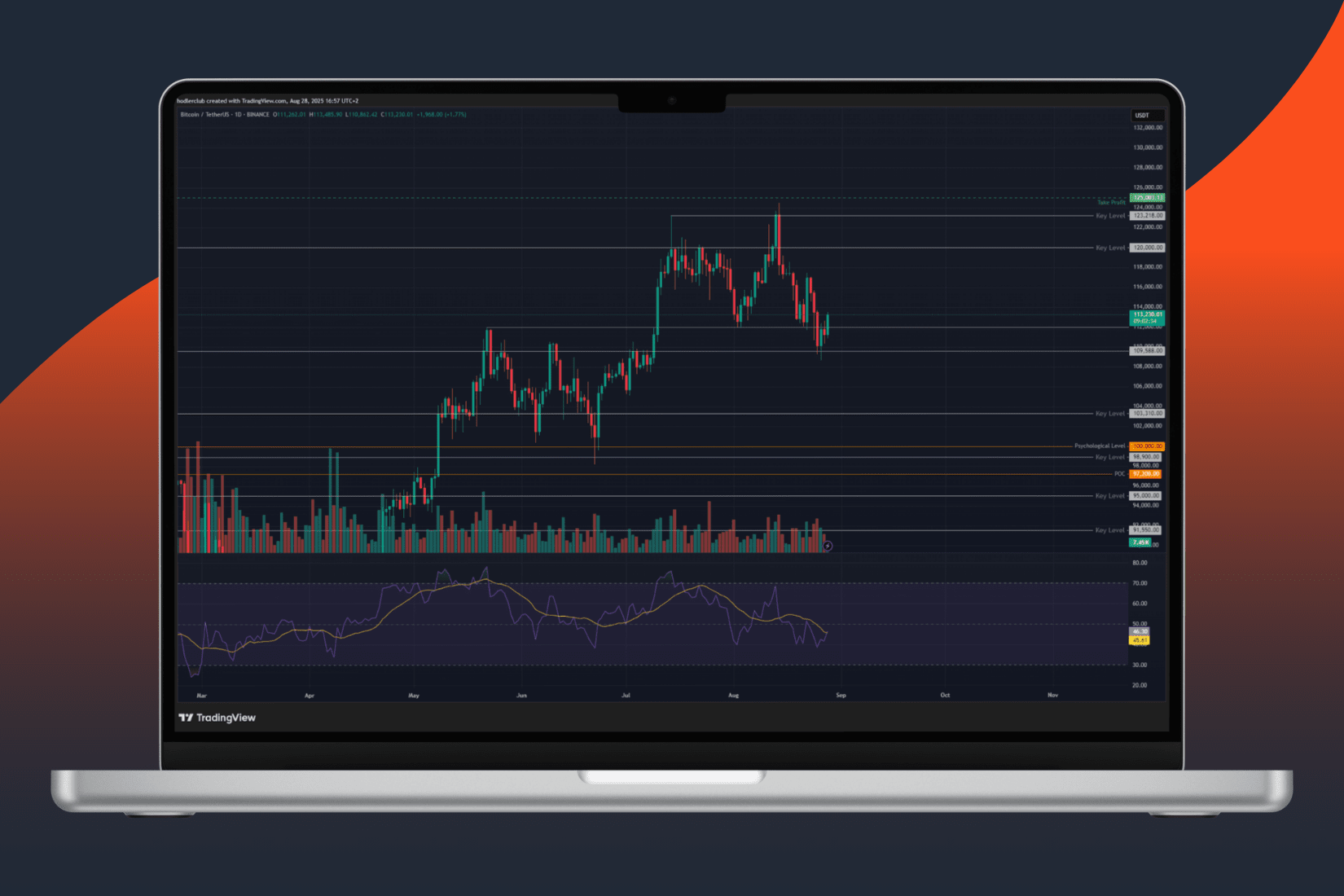

Analysis of the current market situation.

Bitcoin is currently consolidating between 107,000 USD and 115,000 USD, remaining close to its all-time high. Projections for September 2025 suggest a possible breakout towards the range of 125-128,000 USD, provided current support is maintained.

Bitcoin ETFs as the main catalyst for gains.

Bitcoin ETFs remain one of the key drivers for the price of the most popular cryptocurrency in 2025. Cumulative net inflows to American spot Bitcoin ETFs currently stand at 14.8381 billion USD in 2025, surpassing levels from the same period in 2024. This result shows the growing interest of institutional investors.

In July, Bitcoin ETFs recorded the largest daily inflow in 2025, amounting to 1.18 billion USD. However, the market is not one-dimensional - American spot ETFs are on track for the second largest monthly outflow in history, with a net outflow of 972 million USD.

This dualism in capital flows shows the maturity of the market and its reaction to various macroeconomic factors. In moments of increased optimism, institutional capital quickly returns, confirming a fundamental shift in the perception of Bitcoin as a valuable investment asset, and even a reserve asset.

Whale activity determines the direction of the market.

Currently, 1,455 wallets hold over 1,000 BTC, with Strategy alone controlling over 3% of the total supply, and ETFs (including BlackRock's ETF) adding 6% of the total supply. These numbers illustrate the scale of Bitcoin concentration in the hands of the largest players.

The Gini coefficient reached 0.4677, signaling tighter BTC control by large holders. CryptoQuant recorded the highest outflow of BTC from centralized exchanges in two years, indicating a long-term holding strategy by large investors.

The correlation between whale activity and price is key. Since the beginning of 2025, every major correction has coincided with whale inflows to exchanges, while periods of inactivity among old players have seen price increases above 110,000 USD. This dynamic is crucial for predicting short-term price movements.

Trump's regulatory revolution is changing the rules of the game.

President Donald Trump signed an executive order establishing a strategic BTC reserve for the United States, funded by Bitcoin seized in criminal cases. The USA is estimated to hold about 198,000 BTC, making it the largest known state holder of Bitcoin in the world.

The first 100 days of the Trump administration brought a broad pro-cryptocurrency breakthrough in Washington. The SEC established a new crypto task force, and Trump's nominee for SEC head is seen as a strong supporter of digital assets. The impact of these changes on institutional adoption is already visible - corporate and institutional investors purchased Bitcoin ETFs worth 15 billion USD in the past six to eight weeks.

Halving cycles and the evolution of patterns.

In April 2024, the fourth Bitcoin halving occurred, reducing the issuance from 6.25 to 3.125 BTC per block. Since then, Bitcoin has gained over 40%, although this is a weaker result than previous cycles. If Bitcoin matched the historical average of halving years, its price could reach levels greater than 124,000 USD.

However, the traditional four-year Bitcoin cycle shows signs of transformation. The characteristic 70-80% drops after halving seen in previous cycles are unlikely to repeat due to ETFs, the changing nature of investors, and supportive regulations.

Analysts predict a potential price peak between the fourth quarter of 2025 and the first quarter of 2026, which means that a level of 125,000 USD is quite realistic.

Expert forecasts for 2025.

Standard Chartered expects Bitcoin to reach 200,000 USD by the end of 2025, while Alex Thorn from Galaxy Digital predicts a peak of 185,000 USD in the fourth quarter. Matrixport forecasts a level of 160,000 USD, supported by sustained demand for ETFs and favorable macroeconomic trends.

A more conservative approach is presented by James Butterfill from CoinShares, who sees the possibility of reaching both 150,000 USD and 80,000 USD in 2025, highlighting the unpredictability of the market.

Risk factors and on-chain analysis.

Despite optimistic forecasts, there are also significant risks. Whales are transitioning from accumulation to distribution, and spot ETFs recorded significant outflows between August 15-22. Additionally, changes in Fed policy or regulatory pressure in other jurisdictions could pose significant challenges for the entire cryptocurrency market.

However, on-chain data shows a positive picture of the current situation. American spot ETFs hold 1.3 million BTC (6% of total supply), and corporate treasuries have added 300,000 BTC since January 2025. A negative net flow remaining for over 90 days indicates that more BTC is being withdrawn from exchanges than sent to them. This creates a shortage and sets the stage for a future price breakout.

Price scenarios and strategy for the coming weeks.

Based on the presented analysis, three scenarios for the coming weeks can be distinguished:

Optimistic - assuming 140,000 - 200,000 USD per BTC by the end of the year.

Base case - predicting consolidation around 125,000 - 130,000 USD.

Pessimistic - with a correction below 100,000 USD.

The base case scenario seems the most likely, considering the current market dynamics. The market is already pricing in a target of 132,000 USD - 170,000 USD by mid-2026, driven by M2 growth and inflows into ETFs.

For individual investors, allocating 5-10% in Bitcoin through ETFs or direct purchases seems a reasonable choice, especially with possible Fed rate cuts on the horizon.

A combination of institutional inflows, whale accumulation, regulatory support, and technical fundamentals suggests that Bitcoin has a real chance of reaching or exceeding the level of 125,000 USD this year. The strategic Bitcoin reserve in the USA, record inflows into ETFs, and decreasing supply on exchanges support the bullish scenario.

For many analysts, the question is not "if" Bitcoin will reach 125,000 USD, but "when" it will do so. In the current environment characterized by high institutional inflows and a fundamental regulatory shift, 125,000 USD may prove to be another milestone on the path to significantly higher levels in 2026.

The text does not constitute investment advice. It was created in collaboration with the cryptocurrency exchange Binance.