A Clear Look at the Current Structure and Implications for Traders

The cryptocurrency market is going through a phase that requires more finesse than enthusiasm. We are neither experiencing explosive euphoria nor widespread capitulation. We are operating in an environment where liquidity, macroeconomics, and institutional positioning play a decisive role.

To understand the dynamics of February 15, 2026, three main areas must be analyzed: market structure, the macroeconomic context, and investor behavior.

1. Current Market Structure

Bitcoin: The Pillar of the Trend

Bitcoin remains the structural benchmark. As is often the case, the dominant market direction largely depends on its behavior.

Currently, several factors define the situation:

Moderate but unpredictable volatility

Liquidity concentrated around key technical levels

Strong presence of institutional players

Rapid movements triggered by macroeconomic announcements

The market appears to be in a phase of broad consolidation. This type of setup generally reflects either accumulation or redistribution—two very different scenarios that only become clear in retrospect.

Ethereum: Increased Sensitivity to Capital Rotation

Ethereum exhibits a slightly stronger correlation with speculative capital movements.

When the market becomes more aggressive, risk appetite increases, and Ethereum tends to outperform.

Conversely, when uncertainty rises, capital flows toward Bitcoin or stablecoins.

This alternation reflects a reality: the crypto market operates through internal rotation cycles.

Altcoins: Dispersion and Selectivity

The altcoin market is currently fragmented:

Certain sectors (AI, blockchain infrastructure, RWA) are attracting attention.

Other projects remain under pressure due to a lack of liquidity.

Increased selectivity is observed: investors are no longer massively funding the entire market as they did during periods of euphoria. Capital is concentrated on specific narratives.

2. Macroeconomic Context

The crypto market no longer operates in isolation.

Key factors to monitor currently:

Central bank decisions on interest rates

Inflation data

The dollar exchange rate

Geopolitical tensions

Financial regulations

Rising interest rates or monetary tightening tend to reduce risk appetite. Conversely, easing can support speculative assets.

Currently, the global environment remains cautious. Investors are not panicking, but they are not euphoric either.

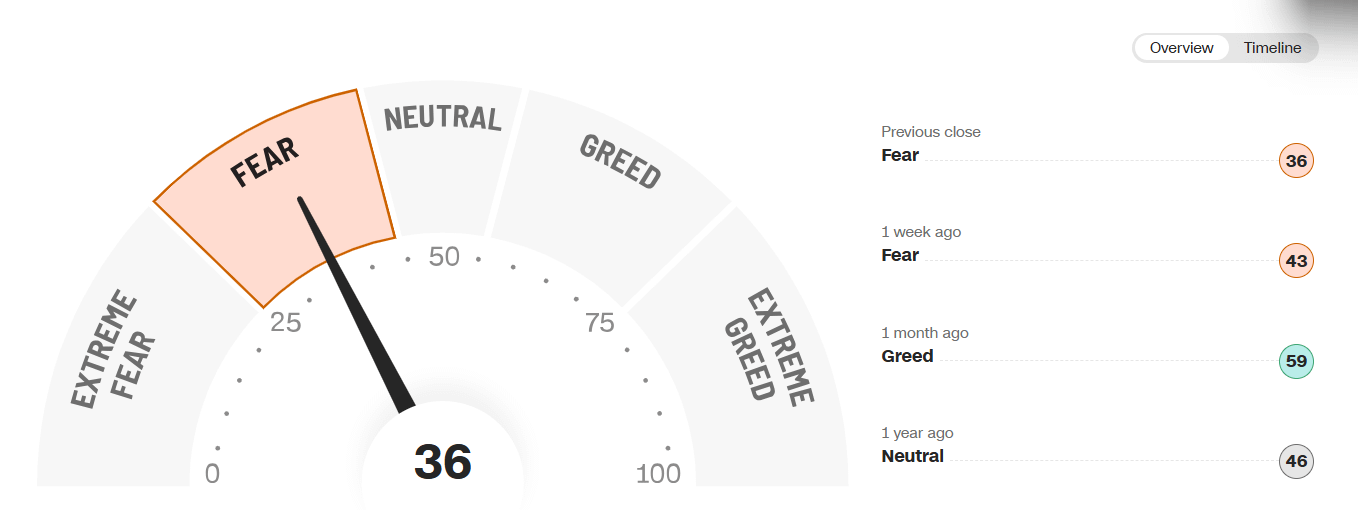

3. Market Sentiment

Current sentiment is characterized by:

High vigilance

Strong sensitivity to news

Distrust of overly rapid movements

Periods where everything seems “obvious” are rare. We are more in a technical market, dominated by risk management and the search for specific opportunities.

4. General Technical Analysis

Without going into specific levels, the current structure shows:

Support zones that have been tested repeatedly

Resistance that is blocking upward impulses

A gradual compression of volatility

Historically, this type of setup can precede an impulsive move.

But the direction will depend on the triggering catalyst.

5. Possible Short-Term Scenarios

Scenario 1: Bullish Breakout

If liquidity flows in strongly and a positive macroeconomic catalyst emerges, the market could trigger a rapid upward surge.

Scenario 2: Rejection and Correction

A lack of volume or negative macroeconomic news could trigger a pullback to lower levels.

Scenario 3: Prolonged Consolidation

The market could continue to move sideways, gradually exhausting impatient traders.

My Advice for Traders

February 15, 2026, is not a day where maximum aggression is rewarded. It is an environment that favors discipline.

1. Prioritize Risk Management

Before entering a position, ask yourself a simple question:

"Where is my stop-loss point?"

If this point is unclear, the position is also unclear.

2. Reduce leverage if volatility increases

Leverage can destroy an account faster than it grows it, especially in a compressed market that can explode in either direction.

3. Avoid trading every move

Not every move is an opportunity.

Trading is not a daily obligation.

4. Don't confuse conviction with stubbornness

A disciplined trader accepts that they will be wrong.

An emotional trader defends their ego.

5. Monitor liquidity, not just price

Breakouts without volume are often traps.

Real moves are supported by clear flows.

6. Embrace uncertainty

No one knows the next major move for certain.

The goal is not to predict perfectly, but to survive long enough to capture the right opportunities.

7. Protect your mental capital

The current market can be exhausting. Taking a break, reducing exposure, or remaining neutral is sometimes the most cost-effective decision.

Conclusion

The crypto market on February 15, 2026, is in a phase of fragile equilibrium. The structure is neither euphoric nor catastrophic. It demands patience, clear thinking, and risk management.

In this type of market:

Impulsive traders burn out.

Disciplined traders build their edge.

The key is not to be right every day.

The key is to still be there when the next major move occurs.