In a context of continuous market fluctuations, many opposing views have emerged and investor sentiment is fluctuating strongly, trust in the future of Bitcoin is becoming a hot topic of discussion.

Amid caution, skepticism, and hope, the question is not where the price will go in the short term, but whether the long-term foundation of Bitcoin is strong enough to continue to maintain trust in the coming years.

1️⃣ Each cycle, the weak leave - those who understand the game stay

Recently, Bitcoin's sharp adjustments have caused panic among many investors.

They sell hastily, cut losses, and leave the market with a losing mindset. The crowd mentality repeats: when prices drop sharply, trust wavers first.

But I remember Warren Buffett's saying:

"Buy when others are fearful and be fearful when others are greedy."

The reality across many cycles shows:

• The most pessimistic phases are often the best accumulation zones.

• BTC is always transferred from 'weak hands' to 'strong hands' whenever the market is purged.

• Survivors through many cycles are not the best at timing the market, but rather the best at managing capital and emotions.

Culling is part of the market structure, not a sign of an end.

______________

2️⃣ Fixed supply - demand fluctuates over time

Bitcoin has a total supply of 21 million BTC. This is not a marketing slogan, but a rule encoded in the protocol.

Meanwhile, the demand side is always changing:

• Global population increases

• Global assets increase

• Awareness of digital assets is increasingly common

• The traditional financial system is increasingly under pressure from debt and inflation

Fixed supply + expanding demand over time creates a clear economic foundation.

Unlike fiat currencies that can be printed more during a crisis, BTC has no 'dilution' mechanism. This verifiable scarcity is the long-term foundation that keeps many people believing.

______________

3️⃣ Institutions have entered, and they do not trade like retail.

Unlike earlier cycles, BTC is no longer just a game for retail investors.

• Spot ETFs have been approved in many major markets

• Traditional investment funds allocate a portion of their portfolios to BTC

• Publicly listed companies hold BTC as a reserve asset

For example, MicroStrategy has continuously accumulated BTC for many years and turned it into a long-term financial strategy.

Institutions do not trade based on emotions, with 10 - 20% volatility. They allocate capital based on multi-year visions, even across several cycles.

This long-term cash flow creates:

• Deeper liquidity

• Higher prices through each cycle

• Legitimization in the eyes of the financial system

When the participant structure changes, the market structure changes as well.

______________

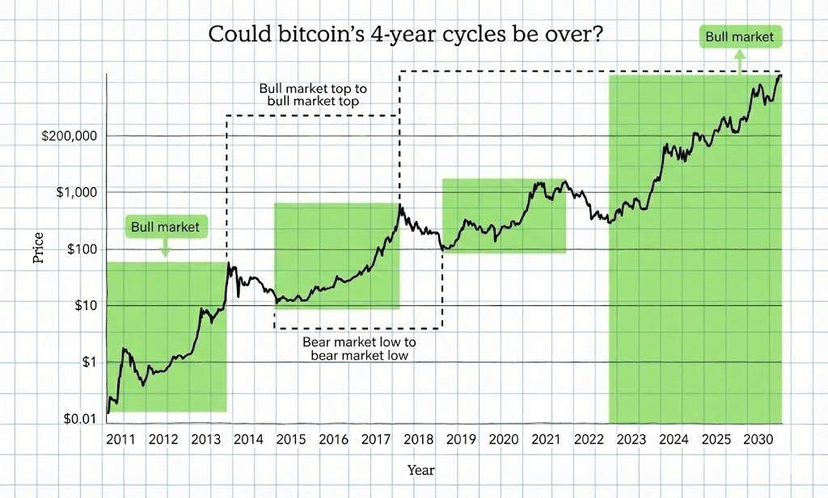

4️⃣ Each cycle, the low is higher than the previous cycle

Looking at the long-term timeframe, we see an important reality:

The subsequent lows are often higher than the previous lows.

This reflects:

• The market's perceived value is gradually increasing

• Long-term confidence does not vanish after each collapse

• Each cycle expands the user and investor base

Markets can be highly volatile in the short term, but the long-term trend shows a gradual maturation in scale and valuation.

Growth does not follow a straight line, but the long-term trajectory remains upward.

______________

5️⃣ BTC is increasingly becoming a 'defensive asset' in crises

In the context:

• Prolonged inflation

• Geopolitical tensions

• Banking or liquidity crises

Many people are starting to see BTC as a form of 'digital gold.'

Not dependent on central banks.

Not controlled by a single nation.

It can be stored and transferred across borders.

Although BTC remains highly volatile, its role in the investment portfolio is gradually shifting from 'pure speculative asset' to 'alternative asset with risk-hedging characteristics.'

______________

Volatility is inevitable in any financial market, especially with Bitcoin being a relatively young asset sensitive to global cash flows.

However, true confidence is not built on short-term ups and downs, but comes from understanding what you hold, why it is valuable, and having the discipline to stay with it in the long term. When understanding replaces emotion, volatility is no longer a threat, but becomes a natural part of the investment journey.