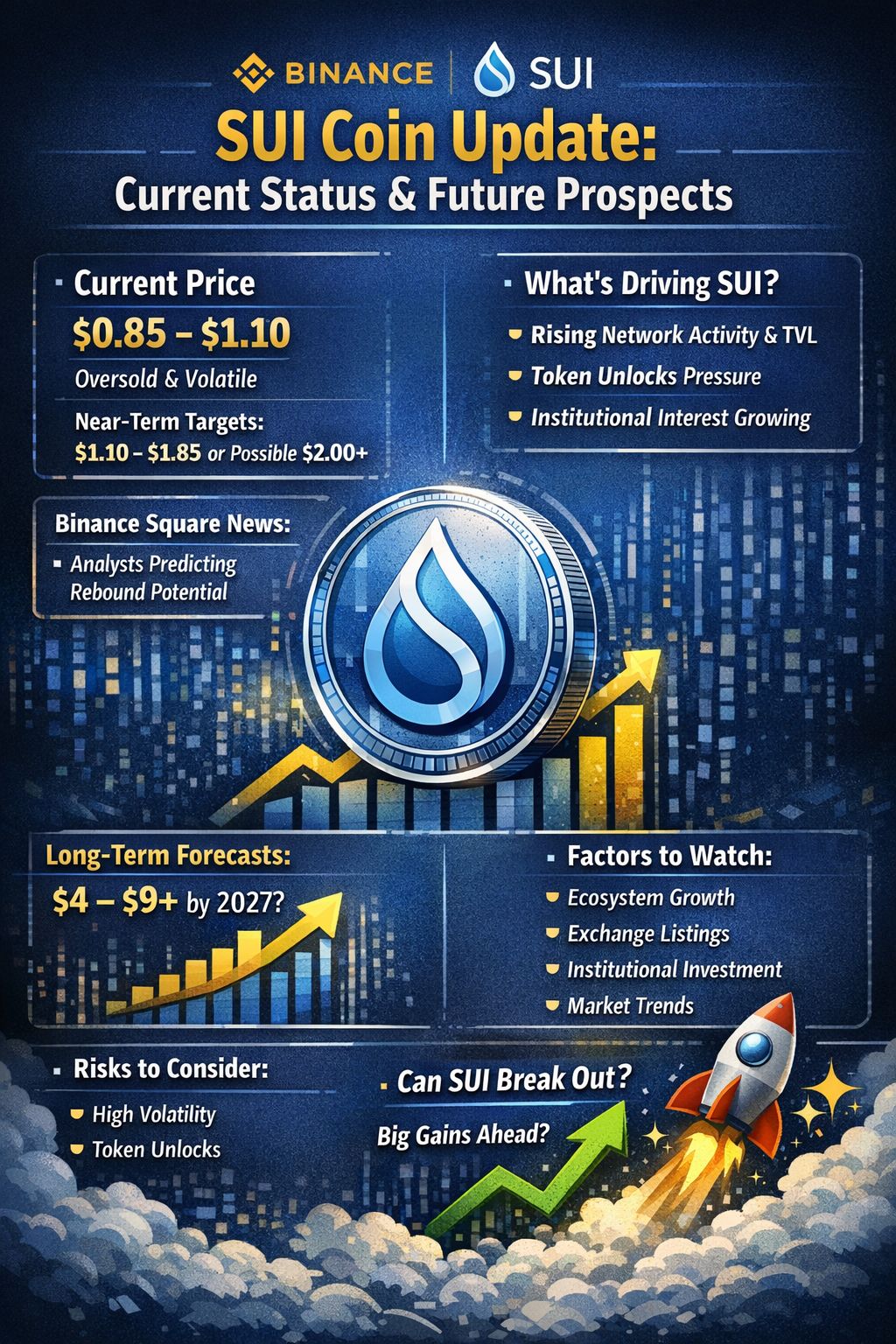

Current Price & Market Behavior

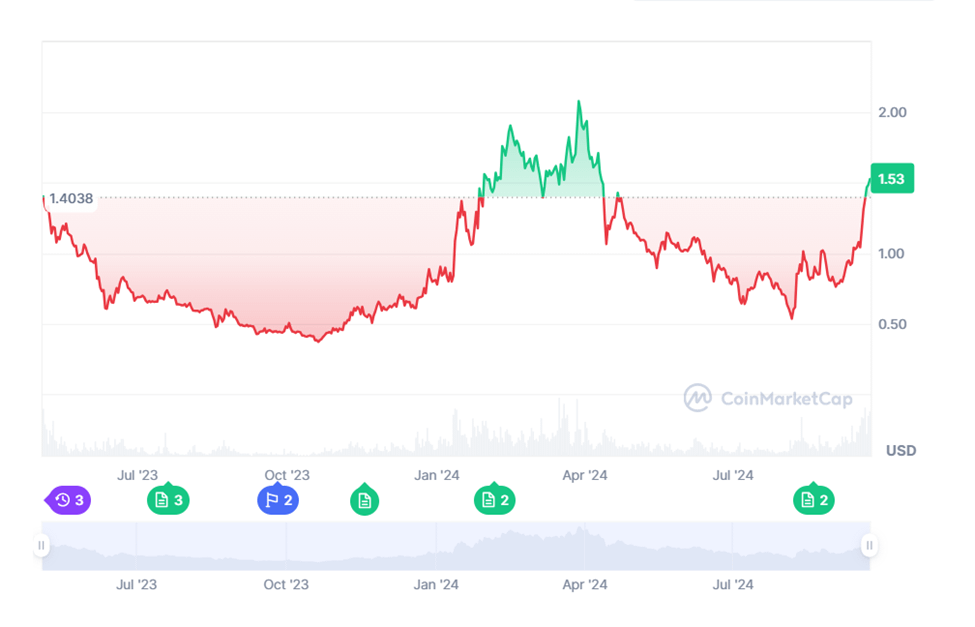

Right now, $SUI has been under selling pressure and volatility, largely due to recent token unlocks that put more supply into the market. That has kept prices relatively low compared with earlier peaks. Recent price action shows SUI hovering near critical support levels around $0.85–$1.10 in early 2026. Technical indicators (like Relative Strength Index) suggest oversold conditions, meaning markets could try a bounce back soon if buying interest returns.

At the same time, some short-term forecasts see a recovery toward $1.10–$1.85 if support holds and momentum improves, with volatility expected to remain in the near term.

News from Binance / Binance Square

Binance has been actively publishing price outlooks and analysis for SUI on its Binance Square content platform. They’ve highlighted both short-term technical momentum and comparisons with other Layer-1 protocols. This kind of attention from one of the largest exchanges helps maintain visibility in the market, even if price action is choppy.

Earlier Binance published longer-term price forecasts suggesting levels like $5 in future cycles based on its network fundamentals and adoption trends, though that forecast was from mid-2025.

What’s Driving SUI’s Price

Technical and On-Chain Activity

There are a few trends analysts are watching:

• Network activity growth and Total Value Locked (TVL) have improved, which supports real usage rather than pure speculation. TVL was reported at over $1 billion early in 2026.

• Institutional interest is quietly rising with product launches and ETF filings tied to the Sui ecosystem (e.g., products from firms like Bitwise).

• Mainnet upgrades boosting throughput and scalability are also positive signals for developers and ecosystem expansion.

These fundamentals matter more over the long term than short bursts of speculative trading.

Token Unlocks and Supply Pressure

Large scheduled unlocks (millions of tokens hitting the market) have put downward pressure on price in recent months. This is a common theme in many new blockchain projects and often blunts rallies until markets absorb the supply.

Short-Term Outlook (Next Weeks to Months)

• Bearish/Base case: If support around $0.85–$1.00 fails, SUI could stay weak or drift lower. Oversold conditions can persist when sentiment is low.

• Neutral/Rebound case: Many technical forecasts point to a bounce toward $1.10–$1.85 as oversold levels resolve and buyers step back in.

• Bullish case: With renewed liquidity and breaking above key resistance, some analysts see targets near $2.00–$2.20 in a medium-term recovery (weeks to months).

In other words, the near term could bring modest recovery if markets stabilize and sentiment improves.

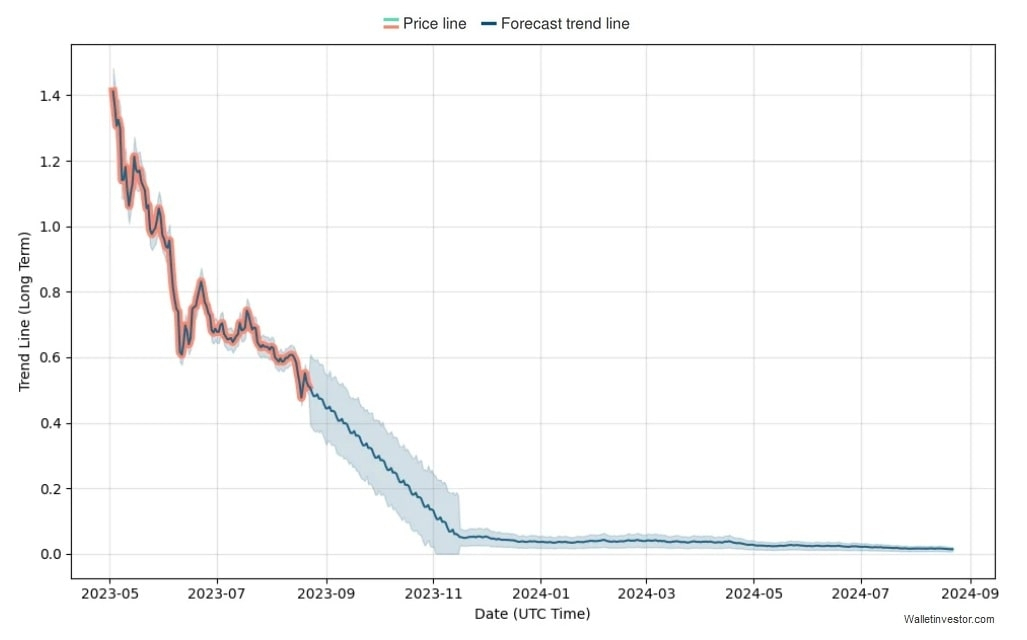

Long-Term Possibilities

Looking past the next few months, the longer SUI stays relevant in the Layer-1 ecosystem, the stronger its case for higher valuation:

• Some price models project multi-dollar levels in later 2026–2027 if adoption grows and macro sentiment turns favorable again. For example, ranges like $4–$9+ have been forecast by certain long-range prediction tools (but those are highly speculative).

• Institutional product support—like ETFs or indexed funds—could introduce new capital into SUI markets and lift liquidity and valuation.

But remember, long-term forecasts are guesses based on trends and not guarantees.

What Could Make SUI Go Up?

Here are the main factors that might drive price higher:

• Exchange Listings and Product Support

Wider availability on major exchanges and integration of tokens like USDC on the Sui network improve liquidity and ease of use.

• Ecosystem Growth

More decentralized apps, DeFi projects, NFTs, and real users on the Sui chain boost demand for SUI. Technical upgrades that improve throughput help here too.

• Institutional Money & ETF Pathways

If regulatory progress continues and approved SUI-linked products appear, that could bring big capital inflows.

• Bullish Market Cycles

Crypto markets tend to move in cycles. If a broader altcoin rally begins, assets like SUI could benefit disproportionately.

Risks to Keep in Mind

• High volatility is always a factor in crypto, especially newer Layer-1 coins.

• Token unlocks can pressure prices when supply increases faster than demand.

• Regulatory uncertainty still affects institutional interest and long-term projects.

Bottom Line

SUI’s current price action is weak but technically oversold, with some analysts expecting a rebound toward $1–$2 in the short term. Institutional interest and ecosystem growth are positives that support future potential, but clear catalysts like ETFs or major adoption would be needed for sustained rallies. Long-term forecasts vary widely, and risk remains high.

#CZAMAonBinanceSquare #USNFPBlowout #TrumpCanadaTariffsOverturned #USRetailSalesMissForecast #USTechFundFlows