Binance in the eye of the storm: Bank run or just cyclical FUD?

Binance has once again become the center of controversy in the crypto market as doubts about its liquidity suddenly explode.

In just a few weeks, social media has been flooded with warnings, speculation, and screenshots of withdrawal flows — creating a sense that 'something big' is quietly happening behind the world's largest exchange.

In a market that has yet to recover from the trauma of 2022, rumors can sometimes be more dangerous than the truth.

How do rumors start?

The story heated up on 9/2 when several influential figures in the industry claimed that Binance was witnessing record net outflows.

On-chain data aggregation platforms are quickly being dissected.

DeFiLlama shows over 2 billion USD net outflow in one month

CoinGlass records that exchange reserves tend to shrink

The problem is: data is detached from context.

And when the context disappears, fear will write its own story.

A technical error – or a spark for panic?

The direct factor is not the financial collapse, but just a temporary withdrawal delay incident.

In traditional finance, this is simply an operational error.

But in crypto, where the memory of FTX still haunts, just one 'withdraw pending' button is enough to trigger bank run psychology.

Trust in this market is more fragile than a balance sheet.

The truth from on-chain data: The picture is very different

If you ignore social media noise and look at the real numbers, the story goes in a different direction.

CoinMarketCap: ~132 billion USD assets

DeFiLlama: ~132.3 billion USD in reserves

Most lies in Bitcoin and Ethereum

A real 'bank run' would leave very clear signs:

- Liquidity dry-up

- The ice pile of withdrawals

- Restrict trading

But a platform still holding over 130 billion USD in observable assets simply does not align with the collapse scenario that many are weaving.

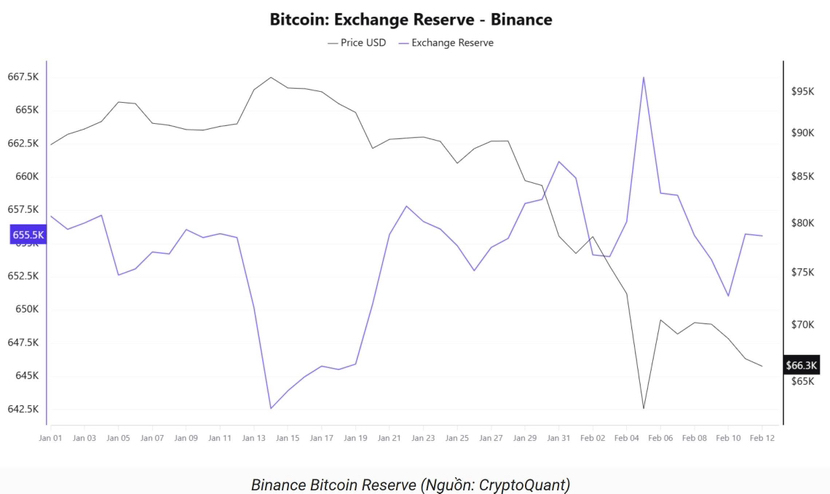

In fact, data from CryptoQuant shows that Binance's Bitcoin reserves have increased again, exceeding 655,000 BTC — completely contrary to the argument of 'being drained'.

USD decrease differs from Assets being withdrawn

A common mistake of the community is misreading USD data.

When the market corrects, token prices drop → reserve valuations decrease → looks like 'withdrawal cash flow'.

But the actual number of coins may not change at all.

That is the difference between:

Depreciation and liquidity reduction

The two concepts are completely different.

🔥How Binance strikes back: Transparency instead of silence

Under public pressure, Binance chose a proactive strategy.

Yihe's co-founder called this a 'psychological withdrawal campaign', while pointing out that actual on-chain assets have increased when the panic subsides.

Binance also:

- Announce proof-of-reserves

- Encourage self-custody

- Propose using private wallets like Trust Wallet

- Provide a data mapping table via OKLink

The message is very clear:

Verify with data, do not trust feelings.

💥Why is Binance always a target?

When you are the liquidity center of the entire market, you will always be scrutinized.

The larger the scale → the higher the systemic risk → rumors spread more easily.

The paradox is:

Because Binance is so important, any minor hiccup is blown up into 'apocalypse'.

There is a saying: 'To sit in a position no one can sit, one must endure the feeling no one can bear.'

That is the price of the number 1 position

Conclusion

FUD cycle or real crisis?

At this moment, the data does not support the scenario of insolvency.

What we are seeing resembles a more familiar FUD cycle than a real bank run.

Crypto operates by code.

But the market operates on emotions.

And when fear speaks up, the truth often gets drowned out.

Smart investors do not chase noise.