There is a specific kind of stress that only shows up in crypto. You press confirm, you feel that tiny pinch in your chest, and you wait. You wonder if the price will move before your action lands. You wonder if the network will slow down right now, at the worst time. You wonder if you should try again, or if trying again will make it worse. That waiting and guessing is not just annoying, it quietly teaches people not to trust on chain finance for serious moments. Fogo is built around a very human promise: it is meant to shrink that scary gap between intention and outcome. They are building a high performance Layer 1 that uses the Solana Virtual Machine, so it runs Solana style programs, but it is tuned for speed and quick confirmations, especially for trading style activity where every second can feel like a lifetime.

How it works is simple to describe, even if the engineering behind it is hard. A blockchain has to do the same loop all day long. People send transactions, the network collects them, decides an order, runs the app logic, and then everyone agrees on the final result. The feeling you get as a user comes from how fast and how consistently that loop happens. If the loop is slow or inconsistent, you do not just lose time, you lose confidence. Fogo uses the Solana Virtual Machine, which you can think of as the engine room where apps run. That matters because it gives builders a familiar environment. If a team already knows how to build in that style, they can bring those skills and patterns with them. It is built to reduce the friction of starting over, and that matters because builders do not have infinite energy. When it is easy to build, more people try, more people ship, and the ecosystem becomes real instead of theoretical.

Now let me explain the architecture in plain words, without turning it into a dictionary. Fogo leans on a Solana style approach where the network has a built in way to keep a shared sense of ordering and time, and a fast way to reach agreement about what happened. On the architecture page, they list key parts like Proof of History, Tower BFT, and Turbine. You do not need to master these names to understand the goal. The goal is to cut down the back and forth that usually slows networks down, and to spread new blocks through the network quickly so everyone stays aligned. If this works the way it is meant to, the chain can keep moving even when activity rises, and your transaction does not feel like it is stuck in a slow line behind thousands of other people.

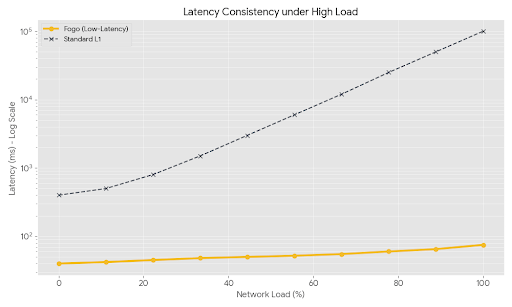

The part that makes Fogo feel different is that they talk openly about low delay design choices, not just raw throughput. Throughput is how much the chain can handle, but delay is what you feel. Delay is the difference between I clicked and something happened versus I clicked and now I am sweating. Fogo’s design focuses on very short block times and quick final confirmation. Binance Academy describes Fogo as aiming for ultra low latency execution and real time on chain trading, and it highlights the idea that the chain is built for fast, smooth activity where timing matters. That is why you see the project described with targets like extremely short block times, because for a trading focused chain, speed is not a nice extra, it is the product.

A big reason a chain can be fast or slow is the validator software. Validators are the machines that help run the network. The client is the software they run. Fogo is described as using a Firedancer optimized style client. In simple terms, they are using a high performance implementation to push execution speed and reduce bottlenecks. That might sound like an internal detail, but it is one of those choices that shows up as a feeling. When the system is sturdy and fast, your actions feel clean. When the system is stretched and messy, you feel it as missed chances and late confirmations. If you have ever watched a trade go against you while you waited for a chain to catch up, you already understand why this matters.

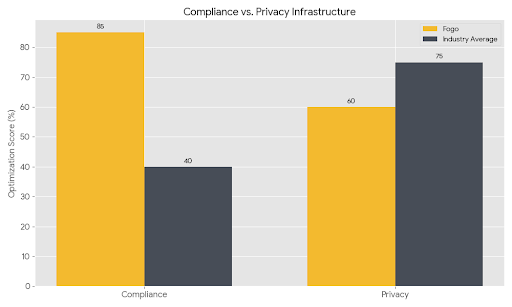

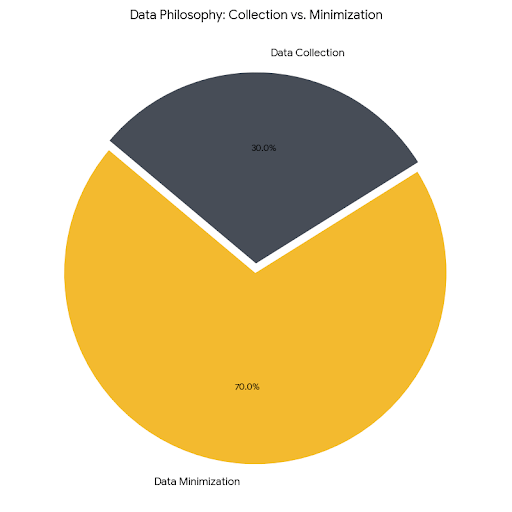

Ecosystem design is where the chain stops being an idea and becomes a place people live. Fogo is leaning into SVM compatibility because it helps the ecosystem grow faster. Builders can reuse existing knowledge and tooling patterns instead of learning a completely different way to write apps. Users can get familiar experiences sooner, because apps can be built in a style that already exists in the wider SVM world. And for a chain aiming at trading and finance, the ecosystem also needs core pieces that reduce fragmentation. Binance Academy notes that Fogo includes protocol level building blocks like an enshrined limit order book and native oracle infrastructure. The plain meaning is this: instead of every app having to build its own version of critical plumbing, the chain wants to bake some of it into the base layer so apps can focus on the user experience. That kind of design can make the ecosystem feel more consistent and less patchy.

Utility and rewards are the part that turns a token from a symbol into a working tool. The native token is FOGO, and the clean version of its job is straightforward. It is used to pay for network activity, it is used for staking to secure the network, and it is used for governance so the community can participate in upgrades and key changes over time. Binance Academy describes FOGO as the utility asset for gas fees, staking security, and governance. The Binance price page also summarizes it in the same spirit, including fees, staking, and governance. That is the simple, honest base layer of utility. When you use the chain, the token is part of the cost. When you support the chain, the token is part of the security. When the chain evolves, the token is part of coordination.

But here is the deeper emotional truth behind token utility. A token only feels meaningful when the network feels alive. If people are actually trading, actually building, actually spending time on chain, then fees become real demand, staking becomes real security, and governance becomes real responsibility. If activity is low, those same words can feel hollow. Fogo is trying to push the chain into a kind of activity that is intense and constant, the kind that creates real volume and real feedback from serious users. And when that happens, the rewards story becomes more than just staking yields. It becomes a relationship between users who rely on the chain, builders who create value on the chain, and validators who keep the chain steady. If this happens, the token is not just held, it is used, and used tokens have a different kind of gravity.

Adoption is the hard part because it is not won by speed claims. It is won by trust. People adopt a chain when they feel safe using it under pressure, not only when they are casually exploring. For a trading focused chain, the first wave of adoption usually comes from a small group of users who are extremely sensitive to execution quality. They notice everything. They notice if confirmations come fast most of the time but fail during spikes. They notice if performance is great in calm periods but shaky when everyone shows up at once. So adoption for Fogo is really a test of consistency. It is not just about being fast on average. It is about being dependable when it is chaotic. If it can hold that line, word spreads quickly because traders talk with their actions. They move liquidity. They move volume. They bring attention. And once real liquidity is there, builders have a reason to launch and stay.

Only mentioning Binance Exchange if it is needed, there is a simple practical point for many users: access matters. If someone wants to buy or trade FOGO, Binance provides a route, and Binance information pages describe how the token is used for fees, staking, and governance in the Fogo ecosystem. That does not guarantee success, but it removes one common barrier, which is the feeling that a new network is hard to reach. When access is easier, curiosity turns into real usage faster.

What comes next is where the project either becomes a lasting part of Web3 or fades into the pile of fast promises. First, they have to prove stability at high speed. When you push for very short block times, you are basically choosing a more demanding life. Every weakness shows up faster. Every edge case appears sooner. The chain has to be monitored, tuned, and upgraded carefully. Second, they have to deepen the ecosystem so the chain is not dependent on a single idea. A trading focused base layer still needs everything around trading, tools for liquidity, risk management, pricing data, and the kind of infrastructure that makes users feel protected rather than exposed. Third, they have to keep the token utility connected to real value. If staking is easy and rewarding, people will support the network. If governance is clear and not chaotic, people will feel included. If fees stay reasonable and predictable, people will keep using the chain without feeling punished for being active.

The reason Fogo matters for the Web3 future is not just that it is another Layer 1. It matters because it is taking aim at a very real emotional barrier. People do not leave Web3 because they hate self custody or open markets. They leave because they hate uncertainty, delays, and that sinking feeling of being too late. A chain built for fast, predictable execution is not just a technical upgrade, it is a trust upgrade. If Fogo can deliver on its promise, it raises the standard for what on chain finance should feel like. It pushes Web3 closer to a world where clicking confirm feels calm instead of stressful, where speed is normal instead of rare, and where the next generation of apps can be designed for real time life, not for waiting. That shift is important because the future of Web3 is not just about being decentralized in theory, it is about being usable in the moments that decide everything.