In January, the consumer price index in the USA rose by 0.2% after seasonal adjustments. Year-on-year, the CPI was 2.4% compared to 2.7% at the end of December.

The main factor for the increase in the index for the month was housing prices, noted the Bureau of Labor Statistics (BLS).

Core CPI, which excludes food and energy prices, increased by 0.3% in January, and over the 12 months — by 2.5%.

Here, the main contributions to inflation came from airline tickets, hygiene products, recreation, medical care, communication, and used cars. Prices for household goods, home appliances, and vehicle insurance have decreased.

Ahead of the publication of statistics, the consensus forecast on Wall Street for CPI anticipated a rise of 0.26% for the month and 2.5% year-on-year. This represented a decrease from December's 0.31% and 2.7%, respectively.

For Core CPI, financial companies also forecast a reduction over 12 months to 2.5%. Leading economic correspondent of WSJ Nick Timiraos noted the 'unusually wide' range of opinions regarding the monthly figure, ranging from 0.25% to 0.42%.

'This indicates additional uncertainty regarding the consequences at the turn of the year, and the transfer of tariffs to future events adds even more ambiguity,' noted the expert.

After the publication of the BLS press release, bitcoin quotes shifted to growth, rising from around $67,300 to ~$68,500.

Over the past 24 hours, the cryptocurrency's rate has increased by almost 2% (CoinGecko).

The S&P 500 index demonstrated increased volatility at the start of trading, but at the time of writing remains roughly at the opening level of $6834. The NASDAQ 100 behaved similarly, with the current value at $24,627.

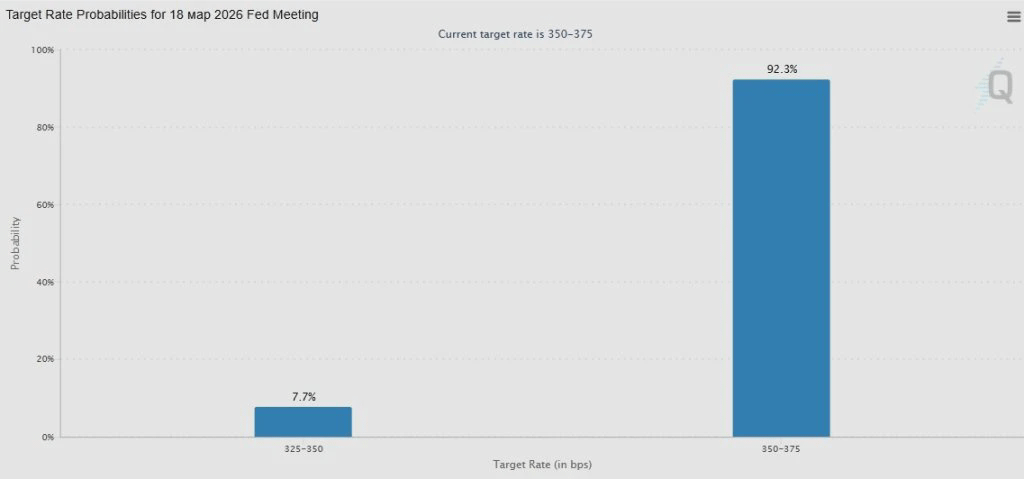

The swap and options markets express almost complete confidence in the Fed maintaining the current key rate range of 3.5-3.75% following the meeting on March 18. The probability of this scenario is estimated at 92.3%. Over the past 24 hours, the value has increased by 0.7%, and over the month, it has risen by 10.7%.

Let us remind you that JPMorgan analysts believe that the regulator will keep the rate unchanged until the end of 2026.