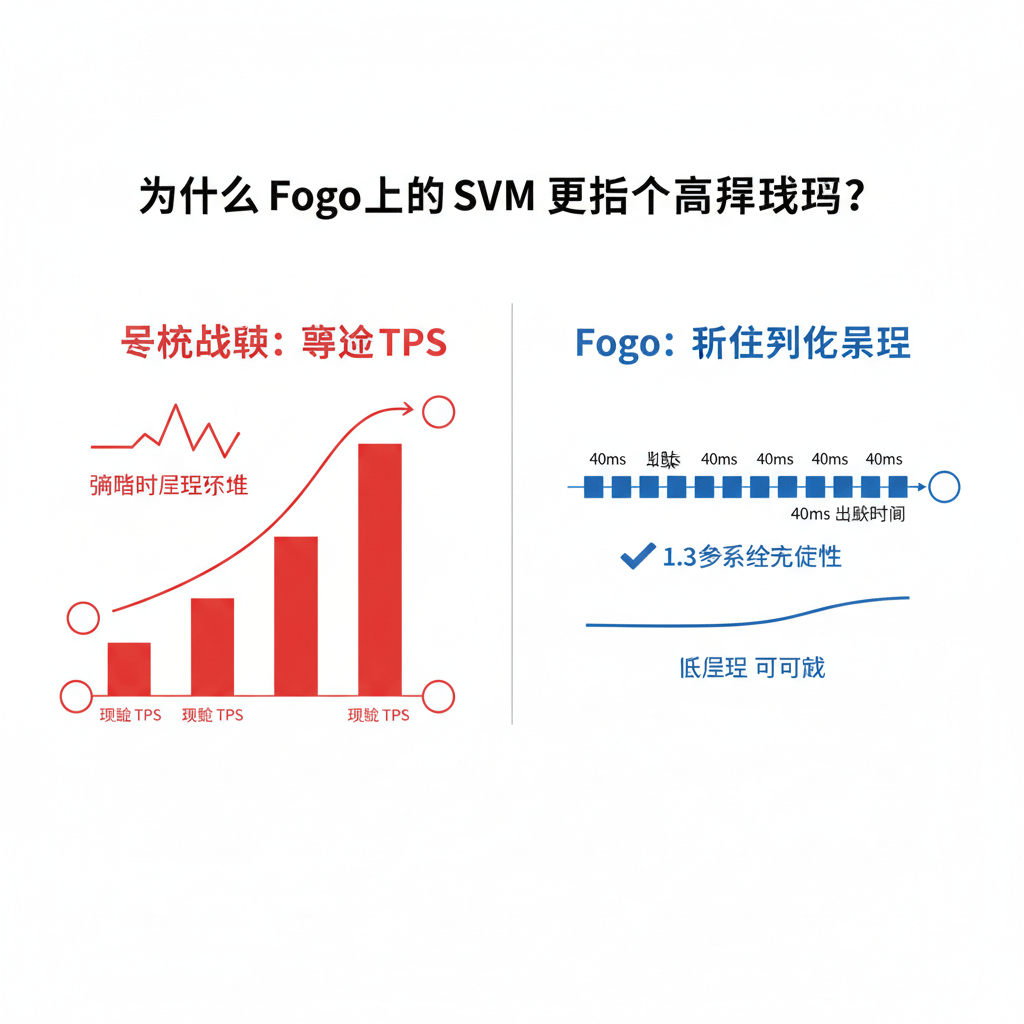

If you are building a product that is truly sensitive to millisecond-level latency, you must understand: what determines the outcome is never just the TPS number, but the latency itself.

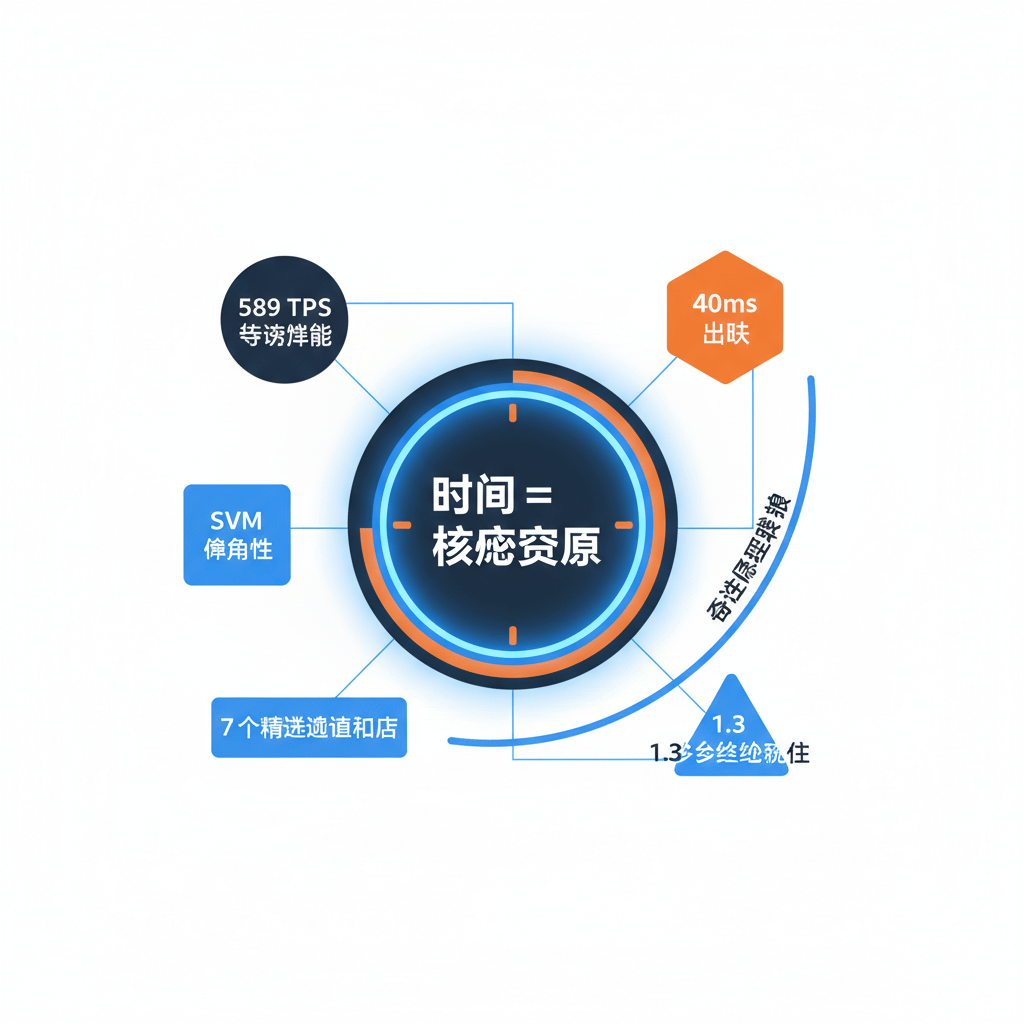

Fogo does not aim to be the so-called 'Ethereum killer', nor does it replicate Solana to compete for universal throughput champion. Its approach is more restrained and focused. There is only one core question: how would we design a settlement layer if we treat 'time' instead of 'throughput' as the most scarce resource in the system?

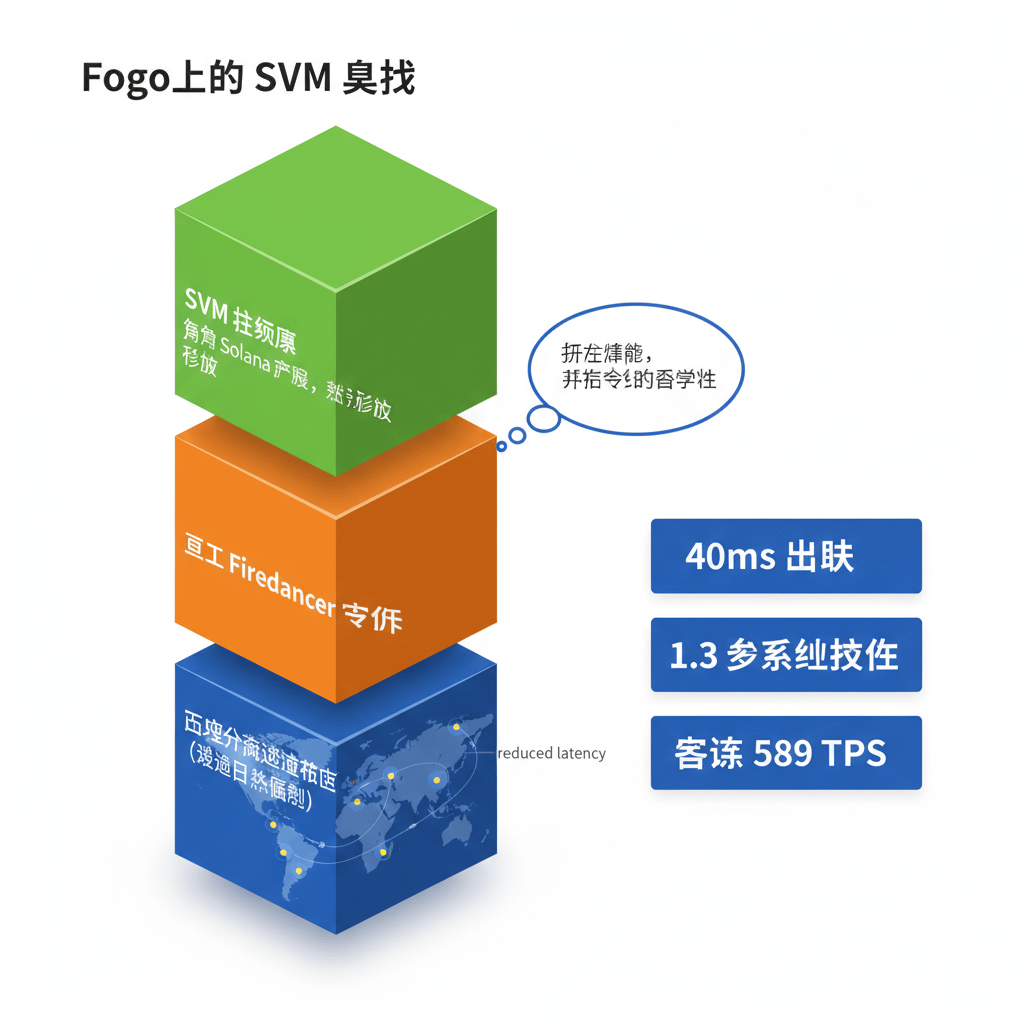

This is where the Solana Virtual Machine (SVM) plays its role on Fogo.

For developers, there is no need to learn a new ecosystem from scratch. Existing Solana programs can be deployed directly without modification. The execution environment remains familiar, mature, and market-validated. But what truly changes is not the virtual machine itself, but its underlying infrastructure.

Fogo starts engineering optimization from the physical layer, aiming to achieve high determinism and stable low latency. The block time is about 40 milliseconds, with final determinism of about 1.3 seconds. For DeFi trading applications, this is not a minor improvement—it's a substantial difference.

40 milliseconds may mean users execute trades at quoted prices or endure slippage in the next block.

This is not about theoretical peak TPS in a laboratory environment, but about maintaining predictable execution performance even during peak congestion.

Architecturally, Fogo has made clear trade-offs. It adopts a single standard Firedancer client, prioritizing extreme performance optimization over client diversity. This choice reflects its design philosophy: reducing variables, lowering uncertainty, and strengthening system determinism.

Validator nodes have also undergone geographic optimization, aligning node distribution with major trading time zones through a 'follow the sun' partitioning model, thereby reducing cross-border settlement delays. In high-frequency trading environments, physical distance is not an abstract concept but a quantifiable performance difference.

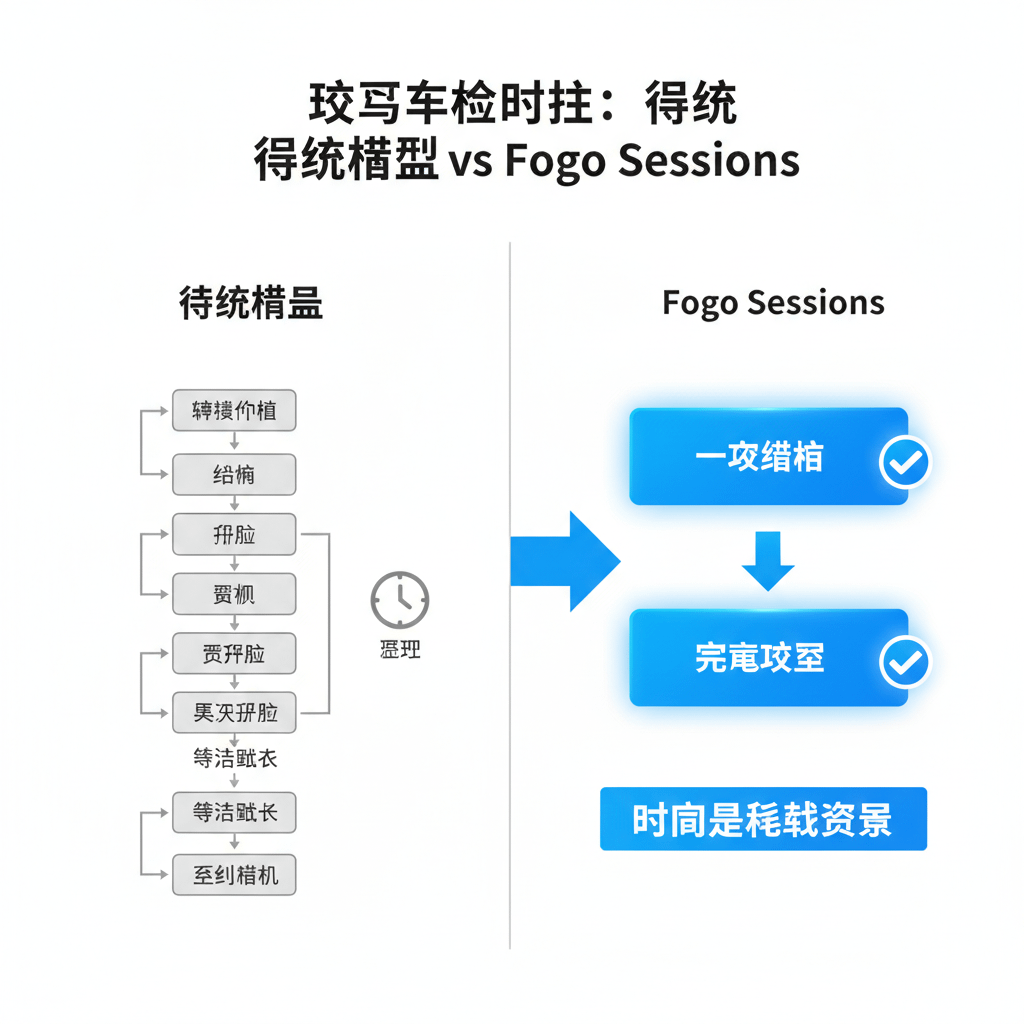

Moreover, Fogo Sessions represent an important innovation for user experience. This is a native on-chain mechanism that supports time-limited and permission-controlled authorizations. The practical effect is that users only need to sign once to interact with dApps, without needing repeated transaction authorizations.

For trading platforms, this significantly simplifies the user process. Wallet confirmations no longer pop up frequently, and the steps have been compressed from multiple clicks to a smoother experience. Gasless transactions become possible, and wallet friction is genuinely abstracted.

More importantly, this goes beyond just architectural concepts. The current network has over $1 million in TVL and maintains a sustained throughput performance close to 600 TPS, demonstrating liquidity driven by real usage rather than mere market speculation.

The validator set has been carefully selected, currently featuring only 7 active nodes, emphasizing quality of operation over quantity expansion, while reducing the MEV attack surface.

Ultimately, Fogo runs the developer-familiar SVM on a consensus and hardware architecture that truly views 'time' as a core resource.

For developers building trading systems, market infrastructures, or any latency-sensitive applications, this design philosophy deserves serious consideration.

Because after scaling,

speed is no longer just a feature.

It is, in itself, the product.