The illusion of quick money.

Many of us enter the world of perpetual futures with a clear goal, to make money overnight. We see incredible profit captures and think that success is guaranteed. I was there too last year, but today I want to speak to you with the honesty of someone who has seen their numbers in red and has had to manage frustration to maintain their mental peace and harmony with family.

Why does it seem like the market is watching me?.

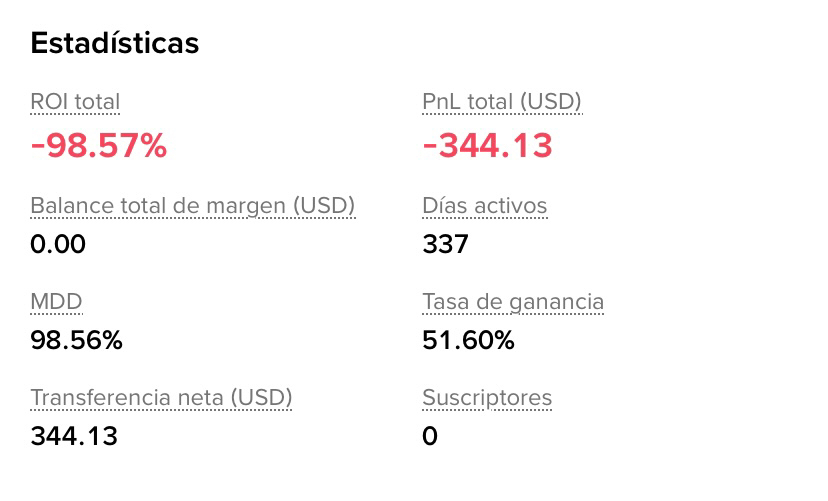

For months, I traded cautiously, managing risk and using little leverage. However, I accumulated losses of almost -344 USD. What frustrated me the most was that feeling that as soon as I opened a Long or a short, the market turned against me. I understood that it is not bad luck; the market moves on liquidity and algorithms that know exactly where our entries are to move the price against us.

It's no coincidence that the price seeks your exit points; the system is designed to look for where there is more money accumulated. Entering out of emotion when we see a giant green candle is falling into the trap of those who need our liquidity to close their own positions.

The risk of crossing the line.

In this 2025 and what has gone by in 2026, thousands of people are joining the crypto world seeking an economic escape. But it must be made clear: easy money does not exist. Futures trading can become a dangerous addiction if caution is not exercised. It is easy to fall into the circle of wanting to "recover" what was lost, turning finances into a habit that robs tranquility. If you do not control your emotions, the real liquidation will not be of your account, but of your mental peace.

🖇️ The responsibility strategy.

Today my approach is different. I am not looking for magical profits, but rather to understand how the game works. The best strategy is discipline:

1. Do not trade with necessary money: Only use capital that does not compromise your home.

2. Wait for the real signal: You have to wait for the price to break an important level (resistance), return to that same point without crossing it downwards, and then give the signal to rise. If that movement does not happen, stay out.

3. Set limits: If you lose, accept the loss and close the screen. The market will be there tomorrow.

4. Training before investment: Before putting a single real dollar, take time to understand how whales move the charts to seek your liquidity.

Individual responsibility is our greatest armor. We are in a stage where the search for liquidity is constant and only those who keep a cool head survive. At first, I told you that I lost money, but...

Do you know what I gained? I gained wisdom. I understood that patience and emotional control are worth much more than any "lucky" trade.

In this 2026 where the market always seems to go after our liquidity, do you think futures trading is for everyone, or is a very strong mentality needed to avoid falling into the trap of easy money?

FOLLOW ME FOR MORE ANALYSIS AND NEWS!