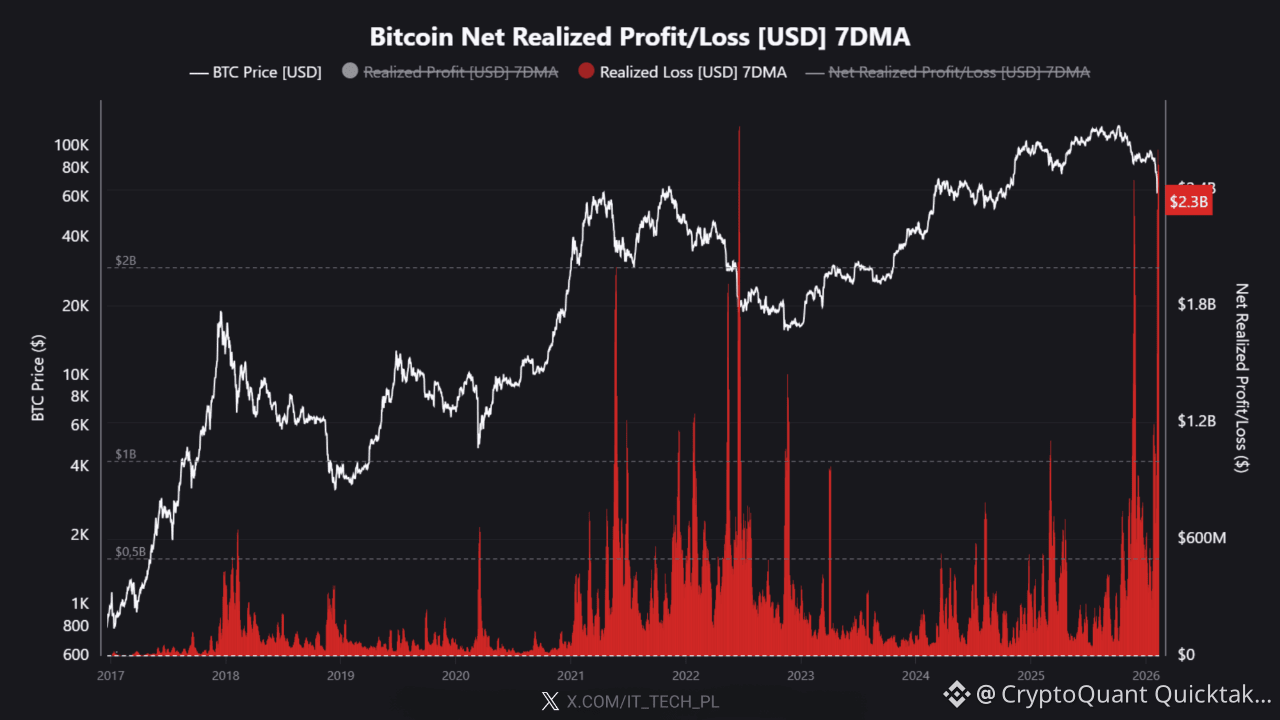

Bitcoin just posted $2.3B in realized losses.

This is one of the largest capitulation events in BTC history, rivaling the 2021 crash, 2022 Luna/FTX collapse, and mid-2024 correction.

📊 What is Net Realized Profit/Loss?

It measures the dollar value of profit or loss locked in when Bitcoin moves on-chain. Red bars show coins sold or transferred at a loss relative to their purchase price.

The bigger the bar, the more pain.

🔴 Current reading: $2.3B (7-day average)

This puts us in the top 3-5 loss events ever recorded. Only a handful of moments in Bitcoin's history have seen this level of capitulation.

👥 Who is selling?

Short-Term Holders (coins held <155 days) who bought between $80K-$110K are capitulating. Weak hands and overleveraged retail are locking in steep losses.

Long-Term Holders are not the source of this spike. They hold through drawdowns.

📍 Historical Context:

In the past, extreme loss spikes like this triggered rebounds. We're seeing it now: BTC bounced from $60K to $71K after the capitulation.

But this could still be the beginning of a deep and slow bleed-out. Relief rallies happen even in prolonged bear markets.

Takeaway: $2.3B in realized losses triggered a bounce from $60K to $71K, consistent with historical capitulation patterns. But the risk remains that this is relief within a longer distribution phase, not a trend reversal. Watch for sustained strength or further deterioration.

Written by IT Tech