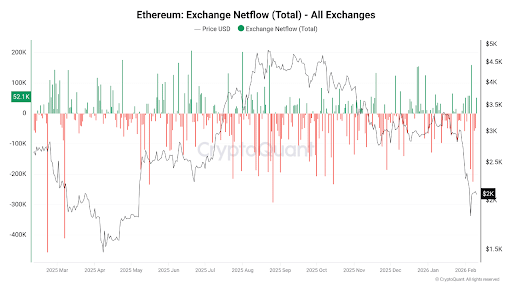

Even though Ethereum’s price has been under pressure recently, large investors known as whales are still making big moves behind the scenes. In fact, over $400 million worth of ETH has been withdrawn from crypto exchanges, and that’s catching the attention of analysts.

So what does this actually mean for everyday investors?

Recent blockchain data shows that major Ethereum holders are moving large amounts of ETH off exchanges. In total, more than 220,000 ETH has flowed out, the biggest withdrawal level seen since October.

When investors take crypto off exchanges, they usually move it to private wallets or long-term storage. This often suggests they are planning to hold rather than sell.

In simple terms, fewer coins on exchanges can mean less immediate selling pressure, which can help support prices if demand increases.

Why Are They Buying Now?

Much of this activity happened while Ethereum was trading around $1,800 to $2,000. Large investors may see this range as a good value zone during the current market downturn.

Whales often think long term. Instead of reacting to short term price drops, they may use lower prices as opportunities to accumulate more assets.

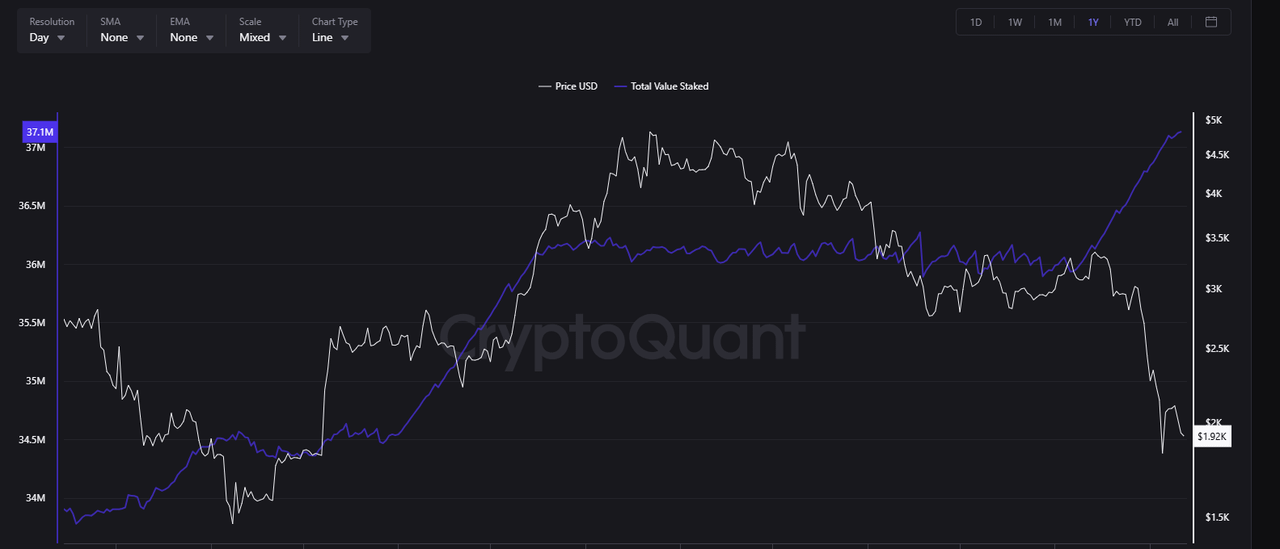

Ethereum Staking Is Also Rising

Another important trend is Ethereum staking, which has reached a record level.

Over 30% of all ETH supply is now locked in staking, equal to tens of billions of dollars. Staking means investors lock their ETH to help secure the network and earn rewards, but they cannot easily sell it while locked.

This creates a supply squeeze. When more coins are locked and unavailable for trading, the remaining supply becomes more limited. If demand rises, limited supply can push prices higher.

What This Means for Beginners

Here are the key takeaways:

Large investors are accumulating ETH despite falling prices

Fewer coins on exchanges may reduce short term selling pressure

Record staking levels are locking up supply

Long term confidence in Ethereum appears strong

The Big Picture

Ethereum’s price may still fluctuate in the short term, but whale accumulation and rising staking levels suggest strong long term interest.

For beginners, the lesson is simple. Price drops don’t always mean weakening confidence. Sometimes, they are exactly when the biggest investors are quietly buying the most.